The past decade has seen a virtually nonstop advance in the price of gold. Silver, which lagged gold until last year, recently hit a 31 year price high. Gold and silver, both used as currency for thousands of years, have gained broad investor appeal as a hedge against paper currencies.

The increase in the value of gold and silver is due to the fiscal and monetary policies of nations struggling to deal with massive levels of debt – policies that virtually guarantee a continued rise in the price of gold and silver.

Central banks, having exhausted all conventional means of monetary easing, have moved on to the last resort option of quantitative easing and currency debasement. Federal Reserve Chairman Bernanke has twice resorted to the printing presses, and then shamelessly explained the “virtues” of his money printing policy (in convoluted terms) to a gullible public on national television. The subsequent absence of broad public opposition to a policy that is certain to ultimately destroy the financial well being of most Americans seems based on ignorance and/or indifference.

One American who is not ignorant or indifferent to the Fed’s policy of printing money issued a dire warning this week on the dangerous path the Federal Reserve has taken. The reason we should all pay great attention to this warning is because it was issued by a powerful policy maker at the Federal Reserve.

According to Reuters, Richard Fisher, President of the Dallas Federal Reserve stated in a speech that the debt situation in the U.S. is at a “tipping point.” He is quoted as saying, “If we continue down on the path on which the fiscal authorities put us, we will become insolvent. The question is when”. Bank President Fisher further said that no additional extraordinary measures should be taken when the current round of money printing ends in June of this year.

We shall see what happens comes mid year when QE2 is scheduled to end. The problem facing the Fed is that they are out of conventional policy bullets to ease credit conditions with rates already at zero. The ease and apparent lack of consequences in printing money has made additional quantitative easing a very seductive method of allowing huge deficit spending by the government. QE2 is a thinly disguised monetization of the Federal deficit in which the Federal Reserve purchases government debt from the primary dealers after they purchase the debt at Treasury auctions.

Government officials argue that unprecedented deficit spending and quantitative easing are necessary to stimulate economic growth, but this theory has not worked in the real world. Despite trillions in stimulus spending, job creation and economic growth have been extremely weak and are likely to remain so according to economists Kenneth Rogoff and Carmen Reinhart who wrote This Time Is Different: Eight Centuries of Financial Folly. According to Rogoff and Reinhart, economic growth is subpar when public sector debt exceeds 90% of GPD which the U.S. and many other developed nations have already surpassed. In addition, a recovery of the job and housing markets after a financial crisis take many years due to the burden of excessive levels of debt. Ultimately, Rogoff and Reinhart predict that austerity measures will need to be imposed along with some type of debt restructuring.

Is the U.S. capable of reducing spending and instituting austerity measures? Cutting deficits means cutting payments to a long list of incomeless recipients who really don’t care where the entitlement money comes from. Those still actually paying taxes will object strongly to any proposed tax increase to fund government spending. Unable to cut spending or raise taxes leaves the Government with one bad option – print more money.

Politicians, who value getting elected above all else, are likely to strong arm the reliably compliant Federal Reserve Chairman Ben Bernanke to “come to the rescue” again with QE3. In the minds of politicians and Federal Reserve officials, there will always be very compelling reasons to continue borrowing and money printing. With the expected retirement of Federal Reserve Bank of Kansas President Thomas Hoenig this October, the Federal Reserve will be dominated by dovish members who favor the easy money policies of Fed Chairman Bernanke. President Hoenig is one of the few Fed members who oppose continued zero interest rates and quantitative easing.

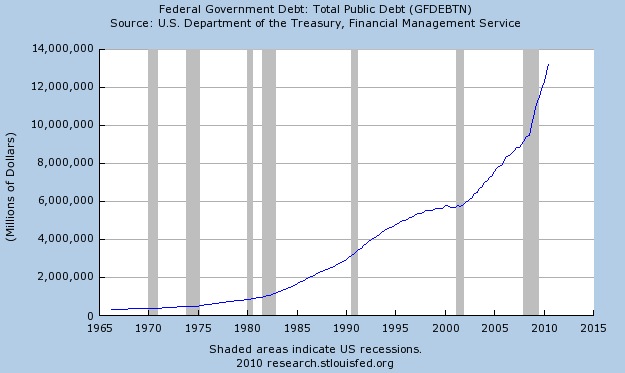

The correlation between parabolic increases in government debt and the price of gold is clear. Since 2000 both government borrowing and the price of gold have been closely correlated as seen below. The increased value of gold directly reflects the decreasing value of paper money.

A nation that has reached the limits on taxation and borrowing has few viable policy options other than a continuing series of quantitative easing programs. Current government policies, if left unchanged, virtually guarantee a continued increase in the price of precious metals.

TOTAL PUBLIC DEBT

GOLD PRICE - COURTESY KITCO.COM

All-time nominal closing high for gold, and all time record quarterly close for silver!