Perhaps it was the realization that the U.S. Federal Reserve was losing to the ECB in the money printing race. Perhaps it was the realization that the only way to prevent a debt imperiled economy from imploding was by supplying new doses of the only remedy left in the Fed’s medicine bag. In any event, Federal Reserve Chairman Bernanke made it clear today that his determination to continue quantitative easing has not diminished.

Perhaps it was the realization that the U.S. Federal Reserve was losing to the ECB in the money printing race. Perhaps it was the realization that the only way to prevent a debt imperiled economy from imploding was by supplying new doses of the only remedy left in the Fed’s medicine bag. In any event, Federal Reserve Chairman Bernanke made it clear today that his determination to continue quantitative easing has not diminished.

In an effort to silence critics who equate QE with currency debasement and inflation, the Chairman has come up with an improved version of QE that will boost the economy without creating inflation or boosting oil prices – in effect, the modern equivalent of turning lead into gold. The new and improved version of QE even comes with a new and impressive sounding moniker -“sterilized bond-buying”.

The Wall Street Journal’s explanation of how this new money creation engine of the Fed would actually work probably left many lesser mortals scratching their heads. See if you can follow how new money creation by the Fed creates wealth and prosperity, while maintaining a sound dollar and zero risk of inflation blow-back.

Third, in the new novel approach, the Fed could print money to buy long-term bonds, but restrict how investors and banks use that money by employing new market tools they have designed to better manage cash sloshing around in the financial system. This is known as “sterilized” QE.

The Fed’s objective under any of these programs would be to reduce the holdings of long-term securities in the hands of investors and banks. The Fed believes that reducing the amount of long-term bonds in the hands of investors drives down long-term interest rates, encourages more risk-taking, and thus spurs spending and investment by households and businesses.

Under the third approach, the Fed would create new money as it buys long-term bonds. But then it would effectively lock up the money rather than letting it loose in the broader economy. The Fed would do this by borrowing the money back from investors for short periods—say, 28 days—in exchange for some low interest rate it would pay investors.

Will this new genius wealth creation mechanism of the Fed actually work or will it wind up driving gold into the stratosphere as the average American finally begins to realize that not only does the Emperor have no clothes, but that he is also delusional?

Here’s the take on the new and improved QE (sorry, I meant to say “sterilized bond-buying”) by astute observer Jim Sinclair, who is never at a loss to expound on the monetary mess we are in.

This would be a hat trick because it assumes the Fed would borrow back funds they have created by good ole debt monetization. It assumes there is no purpose to QE in the first place. It is monetary double talk beyond MOPE or maybe MOPE at a spiritual level. It is an attempt to intellectually cloud the process and to give plausible believability to PR lies.

This is a statement that says we will step on the gas and then equally apply the brakes which means you go absolutely nowhere. It is a statement that is total gobbledegook to deflect the fact that QE is going to infinity. It is a statement that only those who do not understand monetary science might give credibility to.

The claim that QE can be controlled by equal stimulation and draining adds up to nothing whatsoever. The idea that the Fed could so perfectly orchestrate pulling and pushing is denied by the fact of where we are right now.

Only gold can protect you from this sinking ship without hope of rescue as there is no captain at the helm.

I am horrified by today’s total distortion of fact of how the monetary mechanism works by the Federal Reserve. We will win the war by jamming the accelerator to the floor and jumping on the brakes simultaneously, therefore stimulating the dead cat bouncing economies of the Western world to prosperity and avoid sovereign debt failure.

My god that is nonsense.

Meanwhile, for those keeping score, the European Central Bank has powered ahead of the Federal Reserve in the money printing race. The Fed’s balance sheet has ballooned to triple its size from 2008 as the Fed printed $2 trillion in new dollars to purchase mortgage backed securities and treasury debt (effectively financing 40% of the U.S. Government’s deficit). As of the end of February, the Fed’s balance sheet stood at $2.94 trillion.

Faced with the total collapse of the banking system, wild money printing by the European Central Bank (ECB) makes the Fed look like an amateur. After dishing out $1.4 trillion to 800 problem banks since December, the ECB’s balance sheet has exploded to $3.96 trillion.

Other central banks worldwide are following the desperate actions of the Fed and the ECB. The combined balance sheets of the ECB, Federal Reserve, England, Germany, Switzerland, Japan and China and Great Britain has expanded from $6 trillion in mid 2007 to over $15 trillion today.

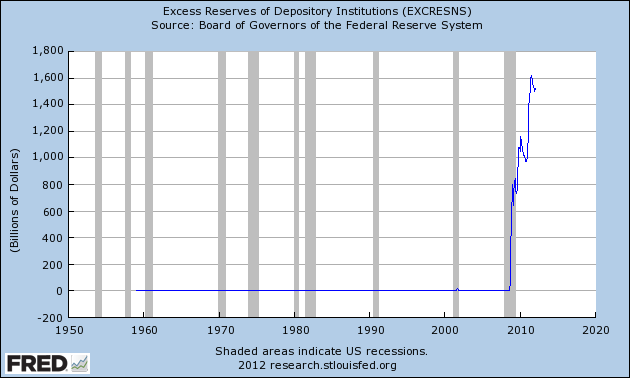

Most of the central bank money has been used to liquify insolvent banks by purchasing bank assets of dubious value. A good portion of the funds received by banks has in turn wound up as idle excess reserves, as the banking industry refuses to expand lending to already over-leveraged or insolvent borrowers.

There will be one surefire way to determine when the money created by the central banks eventually works it way into the real economy – the price of gold will explode upward with a concurrent rise in inflation and wide spread debasement of virtually every world currency. In the meantime, as we watch the “QE to infinity” process unfold before our eyes, gold remains on the bargain table.