Production figures from the U.S. Mint for March show a sharp increase in the sale of both gold and silver bullion coins from the previous month.

Production figures from the U.S. Mint for March show a sharp increase in the sale of both gold and silver bullion coins from the previous month.

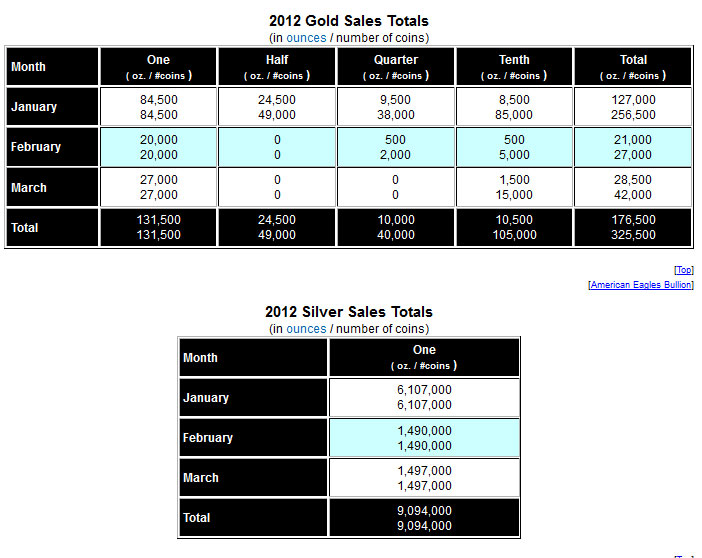

Total sales of the American Gold Eagle bullion coins increased in March to 62,500 ounces, up from 21,000 ounces in February. Total sales of the American Silver Eagle bullion coins totaled 2,542,000 ounces in March, up from 1,490,000 ounces in February. Sales of both bullion coins for the first quarter of 2012, however, declined from the prior year.

Sales of the American Gold Eagle bullion coins totaled 210,500 ounces for the first quarter of 2012, down 29.7% from the 299,500 ounces sold in the first quarter of 2011. Total sales of the American Silver Eagle bullion coins amounted to 10,139,000 ounces during the first quarter of 2012, down by 18.4% from the 12,429,000 ounces sold in the prior year’s first quarter.

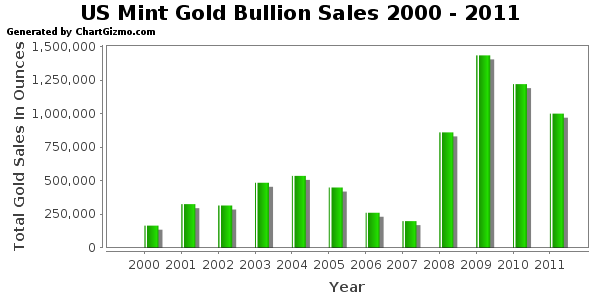

The all time record year for sales of the American Gold Eagle bullion coins occurred in 2009 with 1,435,000 ounces sold. The all time high record for sales of the American Silver Eagle bullion coins was in 2011 when a total of 39,868,500 one ounce coins were sold.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Ounces Sold | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 210,500 | |

| Total | 7,460,000 | |

| Note: 2012 totals through March 31, 2012 | ||

The amount of physical gold bullion purchased purchased from the U.S. Mint over the past 12 years remains relatively small compared to the amount of gold invested in the two largest gold trust ETFs. The SPDR Gold Shares ETF (GLD) is the world’s largest physically backed gold exchange traded ETF fund with current holdings of 41.4 million ounces of gold. The iShares Gold Trust ETF (IAU) currently holds 6.2 million ounces of gold.

The total sales of gold and silver bullion coins detailed above do not include U.S. Mint gold and silver numismatic coin sales which are directly sold to the public. American Gold and Silver Eagle bullion coins are only sold to a network of authorized purchasers who in turn resell the coins to secondary retailers and the public. The U.S. Mint decided that using Authorized Purchasers to sell gold and silver bullion coins to the public was the most efficient means of selling the coins to the public at competitive prices.

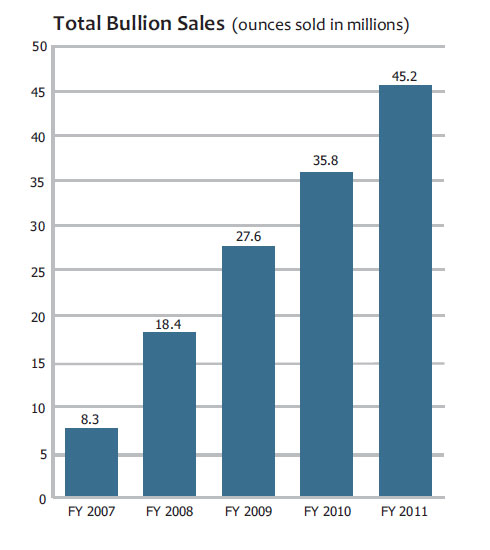

Shown below are the U.S. Mint sales figures for the American Silver Eagle bullion coins since 2000. Sales totals for 2012 are through March 31st.

| American Silver Eagle Bullion Coins | ||

| YEAR | OUNCES SOLD | |

| 2000 | 9,133,000 | |

| 2001 | 8,827,500 | |

| 2002 | 10,475,500 | |

| 2003 | 9,153,500 | |

| 2004 | 9,617,000 | |

| 2005 | 8,405,000 | |

| 2006 | 10,021,000 | |

| 2007 | 9,887,000 | |

| 2008 | 19,583,500 | |

| 2009 | 28,766,500 | |

| 2010 | 34,662,500 | |

| 2011 | 39,868,500 | |

| 2012 | 10,139,000 | |

| TOTAL | 208,539,500 | |

Currently, the United States Mint has three bullion products available to its network of authorized purchasers. The American Silver Eagle is struck in one ounce of .999 fine silver. The American Gold Eagle is struck in 22 karat gold and comes in one ounce, half ounce, quarter ounce, and tenth ounce bullion weights. The American Gold Buffalo is struck in 24 karat gold and available in one ounce size only.

Currently, the United States Mint has three bullion products available to its network of authorized purchasers. The American Silver Eagle is struck in one ounce of .999 fine silver. The American Gold Eagle is struck in 22 karat gold and comes in one ounce, half ounce, quarter ounce, and tenth ounce bullion weights. The American Gold Buffalo is struck in 24 karat gold and available in one ounce size only.

The number of ounces worth of gold bullion coins sold by the United States Mint rose in the latest week, bolstered by the launch of the 2011 Gold Buffalo coins. Silver bullion sales showed a slight increase, as the year to date total for American Silver Eagles moved above 11 million.

The number of ounces worth of gold bullion coins sold by the United States Mint rose in the latest week, bolstered by the launch of the 2011 Gold Buffalo coins. Silver bullion sales showed a slight increase, as the year to date total for American Silver Eagles moved above 11 million. Sales of the United States Mint’s American Silver Eagle bullion coins were slower in the latest week. However, the slow down seems to be the result of the allocation program currently in place, as opposed to a reduction in demand. Sales for Gold Eagle bullion coins dropped to the lowest weekly total for the year to date.

Sales of the United States Mint’s American Silver Eagle bullion coins were slower in the latest week. However, the slow down seems to be the result of the allocation program currently in place, as opposed to a reduction in demand. Sales for Gold Eagle bullion coins dropped to the lowest weekly total for the year to date.