Gold’s non stop advance since early July saw a rapid reversal on Wednesday as gold lost $104.20 to close at $1,752.30 in New York trading.

Gold’s non stop advance since early July saw a rapid reversal on Wednesday as gold lost $104.20 to close at $1,752.30 in New York trading.

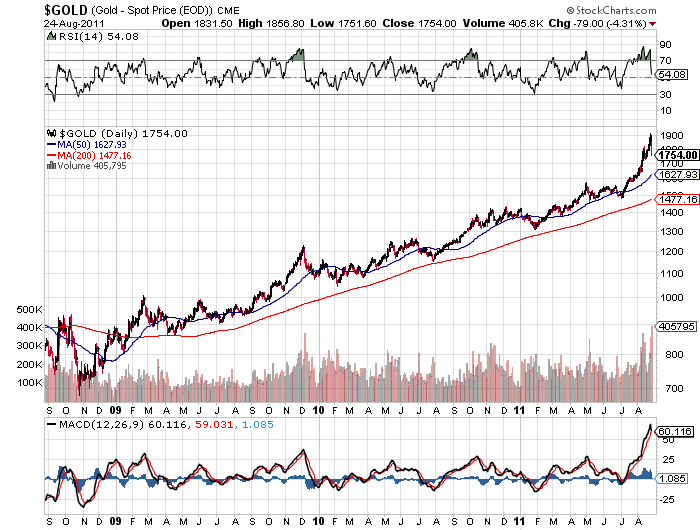

Gold prices have soared this year on fears of another financial crisis and the continual debasement of paper currencies by governments that are tottering on the brink of default. Gold began the year at $1,388.50 and by early May traded over $1,550. After consolidating for two months, gold broke out of its trading range in early July and breached the $1,900 level earlier this week. Despite today’s sharp sell off, gold is still up $363.80 or 26% for 2011.

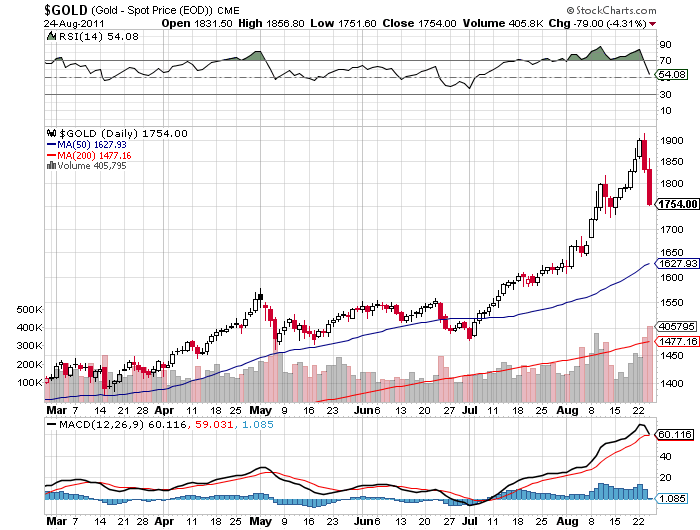

As short term trend traders, hedge funds and speculative buyers jumped into gold, prices became overbought with gold trading $423 above its 200 day moving average. The same traders playing gold for short term profits jumped out just as quickly when prices started to reverse. Two factors that encouraged profit taking in gold were reports that the Fed would not immediately announce another round of money printing and the sharp hike in margin requirements on gold futures by the CME Group.

On a short term basis gold was overbought and due for a correction after an almost vertical rise from $1,500 as can be seen below.

A view of a longer term chart gives a different perspective – the long term bull market in gold remains intact and the fundamental reasons for owning gold have not changed.

The non stop “gold bubble” chatter by talking heads who missed participating in the decades long gold rally are focusing on a short term price movement instead of the fundamentals that will continue to drive gold prices higher. Every bull market has corrections and are an opportunity to add to positions. As a long term investor in gold since the early 1990’s, I have seen other investors trade in and out, losing money each time, instead of simply going with the long term bull trend.

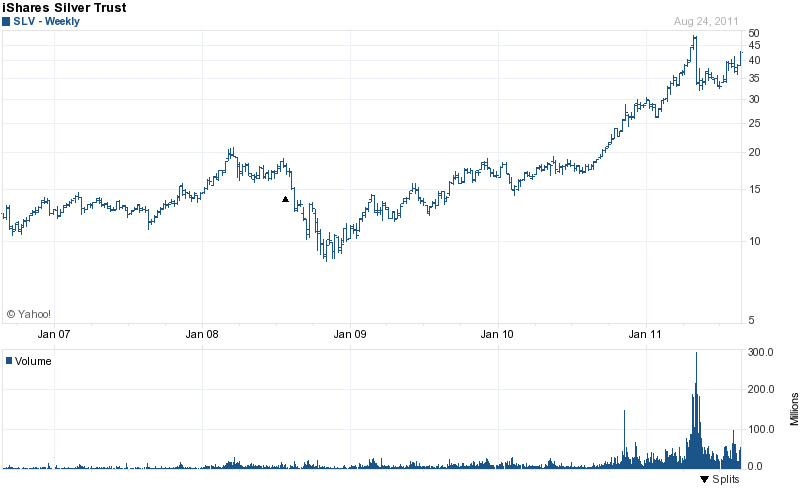

Many analysts have expressed concern that investors might be panicked out of the GLD causing the price of gold to plunge. This does not seem to be the case despite the large drop in gold prices this week. As of Wednesday, the GLD gold holdings declined by only 39.67 tonnes. In addition, when silver spiked in early May, trading volume in the SLV exploded by 750% above the daily average trading volume. Despite the volatility in gold this week, trading volume in the GLD expanded by only 350% above average trading volumes. This would seem to indicate that investment in the GLD is a core holding by long term gold investors who are not inclined to sell on normal price corrections.

The SPDR Gold Trust currently holds 39.6 million ounces of gold valued at $70.1 billion. There has been much hype about the value of the GLD exceeding that of the SPDR S&P 500. A more proper context for comparison is to compare the value of the GLD to the increase in sovereign debt and money printing. Bernanke’s latest episode of QE2 money printing was 850% larger than the entire value of the GLD and you can count on additional Fed currency debasement in the future.

GLD and SLV Holdings (metric tonnes)

| August 24-2011 | Weekly Change | YTD Change | |

| GLD | 1,232.31 | -39.67 | -48.41 |

| SLV | 9,836.18 | +109.08 | -1,085.39 |

The iShares Silver Trust holdings gained 109.08 tonnes for the week ending August 24, despite the slide in silver prices. The SLV has been building a base in the $35 to $40 range since the May correction. Many analysts proclaimed that the “bubble” in silver prices had burst after the sharp price correction in May. From a long term perspective, the May correction did little to diminish either the bullish fundamentals or the long term upward trend in silver prices.

The SLV currently holds 316.2 million ounces of silver valued at $13.3 billion.

Of course, over time, pessimists will be vindicated and so will optimists. A silly question to ask. Nothing fundamental has changed.

Waiting For Bernanke – like the title of a play, something very existential there. So, durable goods were up and that helped push gold down. And let’s not forget profit-takers. If you had bought gold at 1700, maybe 1870 felt like the right time to reap. Remember, pigs get fat, hogs gets slaughtered.

There is money to be made, even though now the faint of heart will fade away from the gold market. But, personally, I think there I still a LOT of room at the top.

Been using this to keep steady – I am recommending this small, stellar primarily technical analysis company: http://ow.ly/69JZ1