According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

According to the latest U.S. Mint report, sales of the American Eagle Gold bullion coins for December 2012 totaled 76,000 ounces, up 16% from December 2011 when 65,500 ounces were sold. Sales for the month were down 44.3% from November sales which totaled 136,500 ounces.

Sales of the gold bullion coins can vary dramatically from month to month. The highest sales month was November with sales of 136,500 ounces and the lowest sales month was April when only 20,000 ounces were sold. Average monthly sales of the gold bullion coins for 2012 was 62,750 ounces with total sales for the year coming in at 753,000. The gold bullion coins are available in one ounce, one-half ounce, one quarter ounce and one-tenth ounce.

Sales of the American Eagle Gold bullion coins have now declined for four straight years in a row. The all time record sales year was 2009 when the U.S. Mint sold 1,435,000 ounces. The value of the gold bullion coins purchased since 2000 totals almost $13.5 billion.

The U.S. Mint only sells the gold bullion coins to a network of authorized purchasers who buy the coins in bulk based on a markup and the market gold value. The primary distributors who buy the coins then resell them to other bullion dealers, coin dealers and the public. By using this type of distribution channel, the U.S. Mint believes that the coins can be made widely available to the public with reasonable transaction costs and at premiums in line with other bullion programs.

The 2013 American Gold Eagle bullion coins were first available to authorized purchasers on January 2, 2013. Demand for the newest gold bullion coins was very strong with 50,000 ounces sold on the first day. For the entire month of January 2012, a total of 127,000 ounces of the coins were sold.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Sales Oz. | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 753,000 | |

| Total | 8,002,500 | |

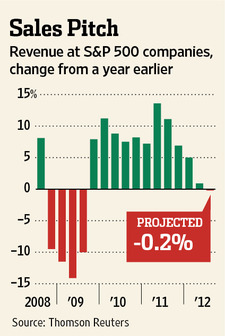

After a volatile year, gold ended with a strong note for 2012, up by 7.1% and rising for the 12th year in a row as global central banks ramped up the printing presses in an attempt to “stimulate” the world economy. In his annual “10 Surprises ” list for 2013, Byron Wien, Chairman of Blackstone Group’s advisory unit predicted that gold would reach $1,900 as “central bankers everywhere continue to debase their currencies and the financial markets prove treacherous.” Based on the way things are going and the speed at which central banks are joining the money printing race, Mr. Wien’s forecast is likely to prove extremely conservative.

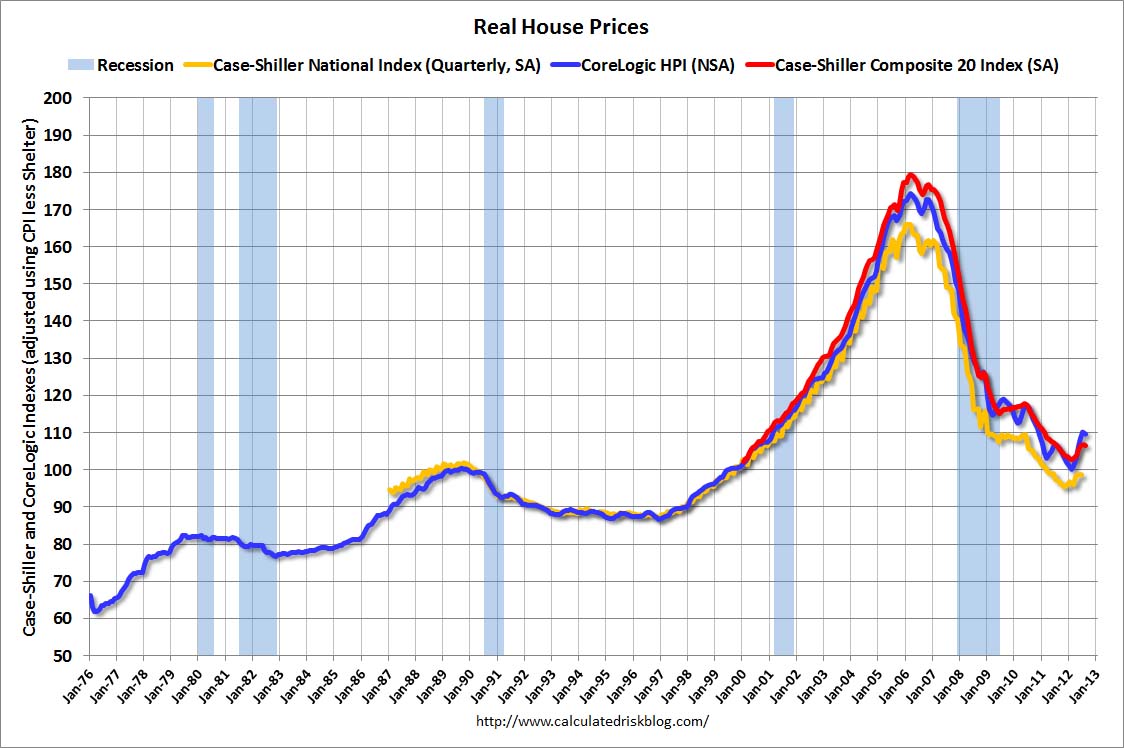

Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

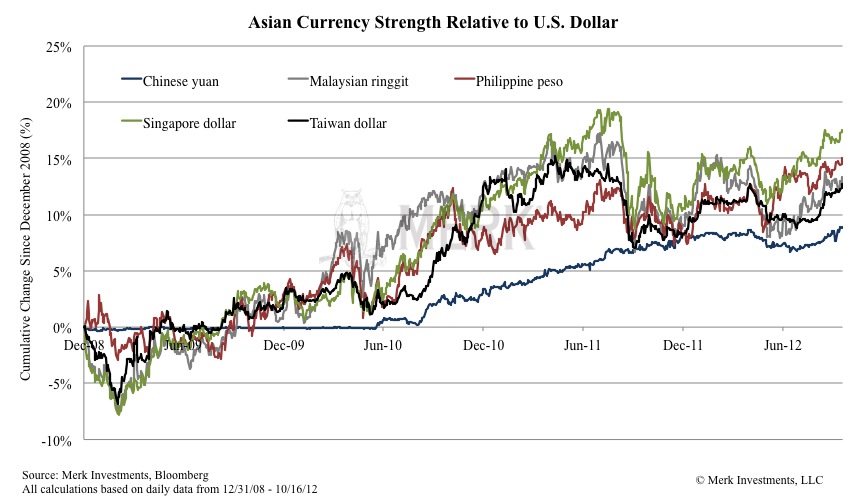

As gold demand in Asia soars, vault companies are racing to keep up with storage demand. In July, Gold and Silver Blog reported on a

As gold demand in Asia soars, vault companies are racing to keep up with storage demand. In July, Gold and Silver Blog reported on a

By

By

Gold news from around the web-

Gold news from around the web-

By

By

By

By

By Axel Merk & Yuan Fang

By Axel Merk & Yuan Fang

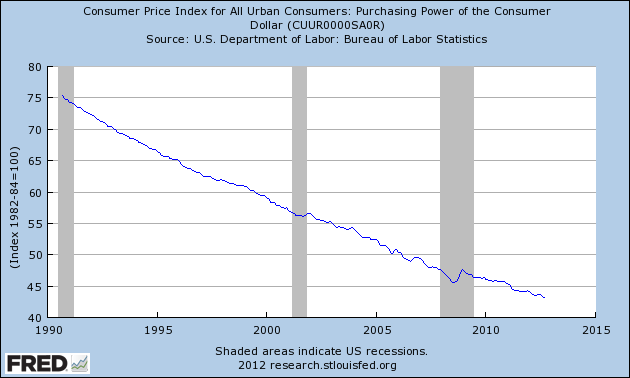

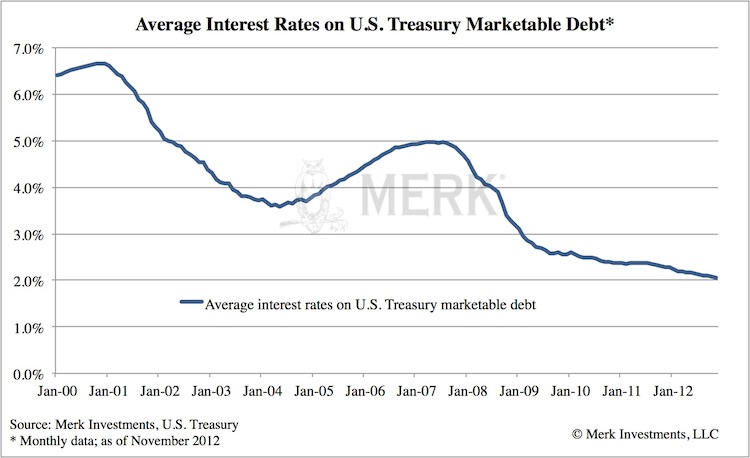

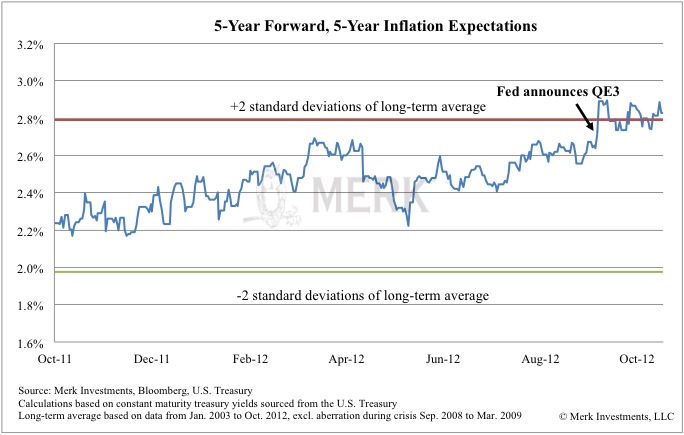

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.