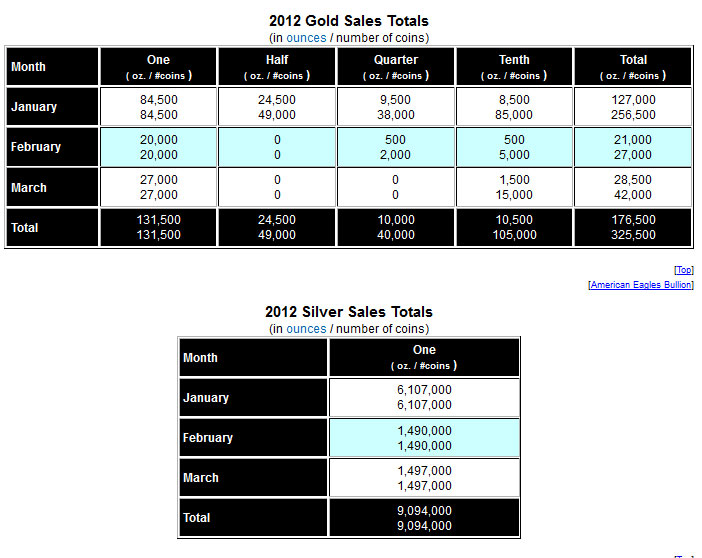

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May.

According to the latest report from the U.S. Mint, sales of both gold and silver bullion coins rebounded strongly during May.

Sales of the American Gold Eagle bullion coins during April had declined to only 20,000 ounces, the lowest monthly sales since June 2008 when 15,500 ounces were sold. During May, the U.S. Mint sold 50,000 ounces of gold bullion coins, up 150% from April sales of 20,000 ounces.

The monthly sales figures for bullion coins can vary dramatically for a number of reasons, but support for the increase in demand during May may be due to the recent pullback in gold prices. During May, the closing London PM Fix Price for gold declined by 6.3% from $1,664 to $1,558 per ounce. Through the end of May, gold has declined by $40 from $1,598 at the beginning of 2012. Gold reached a 2012 high of $1,781 on February 28th.

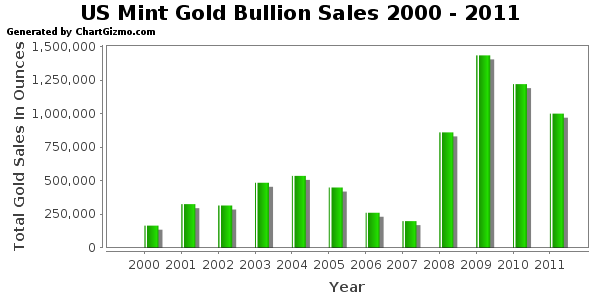

Sales of the American Eagle gold bullion coins hit a record high during the financial turmoil of 2009 as investors eagerly purchased 1,435,000 ounces of gold. Ironically, sales of gold declined during the next two years despite the fact that the financial system has become more unstable as sovereign governments worldwide continue to borrow and print fiat money on an unprecedented scale in an effort to prop up a world economy burdened by unsustainable debt levels and nonexistent economic growth. The ongoing simultaneous collapse of the banking systems and economies of the Eurozone is the most obvious trigger for the next phase of the financial crisis. As confidence in paper money evaporates, expect gold to soar as investors stampede into the only currency that governments cannot debase.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Sales Oz. | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 280,500 | |

| Total | 7,530,000 | |

| Note: 2012 totals through May 31, 2012 | ||

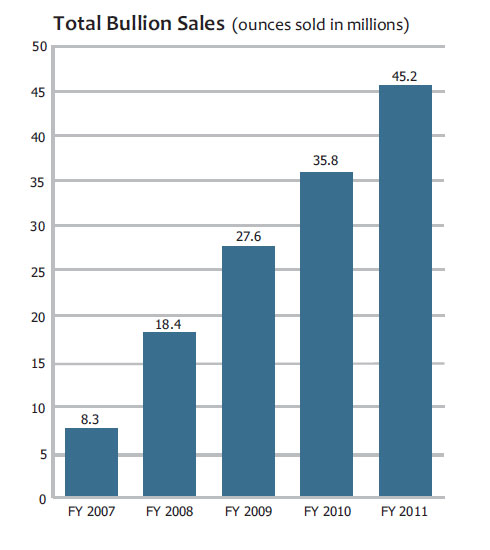

Sales by the U.S. Mint of the American Silver Eagle bullion coins for May almost doubled from the previous month. Total sales of silver bullion coins for May totaled 2,750,000 ounces, up 81% from sales of 1,520,000 ounces in April. Year to date sales of the American Silver Eagle bullion coins through May 31st came in at 14,409,000, down by 23.8% from the first five months of 2011. Sales of the silver bullion coins reached all an all time high during 2011. Since reaching a multi decades high of $48.70 during April of 2011, silver has since corrected, closing out the month of May 2012 at $28.10.

Total annual U.S. Mint sales of the American Silver Eagle bullion coins since 2000 are shown below. Sales totals for 2012 are through May 31.

In addition to gold and silver bullion coins, the U.S. Mint also sells numismatic versions (uncirculated and proof) of gold and silver American Eagle coins which can be purchased by the public directly from the U.S. Mint. Gold and silver bullion coins are sold by the U.S. Mint only to authorized purchasers who in turn resell them to the general public and secondary retailers.

| American Silver Eagle Bullion Coins | ||

| YEAR | OUNCES SOLD | |

| 2000 | 9,133,000 | |

| 2001 | 8,827,500 | |

| 2002 | 10,475,500 | |

| 2003 | 9,153,500 | |

| 2004 | 9,617,000 | |

| 2005 | 8,405,000 | |

| 2006 | 10,021,000 | |

| 2007 | 9,887,000 | |

| 2008 | 19,583,500 | |

| 2009 | 28,766,500 | |

| 2010 | 34,662,500 | |

| 2011 | 39,868,500 | |

| 2012 | 14,409,000 | |

| TOTAL | 212,809,500 | |

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The United States Mint plans to issue the first of this year’s America the Beautiful Silver Bullion Coins in late April. Last year, the series caused quite a stir when the low mintages made them more akin to scarce collectibles than bullion coins. For the current year, the US Mint has planned significantly higher production levels that will eliminate some of the excitement, but hopefully allow the coins to trade as intended, based primarily on the precious metals content.

The United States Mint plans to issue the first of this year’s America the Beautiful Silver Bullion Coins in late April. Last year, the series caused quite a stir when the low mintages made them more akin to scarce collectibles than bullion coins. For the current year, the US Mint has planned significantly higher production levels that will eliminate some of the excitement, but hopefully allow the coins to trade as intended, based primarily on the precious metals content. As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.

As will generally be the case with silver products, the smaller weight offerings carry a larger premium than than larger weight products. This can be the result of the fixed costs associated with manufacture or volume discounts which may be available for purchases in bulk quantities.