Major Gold Mining Stock Outperforms Bullion and Gold ETFs

Investors in gold often wonder about the best way to own the precious metal. Gold is gold but depending on the vehicle used to purchase gold, investment returns can vary dramatically.

Simply put, the three basic ways to invest in gold are gold bullion, gold bullion ETFs, and gold mining stocks.

Gold Bullion

Purchasers of gold bullion may not trust “paper gold” or they may simply appreciate the beauty of gold bars and coins. There is an innate satisfaction in being able to physically admire and touch gold, a metal that has had value to man since before the dawn of civilization. Paper currencies always eventually wind up worthless while gold will maintain purchasing power. The pleasure of owning physical gold does have drawbacks, the biggest of which is security and storage.

Although gold has moved up dramatically since 2019, the current price of around $1,950 is still slightly below the record high of $2,061 reached in August 2020.

![gold Technical chart [Kitco Inc.]](https://www.kitco.com/lfgif/au0730lf_ma.gif)

Gold Bullion ETFs

An easy and low-cost method for purchasing gold bullion is by investing in gold bullion ETFs. Funds put into gold ETFs are invested in physical gold and the fund is responsible for physical security. The largest gold ETF is the SPDR Gold Shares (GLD) which currently holds about $68 billion in assets. The ETF has a relatively low expense ratio of 0.40%. The GLD will closely match the move in the price of gold bullion less the expenses of running the fund.

The GLD currently trades at $181.47 slightly below its high of $190.81 reached in August 2020.

Another ETF worthy of consideration is the iShares Gold Trust (IAU) which currently trades at $36.97, holds $32 billion in physical gold and has an expense ratio of only 0.25%.

Gold Mining Stocks

Gold mining stocks are where it all starts. Someone must undertake the expensive process of locating and mining gold ore to produce refined gold. The profit generated by the gold mining stocks depends not only on the price of gold but also on how efficiently gold mining companies are at exploration and deploying capital. Many junior gold mining companies have not been able to participate in price gains despite the increase in gold prices.

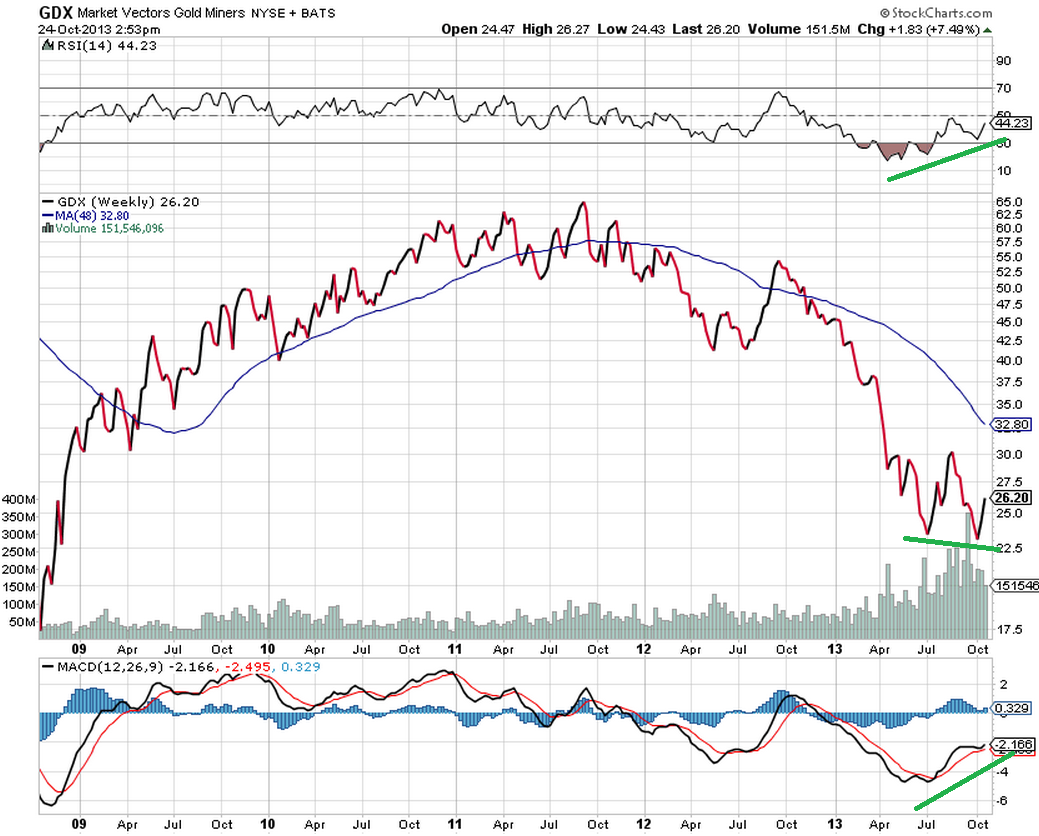

There are two ways to invest in gold mining companies. An investor can invest in a basket of gold mining stocks in a mutual fund or ETF such as VanEck Gold Miners ETF (GDX) or by purchasing individual gold mining companies. Purchasing an ETF allows an investor to spread risk across the industry. Purchasing a successful gold mining company can result in gains that far exceed the increase in gold bullion.

For example, the GDX currently trades at $39.67, below the price reached in August 2020.

Now, look at the performance of Newmont Corporation (NEM) a major gold mining company which has recently exploded to an all-time high and up 173% since late 2019.

There is no way to know which way of investing will work out best until after it happens. Always diversify to reduce risk is probable the best advice.

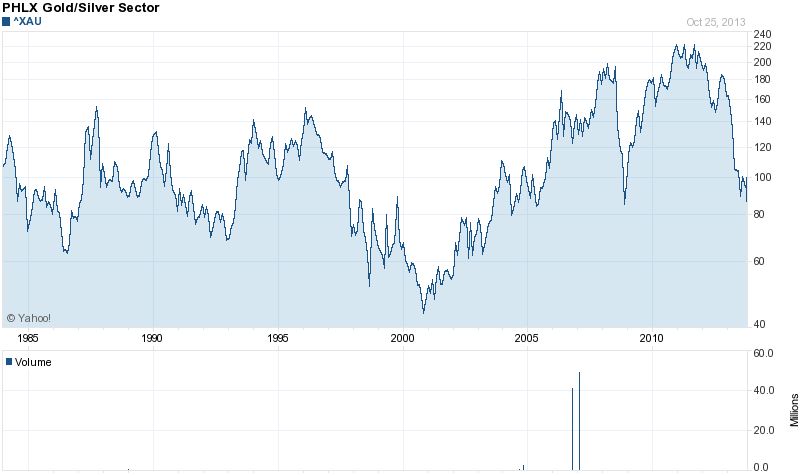

Gold has been on a rampage since the early 2000’s with yearly gains for 12 years in a row. Nothing lasts forever and the number 13 is starting to look very unlucky for gold. Barring a major upset in the world financial system, it looks increasing likely that gold will decline in the 13th year of its long rally in the year 2013.

Gold has been on a rampage since the early 2000’s with yearly gains for 12 years in a row. Nothing lasts forever and the number 13 is starting to look very unlucky for gold. Barring a major upset in the world financial system, it looks increasing likely that gold will decline in the 13th year of its long rally in the year 2013.

In an

In an

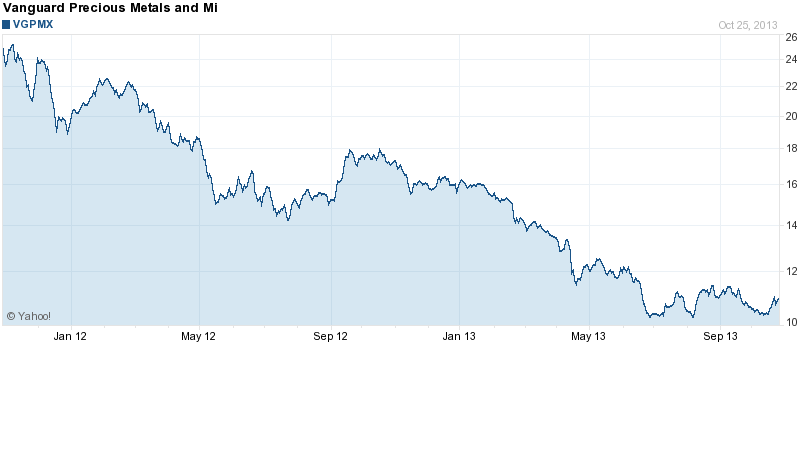

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

The bear case for gold and silver stocks is well known and investors have reacted by dumping mining stocks indiscriminately. The staggering decline in gold and silver stocks over the past two years now exceeds the decline that occurred during the crash of 2008 when the financial system was at the brink of collapse.

By

By  By

By

General Outlook for Gold and the Miners

General Outlook for Gold and the Miners