Does anyone really think that gold is unencumbered, unleased, and actually physically there? Yes, I know…

Does anyone really think that gold is unencumbered, unleased, and actually physically there? Yes, I know…

- They would not lie to us, right?

- The official numbers must be true, right?

- They seem like trustworthy people, right?

- Why wouldn’t it be there?

The official gold holdings ( rounded numbers) of the US Treasury Department are as follows:

Fort Knox 147,000,000 ounces, West Point 54,000,000 ounces, Denver 44,000,000 ounces, Federal Reserve of NY 13,000,000 ounces, other 3,000,000 ounces – Total – 261,000 ounces.

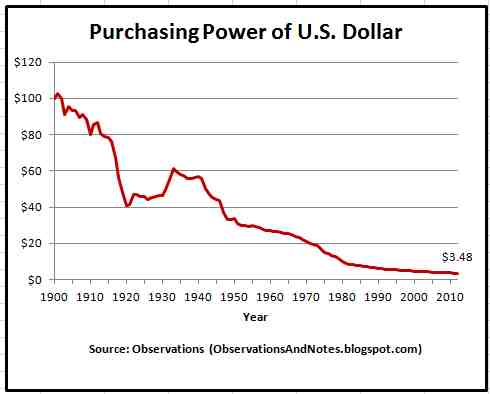

Glad you asked that question. Why wouldn’t it be there? Gold is a bit like an “anti-dollar.” The Federal Reserve creates new dollars by the trillions – dollars are their product. Wal-Mart sells snow shovels and a few other things, Wall Street sells stocks and everything paper, Hollywood sells dreams and entertainment, but the Fed sells dollars, and they don’t like competition. Gold has been real money for 5,000 years world-wide. Federal Reserve notes have been passed off as money for a few decades, and in that time they have lost most of their value as measured against commodities such as wheat, gasoline, and cigarettes.

It could have been worse! Western central banks (officially) and governments sold a considerable sum of gold during the 1990s to help repress the price of gold and to slow the apparent decline in the value of paper money. They also “leased” an unknown amount of gold to bullion banks who also sold that gold into the market. The leases are still “on the books,” so the central banks officially still own the gold, even though it is probably long gone – likely to China, Russia, India, and the Middle East.

Yes, central banks and governments have motive, means and opportunity to suppress the price of gold. They want to support their product (dollars, euros, etc.) and to defeat the competition – gold. If you were a central banker or treasury official who was inflating his currency and consequently reducing its purchasing power, wouldn’t you want to suppress the price of gold to delay recognition of your involvement in the devaluation process?

So why not just do an audit? This is a simple question with a complex set of answers. Here are a few.

- The US gold has not been audited in over 50 years. This must seem strange to any thinking person, but it appears unlikely to change.

- If the Treasury agrees to an audit and the gold is not there, the result will be much unpleasantness – possible indictments, damaged reputations, social unrest, chaos, disillusionment, and destroyed trust – and there is plenty of disillusionment and destroyed trust already.

- If the Treasury performs an audit and the audit claims the gold is actually there, will anyone believe the results of the audit? Is it truly unencumbered – not sold, leased, or hypothecated? Would we even believe an audit had been actually performed?

- If the Treasury acknowledges the lack of a credible audit for over 50 years and then says “we don’t think it is necessary,” will anyone take them seriously?

- The Treasury might claim an audit would be too expensive, but the US government probably wastes the cost of an audit every few hours, so that explanation is likely to sound hollow and stupid.Bottom line: The whole subject of an audit is fraught with potential trouble for both the Treasury and the Fed. The simple solution is to stonewall the audit question and “extend and pretend.”

The problem is that the questions just won’t die. GATA has researched the subject thoroughly and suggests that much of the Treasury gold is probably gone. Eric Sprott has examined the export numbers (official US government export data) and concluded that somehow the US exported about 4,500 tons of gold more than can reasonably be accounted for.

Germany asked for their gold back – a measly 300 tons – and was told it would take seven years to return their gold. It the gold was physically in the vault and unencumbered, it should have taken a few weeks at most. Seven years – really? This must seem strange to any thinking person.

From Bill Holter: “I would like to address the biggest (in my mind) conspiracy theory (fact) of all. It has been “said” for nearly 60 years that the U.S. has 8,400 tons of gold left. First off, there has been no audit done since 1956, not even Senators or Representatives (except for one time in the ’70?s for glance) have been allowed to actually see the gold. “Trust us” is what the population has heard, “trust us” is what foreigners are told…trust us, trust us, trust us. The problem is that so much anecdotal evidence has been dug up by GATA and others. Eric Sprott just last month looked at the U.S. gold export numbers going back 10 years or more and found that 4,500 tons OVER AND ABOVE what are reported as production has been shipped out. Where did that gold come from? When looked at with your 3rd grade mind in gear, there is no way that the gold is really there.

… Forget about all of the past official memos uncovered. Forget all of the evidence that GATA has uncovered over the last 15 years. Forget that Germany asked for their gold and were told “wait 7 years.” Forget that gold and silver prices have not acted like any other market since the mid 90′s and those prices have now crashed 3 times in the face of massive demand. Forget that 2 of the smash downs occurred WHILE the CFTC was supposedly “investigating” the silver market. Forget that 40% of the world’s total gold production was sold in reckless fashion in less than 12 trading hours (who would, could, do this?) FORGET IT ALL! …trust us. … All of this “conspiracy stuff” when put together rather than separately makes sense.”

I don’t know how much gold is left, but I have two (only slightly serious) suggestions:

A very large number of readers on the Deviant Investor site have voted over the past several months regarding what % of the gold they think remains in the US Treasury. The choices were all of it, most of it (>75%), about half (40% to 75%), some (20% – 40%) or very little (<20%). Readers clearly do not believe the official story – about 60% believe very little remains and another 21% believe less than 40% remains. Only 3% think it is all there. A weighted average suggests that the voters on this site believe approximately 20% of the gold physically remains and is unencumbered.

Nixon temporarily closed the “gold window” almost 42 years ago. Since that time, the official CPI shows that the dollar has lost about 83% of its value. For simplicity, let’s assume that 17% of the dollar’s purchasing power remains and assume that 17% of the gold remains.

We don’t know how much of the gold remains. Does it really matter?

Do any of the following matter?

- Government promises

- Central bank promises

- Integrity of politicians

- Integrity of hundreds of present and past Treasury employees

- Backing for $Trillions in debt besides “full faith and credit”

- A possible solution to the massive debt problem of the US government. If the gold is still there, value it at some large number, say $15,000 – $30,000 per ounce, and then back the dollar with gold. This is not my idea – some very intelligent people have advocated it. If the gold is mostly gone, this option is less likely.

Summary

- Fort Knox: Per the voting and dollar devaluation “method” – assume about 20% of the official gold remains – physically in the vaults, unencumbered, not hypothecated or leased to bullion banks. Yes, I know, this is not defensible, scientific, statistically significant, or verifiable. But it sounds about right to me.

- Denver: Assume about the same

- West Point: Assume about the same

- Federal Reserve Bank of New York: Ask the Germans! Assume very little remains.

How much physical gold do you have? How much do you want when you contemplate nearly $17,000,000,000,000 in official US government debt, another $100 – $200 Trillion in unfunded liabilities, and nothing backing that unbelievable amount of debt except the “full faith and credit” of what is clearly a government that won’t balance a budget and must resort to printing dollars to pay its bills?

How much gold do you have stored in a secure (off-site) facility?

GE Christenson

aka Deviant Investor

Rick Rule

Rick Rule Richard W. Fisher, president and CEO of the Federal Reserve Bank of Dallas gave a very interesting speech today, acknowledging that the Federal Reserve policy’s are experimental. No one, including the Federal Reserve, knows how this unprecedented monetary accommodation will affect the economy and the value of the dollar.

Richard W. Fisher, president and CEO of the Federal Reserve Bank of Dallas gave a very interesting speech today, acknowledging that the Federal Reserve policy’s are experimental. No one, including the Federal Reserve, knows how this unprecedented monetary accommodation will affect the economy and the value of the dollar.

By GE Christenson

By GE Christenson By: GE Christenson

By: GE Christenson A profound thanks to all the short term fickle speculators in gold and silver who have shifted their portfolio allocations to stocks, bank accounts and

A profound thanks to all the short term fickle speculators in gold and silver who have shifted their portfolio allocations to stocks, bank accounts and  Begin the analysis in 1971 when Nixon dropped the link between the dollar and gold. A pack of Marlboros cost (depending on local taxes) about $0.39. We paid about $0.36 for a gallon of gasoline. The DOW Index was about 850. Silver was priced at about $1.39.

Begin the analysis in 1971 when Nixon dropped the link between the dollar and gold. A pack of Marlboros cost (depending on local taxes) about $0.39. We paid about $0.36 for a gallon of gasoline. The DOW Index was about 850. Silver was priced at about $1.39.

One of the best methods for protecting wealth against a constantly depreciating paper currency is to own precious metals.

One of the best methods for protecting wealth against a constantly depreciating paper currency is to own precious metals. Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar.

Last Wednesday, with New York gold down over $40 per ounce, even long time gold bulls were advising caution before committing to further investment. Some precious metals dealers reported a flood of panic selling by anxious investors who were unloading physical coin and bar.