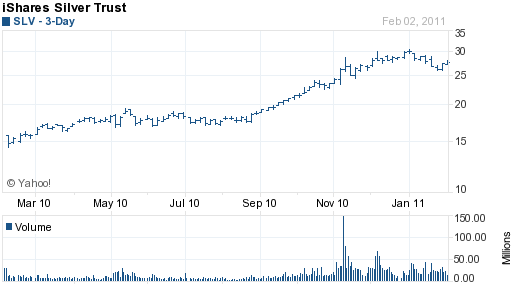

Both the SPDR Gold Share Trust (GLD) and the iShares Silver Trust (SLV) registered minor declines over the past week.

Both the SPDR Gold Share Trust (GLD) and the iShares Silver Trust (SLV) registered minor declines over the past week.

Holdings in the GLD declined by 2.43 tonnes compared to a decline of 21.85 tonnes in the previous week. Since the start of the year, total holdings have declined by 4.2% or 53.57 tonnes. The GLD currently holds 39.5 million ounces of gold.

The holdings of the GLD currently have a market value of $52.7 billion, making the GDL a very significant presence in the gold market. The market cap of the GLD far exceeds that of major gold producers such as Goldcorp (GG) at $30 billion, Newmont Mining (NEM) at $27.4 billion and Randgold (GOLD) at $7.1 billion.

Gold has now made three failed attempts to decisively pierce the $1400 level since last November, forming a triple top in the process. The failure to breakout to new highs and the large price gain of $250 per ounce since last July has motivated some nervous selling by gold investors. A look at the one year chart shows that gold’s short term momentum has faltered as prices breached the 14 day moving average. The next important test will be at the 200 day moving average which gold has traded above for the past two years.

Despite the recent minor setback in gold prices, the long term trend of gold remains intact technically and fundamentally.

GLD and SLV Holdings (metric tonnes) |

|||

2-Feb-2011 |

Weekly Change |

YTD Change |

|

GLD |

1,227.15 |

-2.43 |

-53.57 |

SLV |

10,400.60 |

-47.10 |

-520.97 |

Silver holdings in the iShares Silver Trust (SLV) declined by 47.1 tonnes over the past week compared to a decline in the previous week of 127.6 tonnes. The year to date decline of 520.97 tonnes represents a 4.7% drop in silver holdings which trails the 7.8% year to date decline in the price of silver. The SLV has declined by 9% from its high of $30.40 at the beginning of the year. After a huge gain of 67% in the price of silver since late last year, it is normal to see price consolidation before another advance.

In this writer’s opinion we have not seen a parabolic blow off type price move, nor have we seen the excited entry of first time silver buyers lured by stories of rising prices. One of the sentiment gauges that I use involve noting how many of my friends and clients ask or offer unsolicited advice on a specific investment category. Thus far, not even one person has mentioned silver. Despite the huge advance in silver prices, public awareness seems minimal, implying long term bullishness.

“Since the start of the year, total holdings have declined by 4.2% or 53.57 tonnes.”

This is very bullish for gold as it portends that people are struggling to easily find gold to deliver, and are using GLD as an easy place to get physical.

Where else would you be able to buy 50 tons of gold at the moment??!! The IMF? Err no. Mr. Sprott already tried that!!

There is no gold left! Quick buy some gold!!!