Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

Long term gold and silver investors who have gradually accumulated physical precious metals over the years have seen the value of their holdings increase substantially when measured against the value of the paper dollar. Astute investors realize that a large part of the “gains” on their precious metals have merely preserved purchasing power compared to paper money which has been consistently debased by the monetary and fiscal policies of the government and federal reserve.

In the eyes of the taxing authorities, however, the increased value of an investment due to inflation is still considered a gain regardless of whether or not there was an increase in purchasing power. As the chart below graphically depicts, a $4,000 investment made in 1986 and now worth $8,000 is still worth only $4,000 in purchasing power -thus the true economic gain is zero. Try telling that to the IRS! After paying long term capital gains on the phantom $4,000 “profit”, you are left with less that you had in 1986.

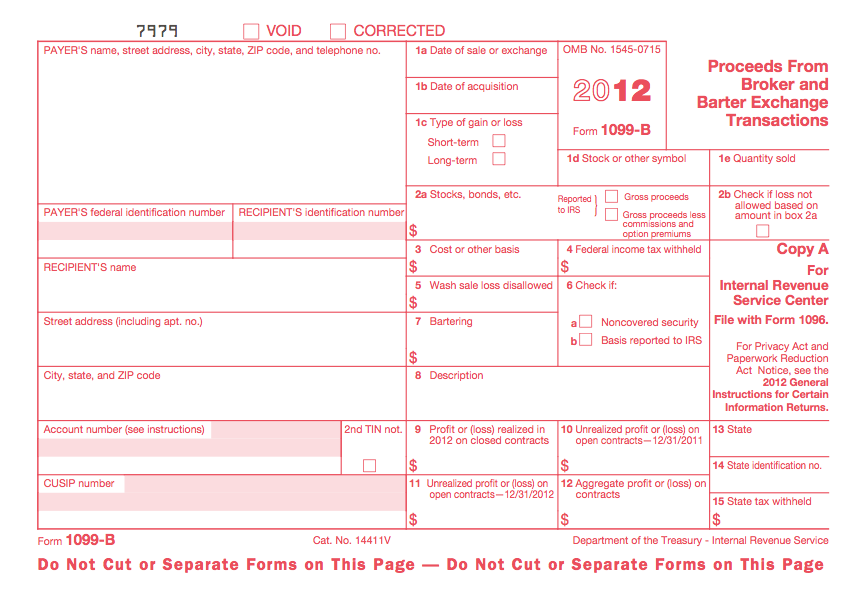

There is, however, a silver and gold lining for investors in physical precious metals since, under many circumstances, the sale of your gold and silver bullion is not reported to the IRS. There are circumstances, however, in which a bullion dealer is required to file a Form 1099-B with the IRS which reports sales transaction proceeds, name, address and social security number. It is obviously important to most investors to know what types of sales are kept private and what types of sales are reported to the IRS.

Thanks to our friends at GoldSilver.com, here is the essential up to date information that you need to know before selling gold and silver bullion.

Before we begin, the following information covers aspects of investor privacy, not an investor’s responsibility to pay income tax gains on any profits made from the purchase and sale of investment grade bullion products. For tax questions, please seek professional tax consul.

We know investor privacy is very important to physical silver and gold purchasers and confidentiality is one of the values we covet most along with our customers.

For some bullion investors, ensuring themselves a private sale is their most important objective and we understand the myriad of reasons as to why this is so.

That being said, we must always adhere to the rules of our industry.

Being a bullion dealer, we are often asked by customers questions like…

– Are my transactions private?

– When I sell my gold bullion or silver bullion, is it a private transaction, or is it reported to the IRS?

First, when a customer buys from our dealership, the transaction is private.

We have specifically designated the current payment method options on our website so that investors who buy bullion from us, do so in confidentiality.

Secondly, when an investor sells their gold bullion or silver bullion to a dealer like us, some of these trades are private while some are not.

Depending upon what you are selling will depend upon whether the powers that be require us as a bullion dealer to fill out something called an IRS 1099-B Form.

IRS 1099 Gold Reporting & Silver Reporting

When you sell your bullion back to a dealer, the pertinent questions for a dealer are:

1) What form of gold and or silver bullion are you selling?

2) What amount of silver bullion and or gold bullion are you selling?

The following covers private investor sales of bullion products we currently offer at GoldSilver.com.

1099 EXEMPT PRIVATE SILVER BULLION

Private silver bullion ( IRS 1099 Form exempt ) consists of any quantity sold to a dealer of the following items:

– American Silver Eagle Coins

– Canadian Maple Leaf Silver Coins

– Austrian Philharmonic Silver Coins

1099 REQUIRED SILVER BULLION

Reported silver bullion ( IRS 1099 Form required ) consists of 1000 ounces or more sold to a dealer of the following items:

– .999 fine silver bullion bars (any sizes)

– .999 fine silver bullion rounds (any sizes)

1099 EXEMPT PRIVATE GOLD BULLION

Private gold bullion ( IRS 1099 Form exempt ) consists of any quantity sold to a dealer of the following items:

– American Gold Eagle Coins

– American Gold Buffalo Coins

– Gold Austrian Philharmonic Coins

1099 REQUIRED GOLD BULLION COINS

Reported gold bullion coins ( IRS 1099 Form required ) consists of 25 ounces or more sold to a dealer of the following items:

– Canadian Gold Maples (1 oz)

– South African Krugerrands (1 oz)

1099 REQUIRED GOLD BULLION BARS

Reported gold bullion bars ( IRS 1099 Form required ) consists of 32.15 ounces or more sold to a dealer of the following items:

– .999 fine gold bullion bars (any sizes)

***

These are the IRS 1099-B Form reporting requirements for the bullion products we offer at GoldSilver.com as of May 2012.

Stay tuned to GoldSilver.com for any future news or proposed changes to the current IRS 1099 gold and silver reporting requirements.

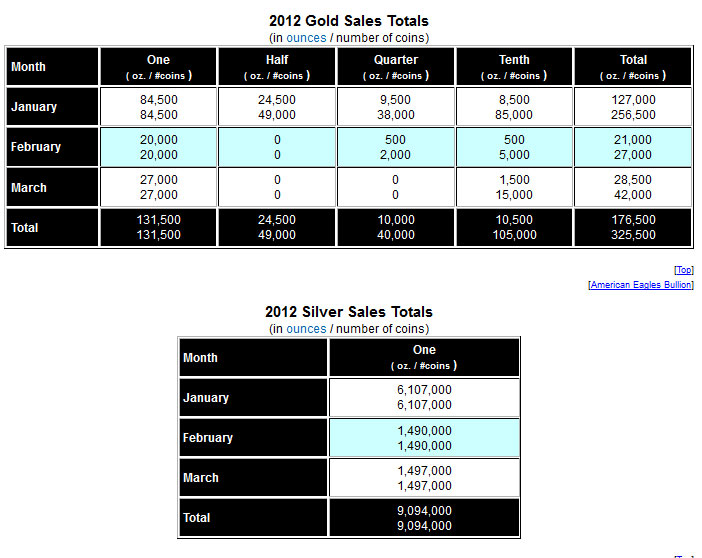

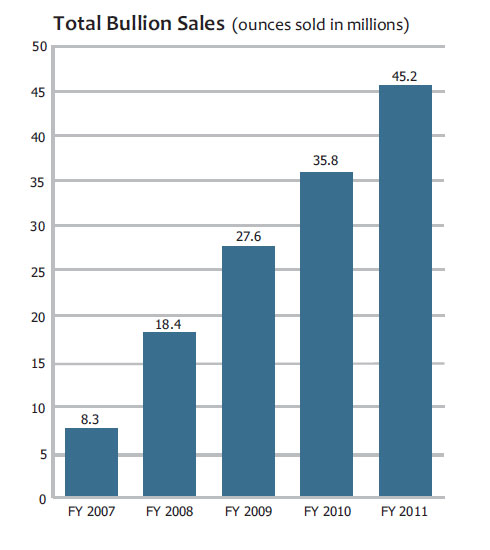

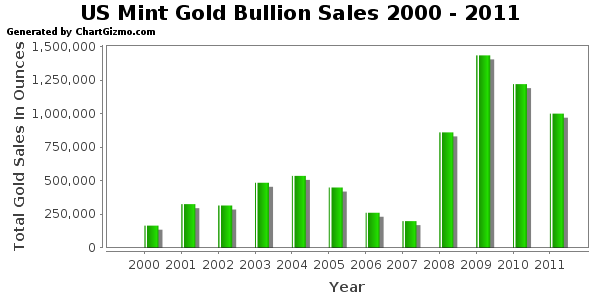

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The latest sales figures from the U.S. Mint show a continuing trend of lower gold bullion coin sales. Sales of American Gold Eagle bullion coins hit an all time high in 2009 when the Mint sold 1,435,000 ounces. During 2010, sales declined to 1.2 million ounces and in 2011 only 1 million ounces of gold bullion coins were sold.

The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels.

The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels. Despite recent volatility, gold and silver prices continue to push to new highs. After a brief pullback on earlier this week, silver rebounded strong and once again approaches the $50 level. Gold, which has lagged the price gains in silver, recently rose to a fresh all time high and remains solidly above the $1,500 level.

Despite recent volatility, gold and silver prices continue to push to new highs. After a brief pullback on earlier this week, silver rebounded strong and once again approaches the $50 level. Gold, which has lagged the price gains in silver, recently rose to a fresh all time high and remains solidly above the $1,500 level.

In the past week, the level of gold bullion sales at the United States Mint rose to a three week high at 35,000 ounces. The level of silver bullion sales remained little changed from recent weeks at 658,500 ounces, as coins continue to be subject to the US Mint’s allocation program.

In the past week, the level of gold bullion sales at the United States Mint rose to a three week high at 35,000 ounces. The level of silver bullion sales remained little changed from recent weeks at 658,500 ounces, as coins continue to be subject to the US Mint’s allocation program.