As politicians celebrated the debt limit increase and congratulated themselves for “saving” the nation that they destroyed, collapsing stock markets and soaring gold prices told a different story. The public spectacle of a dysfunctional Congress debating the debt limit exposed to the world the horrendous extent to which the US government is addicted to endless deficit spending.

As politicians celebrated the debt limit increase and congratulated themselves for “saving” the nation that they destroyed, collapsing stock markets and soaring gold prices told a different story. The public spectacle of a dysfunctional Congress debating the debt limit exposed to the world the horrendous extent to which the US government is addicted to endless deficit spending.

Republican presidential candidate Ron Paul summed up the outcome of the debt limit fiasco best:

This deal will reportedly cut spending by only slightly over $900 billion over 10 years. But we will have a $1.6 trillion deficit after this year alone, meaning those meager cuts will do nothing to solve our unsustainable spending problem. In fact, this bill will never balance the budget. Instead, it will add untold trillions of dollars to our deficit. This also assumes the cuts are real cuts and not the same old Washington smoke and mirrors game of spending less than originally projected so you can claim the difference as a ‘cut.’

The plan also calls for the formation of a deficit commission, which will accomplish nothing outside of providing Congress and the White House with another way to abdicate responsibility. In my many years of public service, there have been commissions on everything from Social Security to energy policy, yet not one solution has been produced out of these commissions.

Ron Paul also provided an explanation of what constitutes a “spending cut” in the bizarro world of government accounting and why, in the end, spending and debts will not decrease.

No plan under serious consideration cuts spending in the way you and I think about it. Instead, the “cuts” being discussed are illusory, and are not cuts from current amounts being spent, but cuts in projected spending increases. This is akin to a family “saving” $100,000 in expenses by deciding not to buy a Lamborghini, and instead getting a fully loaded Mercedes, when really their budget dictates that they need to stick with their perfectly serviceable Honda. But this is the type of math Washington uses to mask the incriminating truth about their unrepentant plundering of the American people.

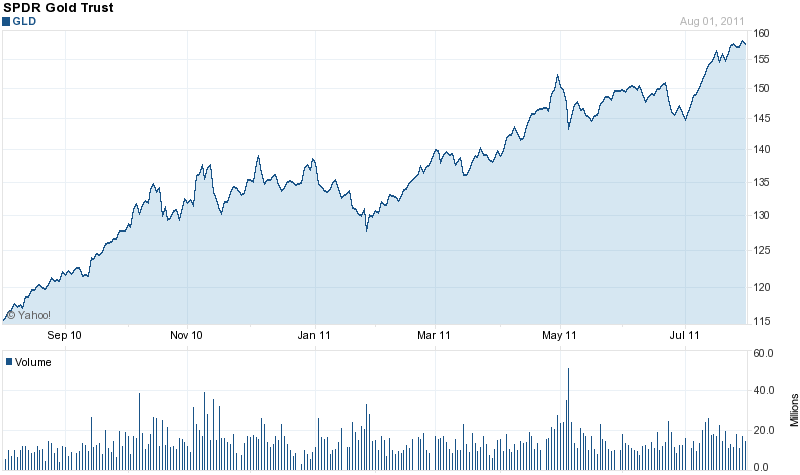

The world was finally tuning in to the reality of the desperate financial condition of the United States. The mainstream press was predicting a plunge in gold prices and soaring stock prices after Congress agreed to increase the nation’s debt limit. Instead, the opposite happened as markets reflected underlying economic reality.

Since mid July, the Dow Jones Industrial Average has plunged by 858 points. Since July 1st, gold has gained $178 per ounce. Meanwhile, the debt crisis in Europe continues to intensify with bond yields soaring in Italy and Spain. The world economy is marching off the edge of a cliff as governments lose the ability to contain the spiraling debt crisis. It’s starting to look like a replay of 2008 on steroids.

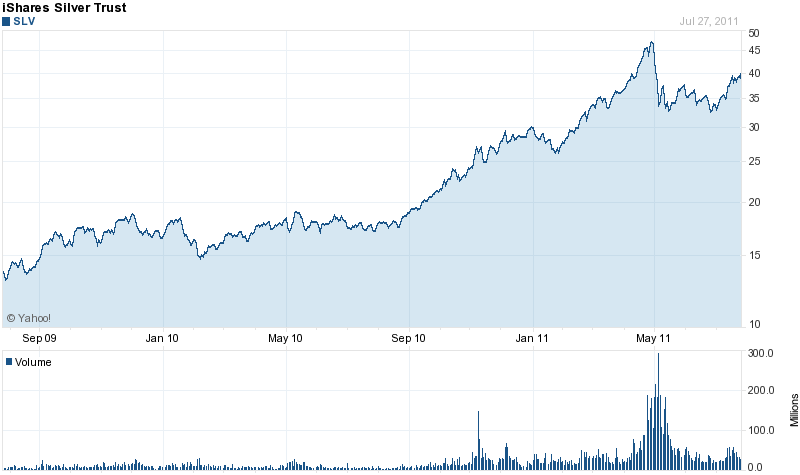

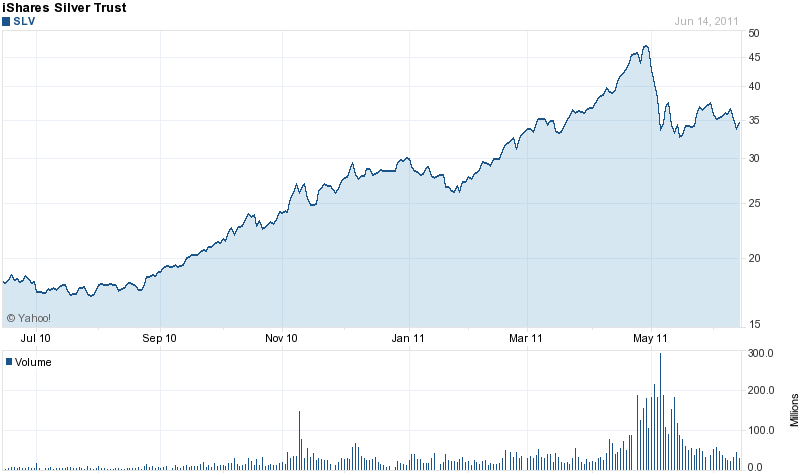

Gold soared by $39.80 on the day to close in New York trading at an all time high of $1,661.10. Silver more than paced the gain in gold, adding $1.61 to close up 4.1% at $40.95.

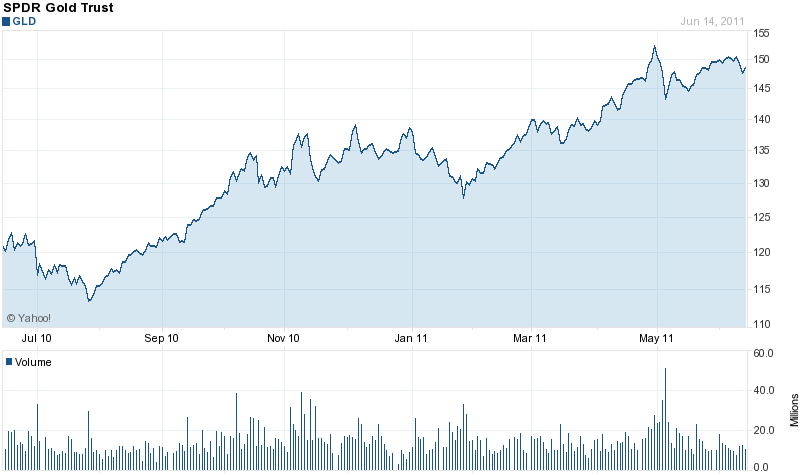

SPDR Gold Trust Holdings Increase, Silver ETF Holdings Decline

Holdings of the SPDR Gold Shares Trust (GLD) gained almost 37 tonnes on the week. For the first time this year, holdings of the GLD are greater than they were at the beginning of the year. The record holdings of the GLD occurred on June 29, 2010 when the GLD held 1,320.47 tonnes of gold.

The SPDR Gold Trust currently hold 41.2 million ounces of gold valued at $67.5 billion. Shares of the GLD hit an all time high, closing at $161.52.

Holdings of the iShares Silver Trust (SLV) declined by 90.93 tonnes after an increase of 112.15 tonnes in the prior week. Since the beginning of July, holdings of the SLV have increased by 288.28 tonnes.

The SLV currently holds 315.9 million ounces of silver valued at $12.5 billion.

GLD and SLV Holdings (metric tonnes)

| August 2-2011 | Weekly Change | YTD Change | |

| GLD | 1,281.75 | +36.95 | +1.04 |

| SLV | 9,824.93 | -90.93 | -1,096.64 |