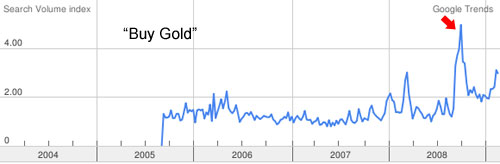

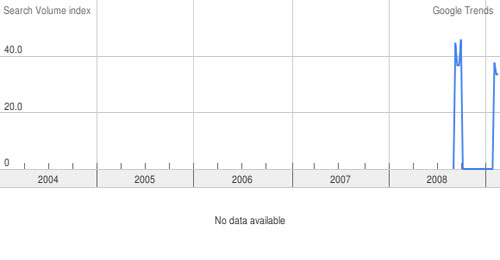

With gold fluctuating around the $900 level, let’s take a look at some thought provoking gold and silver related stories from various blogs and news sites.

With gold fluctuating around the $900 level, let’s take a look at some thought provoking gold and silver related stories from various blogs and news sites.

Incredibly, he claims that there is no shortage of gold and silver coins.

What happened was all the dealers went and bought huge silver supplies back when silver was at $20 and now their stuck and they don’t want to take a loss and so they are telling people they don’t have coins. I promise you sir if you offer $25 for silver coins you’d get all you wanted. There is no shortage.”

He goes on to say the same thing about gold coins.

Gold Coin Shortage Likely To Become Chronic

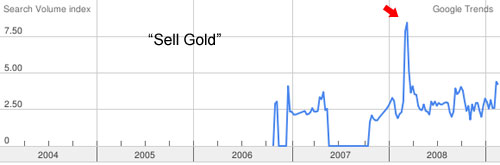

And here’s the more popular conclusion- Yes, there is a gold coin shortage. This is supported by anecdotal evidence, gold coin rationing by world mints, and high prices paid for physical gold and silver in liquid markets.

APMEX Gold and Silver Sales Data

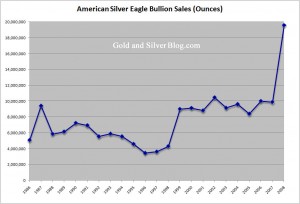

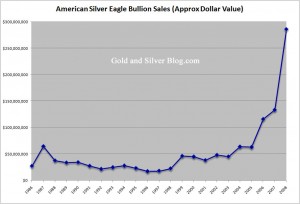

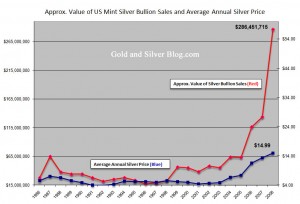

Some first hand sales data from precious metals dealer APMEX. From 2007 to 2008 the number of orders for gold increased 262% and the number of orders for silver increased 358%.

With economy tanking, ‘liberty’ coins made of silver are paying off

Remember the Liberty Dollar? It seems that in commerce, most vendors are more than happy to take them in lieu of paper money.

If you are hoarding physical gold, where do you keep it? Here’s an examination of the pros and cons of various methods of gold storage.

Briefly the US Dollar and Gold had a price correlation of 100%, taking into consideration the prior 15 trading days. The odd correlation has recently reversed sharply.

Back in December

Back in December Gold, silver, and platinum have all been strong performance so far this year, but which has done the best? The table below presents the price of gold, silver, and platinum at the start of the year, today’s price, and the change. The performance of the S&P 500 is thrown in for good measure.

Gold, silver, and platinum have all been strong performance so far this year, but which has done the best? The table below presents the price of gold, silver, and platinum at the start of the year, today’s price, and the change. The performance of the S&P 500 is thrown in for good measure.

Gold’s recent move above $900 has analysts scrambling to increase their price targets.

Gold’s recent move above $900 has analysts scrambling to increase their price targets.