A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.

A broad sell off in commodity prices triggered by a Goldman Sachs prediction of a “substantial pullback” in oil prices had little impact on the strong uptrend in gold and silver prices. Based on the London closing PM Fix Price, gold ended Tuesday off only $19 or 1.3% from Friday’s all time close. Silver, meanwhile, the absolute star of the precious metals group, closed Tuesday at $40.44, up 22 cents from Friday’s 31 year closing high. After the recent huge run up in both gold and silver prices, the very modest price declines suggests that the bulls are on the right side of the trade.

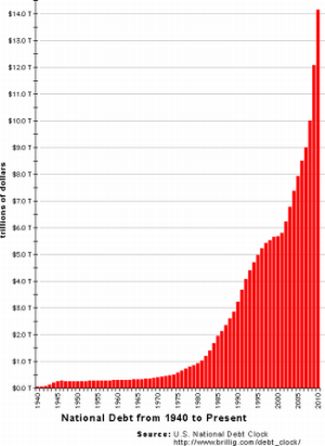

Every bull market has corrections and precious metals will not be an exception. The point to remember is that the U.S. has already passed the point of no return on its inevitable journey to a debt crisis. The mainstream press focuses on the looming battle in Washington over raising the nation’s legal debt limit past $14.2 trillion, yet there is little discussion of the U.S. Government’s total unfunded liabilities of $75 trillion based on open ended entitlement programs. The U.S. is in a debt trap from which a painless escape is impossible.

While the majority of Americans don’t know or don’t care about the spiraling debt disaster facing the Nation, smart money is taking steps to survive and profit from the inevitable day of reckoning.

One of the largest bond investors in the world who has a superb investment track record proclaims that U.S. debt securities have “little value.” In recent remarks, Bill Gross of Pimco candidly states his view on how the U.S. debt crisis will soon end. Mr. Gross states that Pimco has sold all holdings of U.S. debt because “they have little value within the context of a $75 trillion total debt burden. Unless entitlements are substantially reformed, I am confident that this country will default on its debt; not in conventional ways, but by picking the pocket of savers via a combination of less observable, yet historically verifiable policies – inflation, currency devaluation and low to negative real interest rates.”

The smart money sees the future. One logical investment alternative to preserving wealth is in the timeless currencies of gold and silver that governments cannot devalue.

The recent sorry spectacle in Washington only affirms that elected leaders are incapable of preventing an eventual U.S. default (see Why There Is No Upside Limit To Gold and Silver Prices). After scaring half of the old ladies in the country that they wouldn’t get their next social security check, both political parties declared victory after “reducing spending” by $38 billion – a fraction of a percent of total government spending. Even worse, the Washington Post reports that many of the “spending cuts” are accounting gimmicks and budget tricks that will not reduce overall spending.

The great “achievement” of Congress becomes even more pathetic after considering that the national debt has expanded by $3 trillion in the past two years and projected budgeted spending will add almost another $10 trillion in debt over the next 10 years. These horrendous projections assume a growing economy and no major adverse macro economic shocks.

Massive levels of debt and spending commitments leave the U.S. with two ruinous policy choices. Congress can cut spending dramatically and watch the economy collapse after which the Government would re-institute massive spending programs and quantitative easing on an unimaginable scale. The second choice is the odds on favorite – continue the parabolic increase in spending and money printing and watch the economy implode as all bond investors (not just Bill Gross) refuse to purchase worthless treasury debt leaving the U.S. unable to meet its obligations. Either way, the inescapable dilemma that the Nation faces has created the perfect storm for gold and silver.

Yes I went deep into my savings in the mid 90’s and bought a ton of silver from people that couldn’t live on their salary’s so I benefited from their lack of discipline. I also bought a ton of silver eagles and not quite so many gold eagles as I believed they would not appreciate as quickly as silver. Physical silver and gold are the way to go I am sitting fine with a full vault and a gun locker with enough arms and ammo to ward off the scavengers and gangs that will surely be on the hunt when the dollar tanks and the food lines appear. Its still not too late to build some silver value just get off your assets and do it.