By: GE Christenson

By: GE Christenson

THE SETUP

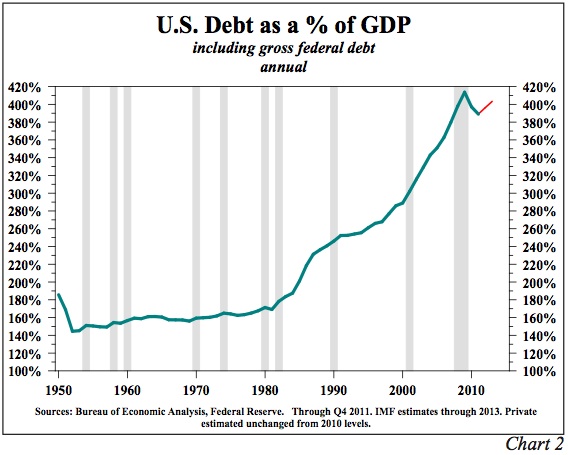

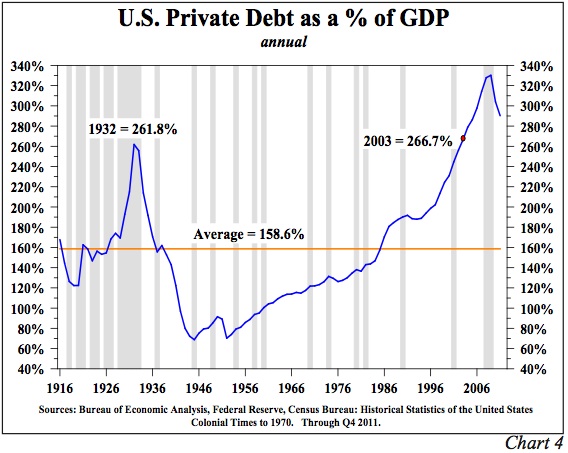

A century ago bankers created the plan for a U.S. central bank, bought enough votes to get it passed into law, encouraged deficit spending, government debt, and extracting the interest payments from taxpayers. The process has worked well for the bankers.

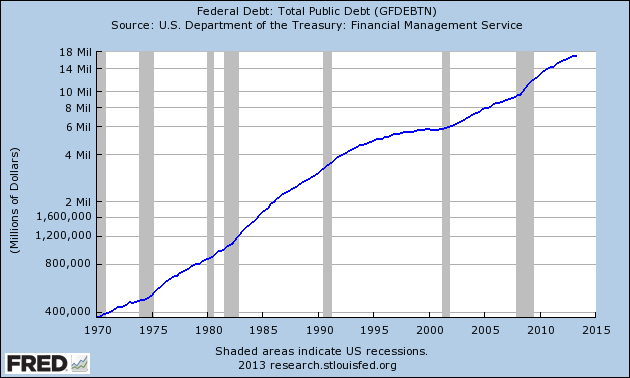

After several expensive wars and the expansion of social programs the U.S. had created considerable debt. In fact, debt and the money supply had increased so much that inflation became a serious problem in the 1960s. Further, the U.S. trading partners no longer wanted dollars but wanted gold instead since they could see that dollars were being created indiscriminately and were losing their value. Nixon (August 15, 1971) did what was good for the financial industry, severed the remaining connection between the dollar and gold, allowed the money supply and debt to increase to never-seen-before levels, and planted the seeds of self-destruction for the dollar and the US economy.

THE CRASH

The process continued until 2008 when the debt and derivatives bubbles had grown so massive that the economy could no longer sustain them. The economy and stock market crashed and financial and political leaders stared “into the abyss” of deflationary collapse, reduced Wall Street income and bonuses, loss of votes, and did what they perceived as necessary: printing money, Quantitative Easing (QE), injecting liquidity, bond monetization, extend and pretend, and so on.

THE “SOLUTION”

The choice was made to “solve” an excessive debt problem by creating more debt – Quantitative Easing (QE) and increased deficit spending. Deficits were increased to a $Trillion or so per year while the government bailed out the bankers and politicians and the public watched Reality TV. It appeared to work, somewhat, for a while.

So the economy (financial industry) and government are desperate for QE, and similar to being hooked on “meth,” they find it difficult to kick the habit and get off the “drugs” of QE, money printing, and central banking. As Gold Stock Bull says,

The economy is addicted to QE and reliant on central bank stimulus to stay afloat. The world now understands that the FED cannot end the bond-buying program and has no intention of doing so anytime soon. If anything, we are likely to see increased quantitative easing in the future, just as a drug addict must up their dosage in order to have the same impact. This monetization of debt increases the bullish outlook on gold, as the gold price has historically trended higher along with the FED balance sheet.

“The question is not tapering. The question is at what point will they increase the asset purchases to say $150 [billion], $200 [billion], a trillion dollars a month…”

“The Fed has boxed itself into a position where there is no exit strategy (and created) a colossal asset bubble…”

Continue QE and you get hyperinflation…”

“Halt, or even taper, QE and the markets crash.”

The picture, sans Fed propaganda, is increasingly clear. QE is necessary to supplement the financial industry and the voracious appetite of the U.S. government for more spending. Merely slowing QE will probably cause markets to crash, interest rates to rise, the government’s expense for interest on past debt will increase while tax revenues decline, and consequently the government needs more, not less, QE.

Of course there is always a way out – the “nuclear” option – let it crash and burn! But no one wants a crash as everyone will be hurt by that choice. Consequently the Fed and the U.S. government (the powers that be – TPTB) scramble desperately. What are the options?

- More QE buys time. Less QE might well cause a crash. So TPTB choose more QE.

- More spending keeps the big corporations (who make LARGE donations to congress) happy. If the government spends less, “everyone” complains. So TPTB choose more spending, more deficits, and more QE.

- Higher interest rates mean that the interest expense for the U.S. government increases. More interest expense means larger deficits and so TPTB are forced to choose more QE.

- Foreign purchases (China, Japan, Russia, etc.) of newly issued U.S. treasury debt are decreasing while some countries are actually reducing their current holdings of treasury debt. This forces the Fed to be the “buyer of last resort” and purchase, via more QE, the debt that normally would have been purchased by China, Japan, Russia and others. Fewer foreign purchases necessitate more QE.

- A weaker economy and fewer people employed means less economic activity, diminished tax receipts and larger deficits. Those larger deficits guarantee more borrowing and more QE.

- Obamacare will create more government expenses and less disposable income for average Americans, which means less consumer spending and therefore less tax revenue for federal, state, and local governments. There is no choice here – it is already law and we are going DOWN that road to much higher consumer costs, lower government revenue, and more government control. The result will be a government desperate for more revenue and more QE.

It does indeed look like a “QE trap.” So ask yourself:

- More QE will weaken the dollar, on average, because more supply indicates less value for each dollar. What will that do to consumer prices for food and energy when the inevitable inflation works its way into the consumer economy?

- What will happen to the prices for gold and silver when the realization finally hits the populace that interest rates are rising, QE is here forever, congress will never balance the budget, and the dollar will continue to weaken. (Hint: There is no fever like gold fever.)

- It is clear that other countries increasingly dislike the U.S. dollar, U.S. treasury debt, and the current policies of the U.S. administration. How much will the prices for imported oil, gold, and silver increase as a consequence of the above?

- What will a dollar collapse do to the prices of gold and silver?

- Knowing the policies of the Fed, the congress, the administration, and the inevitability of QE, do you own enough gold, silver, platinum, land, diamonds, collectible art and other non-paper assets such that you can sleep well at night?

CONCLUSIONS

The U.S. government has spent itself into the “no-win” position whereby more QE is both necessary and dangerous. Most current policies, such as congressional gridlock, inability to pass a budget for five years, Obamacare, weakening economy and tax receipts, declining relations with foreign nations, massive deficits, declining total employment, inability to reduce spending, ongoing wars, probability of future wars, and more, suggest that QE must continue and probably increase.

Stocks may protect you but gold and silver are the safer choice given the inevitability of more QE and a potential dollar collapse.

You decide!

GE Christenson

aka Deviant Investor (see full article here)

In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

In an interview with CNBC, former GOP presidential candidate Ron Paul endorsed the efforts of his son, Senator Rand Paul, to hold up the nomination of Janet Yellen as Federal Reserve Chairman until laws are passed requiring more transparency from the Fed.

By: GE Christenson

By: GE Christenson

The “I won’t buy an umbrella until it rains” crowd has been dumping gold while the case for ownership of safe haven gold has never been stronger.

The “I won’t buy an umbrella until it rains” crowd has been dumping gold while the case for ownership of safe haven gold has never been stronger.

Most people can’t begin to comprehend

Most people can’t begin to comprehend

By: GE Christenson

By: GE Christenson Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Purchases of physical gold have been hitting new all time records. Demand has been fueled by the recent pullback in gold prices and the massive amount of money printing being conducted by central banks in Europe, Japan and the United States. The recent decision by the Federal Reserve to postpone any curtailment of its $85 billion per month of money printing could mark the end of the correction in gold and silver. The Fed’s refusal to reduce the ongoing program of securities purchases signals that QE has morphed from an emergency measure to a permanent Fed policy.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.

Bridgewater’s Ray Dalio, one of the world’s most successful hedge fund investors, has put out a neat video explaining how the economic system works and how the suffocating burden of unmanageable debts can be reduced without propelling the world into uncontrollable inflation or a deflationary depression.