The SPDR Gold Shares Trust (GLD) holdings declined slightly on the week, while the iShares Silver Trust (SLV) increased its holdings by a substantial 164 metric tonnes

The SPDR Gold Shares Trust (GLD) holdings declined slightly on the week, while the iShares Silver Trust (SLV) increased its holdings by a substantial 164 metric tonnes

Holdings in the GLD declined by 5.77 tonnes compared to a decline of 2.43 tonnes in the previous week. Total holdings have declined by 4.9% or 62.48 tonnes since the start of the year. The GLD currently holds 1,218.24 tonnes or 39.17 million ounces of gold valued at $55.2 billion.

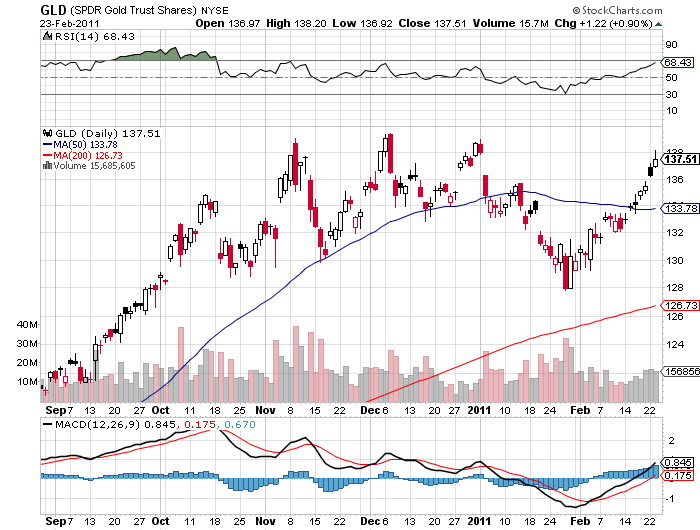

The price of the GLD has traded between $128 and $139 since last October after running up from approximately $110 from the start of 2010. The GLD was originally launched in November 2004 when the price of gold was trading at $445 per ounce.

GLD and SLV Holdings (metric tonnes)

| 23-Feb-11 | Weekly Change | YTD Change | |

| GLD | 1,218.24 | -5.77 | -62.48 |

| SLV | 10,575.23 | +164.00 | -346.34 |

Silver holdings in the iShares Silver Trust (SLV) increased by 164 tonnes over the past week compared to an increase in the previous week of 41.01 tonnes. The year to date decline of 346.34 tonnes represents a 3.2% drop in silver holdings since the beginning of the year.

The Trust is structured so that the value of the iShares will reflect the price of silver owned by the trust. The price of an iShare should closely track the price of one ounce of silver, less the Trust’s expenses. However, the price of the SLV will fluctuate during the day as traders buy and sell shares. If there are many buyers purchasing SLV, the price can rise to a premium over the underlying value of silver as seen in the chart below comparing silver to the SLV.

The amount of silver held by the SLV will vary due to the mechanism by which shares are created or redeemed by the Trust via Authorized Participants. Authorized Participants are typically large Wall Street Investment firms that will either deliver or take silver from the SLV as they arbitrage to take advantage of premiums or discounts of physical silver to the value of the SLV. The GLD operates similarly to the SLV which is why an increase in the price of gold and the price of the GLD may not necessarily result in greater gold holdings by the GLD.

The SLV’s closing price of $32.71 on February 23th is 9.2% above last weeks closing price on February 16th and reflects silvers large price increase over the past week as prices broke out to new highs. Since 2010, the price of silver has more than doubled from the $16 range to the current price of $33.70.