In a previous post, I reviewed the amount of silver bullion sold by the United States Mint during 2008. With this post, I will take a longer term look at silver demand, which highlights the absolute explosion in demand which has occurred in recent years.

The supporting data for the charts included with this post comes from a new section of Gold and Silver Blog which collects the US Mint Silver Bullion Sales data since the inception of the program in 1986. You can visit the page to find the monthly sales figures for any date from 1986 to present. The section also calculates the approximate silver bullion value of each period’s sales based on the average monthly price of silver.

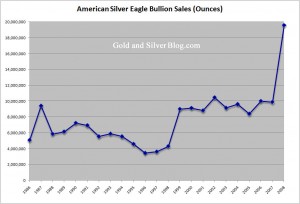

Silver Bullion Sales in Ounces

Here’s a chart summarizing the total ounces of silver bullion sold by the US Mint each year since 1986. (Click on the chart for a larger version.)

During 2008, the US Mint sold 19,583,500 ounces of silver through its bullion program. As explored previously, this marks an all time high for the program. It represents an increase of more than 98% from the prior year, and an increase of 92% from the previous all time high reached in 2002.

One important thing to note when considering the magnitude of the increase for 2008 is that the number of ounces sold could have been much greater. The US Mint suspended silver bullion sales during February before resuming sales on a rationed basis. When the rationing first began, one dealer claimed that he could have sold 500,000 ounces of silver per week, but was only allocated 100,000 ounces.

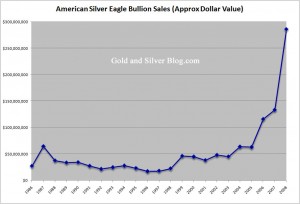

2008 Silver Bullion Sales in Dollars

Here’s a second chart which illustrates the explosion in demand for silver in even more dramatic fashion. The chart shows the approximate dollar value of silver bullion sold by the US Mint each year. As mentioned, this was calculated based on monthly silver bullion sales and the average monthly price of silver. (Click on the chart for a larger version.)

During 2008, The US Mint recorded silver bullion sales of approximately $286,451,715. This marks an all time high and an increase of 114% from the prior year, which was also the prior all time high.

The magnitude of the increase is more pronounced when compared to silver bullion sales from earlier years of the program. Throughout the majority of the 1990’s, the US Mint was selling less than $30 million worth of silver each year. The year for the lowest value of silver bullion sold was 1996 with $17,434,050. During 2008, the US Mint recorded monthly sales exceeding this level for ten out of twelve months.

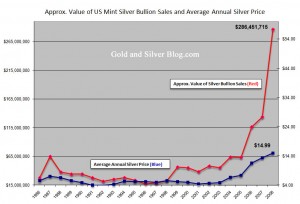

Silver Bullion Sales and the Price of Silver

But what about the price of silver amidst this explosion in demand?

Here’s a third chart which plots the value of US Mint silver bullion sales from the last chart, together with the average annual price of silver for each year. (Click on the chart for a larger version.)

Silver bullion sales increased from a low of $17,434,050 to last year’s high of $286,451,715 representing an increase of 1,543%. The average annual price of silver increased from a low of $3.95 per ounce to last year’s high of $14.99 representing an increase of 203%. While this is a respectable gain, it pales in comparison to the increase in demand.

Everyone has been waiting for the disconnect between the demand for silver and the price of silver to resolve itself. Will it finally happen in 2009?

[phpbay]2009 silver eagle, 3, 39488, “”[/phpbay]

Today, the United States Mint published notification that they would be raising the premiums charged for American Silver Eagle bullion coins. This refers to the premium above the price of silver at which the US Mint sells the bullion coins to Authorized Purchasers. The premium will increase from $1.40 per coin to $1.50 per coin. The increase will be effective from February 9, 2009.

Today, the United States Mint published notification that they would be raising the premiums charged for American Silver Eagle bullion coins. This refers to the premium above the price of silver at which the US Mint sells the bullion coins to Authorized Purchasers. The premium will increase from $1.40 per coin to $1.50 per coin. The increase will be effective from February 9, 2009. With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces.

With the dust somewhat settled for the prior year, we now have some complete US Mint sales data on sales of gold, silver, and platinum bullion coins. As expected, the numbers show some large percentage increases from prior year sales. In particular silver bullion sales reached an all time record high with sales of nearly 20 million ounces.