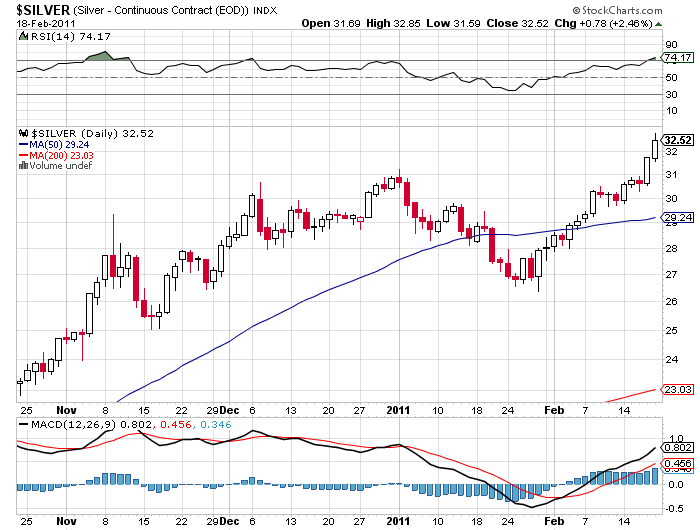

After a brief consolidation below the 50 day moving average in late January, silver resumed its uptrend with a vengeance. The London PM fix price for silver closed at $31.94 up from $30.00 the previous week. Since late January, silver has rocketed $5.50 for over a 20% gain.

The fruitless budget reduction talks in Washington, a slide in the US Dollar Index and a new high on silver are certain to ignite the precious metal markets into another major move upwards. Most investors under the age of 50 probably don’t remember the last time silver prices have soared past $30 in the early 1980’s.

Technically and fundamentally, silver is poised to make a major move. Price movements coming out of long bases usually have a long duration. Silver has broken out from an ultra long base of over 25 years. The initial move from the $5 area to $30 is simply the first phase of what should turn out to be a major upward move.

Silver hit an all time high of $48.70 in January 1980. The inflation adjusted historical high for silver is $130 per ounce. Considering the horrendous manner in which sovereign states are conducting their financial affairs and the potential for another financial crisis, the inflation adjusted high of $130 will look like a bargain price at some future date.

The closing London Fix Prices showed gains across the board from the previous week. Silver was the standout performer with a gain of 6.5%.

| Precious Metals Prices | ||

| Fri PM Fix | Since Last Recap | |

| Gold | $1,383.50 | +19.50 (+1.43%) |

| Silver | $31.94 | +1.94 (+6.46%) |

| Platinum | $1,836.00 | +7.00 (+0.38%) |

| Palladium | $847.00 | +25.00 (+3.04% |

Another Precious Week

Another Precious Week

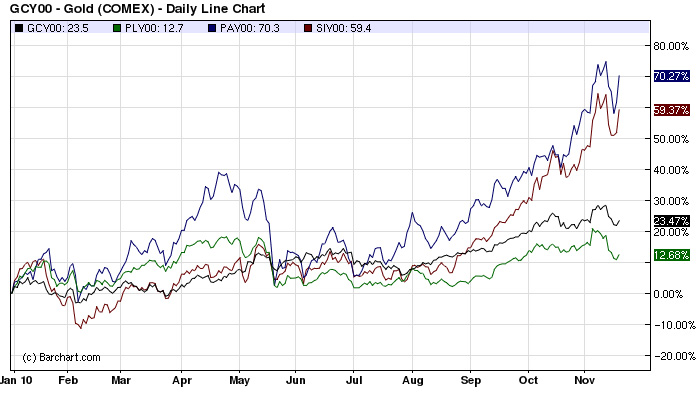

Although gold and silver are experiencing a sharp decline today, they recorded strong performance during the second quarter of 2010. Platinum and palladium both posted declines for second quarter, but maintain gains for the year to date.

Although gold and silver are experiencing a sharp decline today, they recorded strong performance during the second quarter of 2010. Platinum and palladium both posted declines for second quarter, but maintain gains for the year to date. The US Mint’s sales of gold and silver bullion coins during June 2009 showed increases from both the prior month and year ago levels. The increases came amidst two interesting developments for the US Mint’s bullion coin programs.

The US Mint’s sales of gold and silver bullion coins during June 2009 showed increases from both the prior month and year ago levels. The increases came amidst two interesting developments for the US Mint’s bullion coin programs. ETF Securities USA recently filed with the SEC to launch exchange traded funds covering platinum and palladium. There are currently no exchange traded funds covering these metals available in the United States.

ETF Securities USA recently filed with the SEC to launch exchange traded funds covering platinum and palladium. There are currently no exchange traded funds covering these metals available in the United States.