The US Mint American Eagle silver bullion coins remain more popular with investors than ever, despite the decline in the price of silver. Apparently there are plenty of long term silver investors who prefer to hold the physical metal and are viewing the decline in the price of silver as an opportunity to load up at bargain prices.

The US Mint American Eagle silver bullion coins remain more popular with investors than ever, despite the decline in the price of silver. Apparently there are plenty of long term silver investors who prefer to hold the physical metal and are viewing the decline in the price of silver as an opportunity to load up at bargain prices.

The latest report from the US Mint shows that November sales of the silver bullion coins totaled 3,426,000 ounces, down from the previous month but up by 1,126,000 ounces or 49% from the previous year. October 2014 was the highest selling month of the year with total sales of 5,790,000 coins.

Sales of the American Eagle silver bullion coins year to date through November 30 now total 41,547,000, just shy of the all time record sales year of 2013 when the Mint sold 42,675,000 coins. If December sales of the silver bullion coins surpass 1.1 million coins, which is very likely, 2014 will be another record breaking sales year.

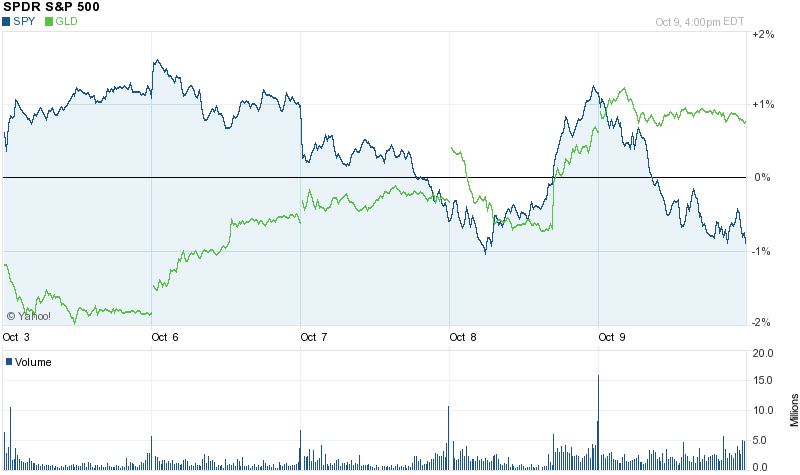

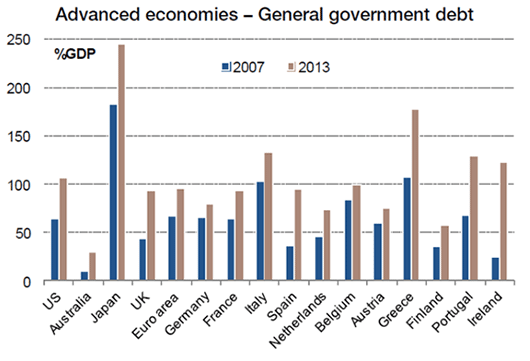

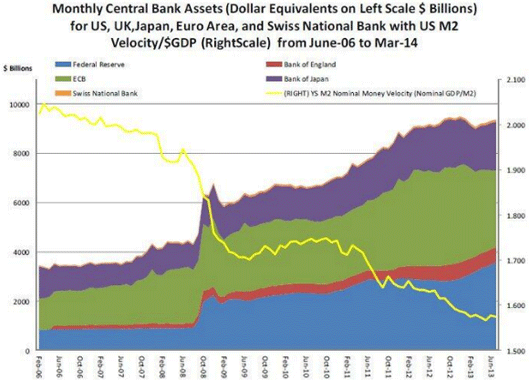

Gold and silver investors can only shake their heads and wonder at investor confidence in central banks as an orgy of money printing continues worldwide and leveraged debt piles up at a rate and amount never seen before in history. The attitude seems to be “who cares – my stocks and bonds and real estate are going straight up.”

At some future point that no one can predict you can count on another financial accident on par or greater than that of 2008-2009 that will destroy confidence in paper money and the ability of governments to repay debt with sound money. At that point the exchange rate between dollars and precious metals will amply reward the investors now buying bargain gold and silver.

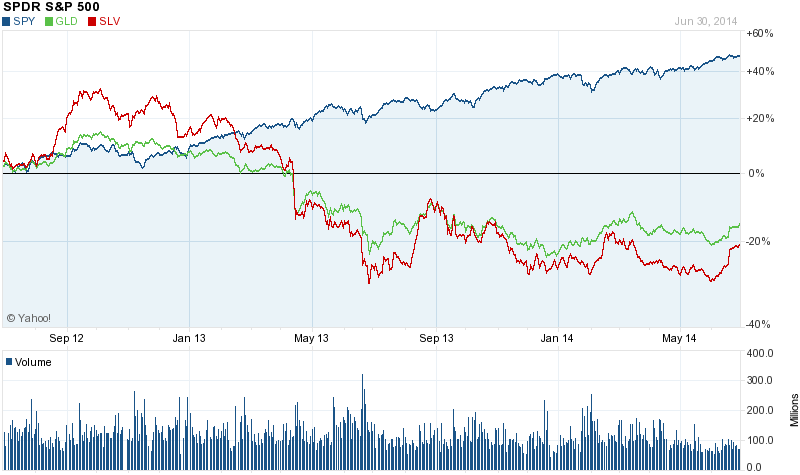

Silver has now given back the bulk of its gains from the highs reached in early 2011 and could well go lower given the bearish sentiment and declining price pattern.

Since 2000 investors have purchased over 300 million American Eagle silver bullion coins. Below are the sales by year with the 2014 total through November 30.