It’s not often that you can buy something at an 83% discount from the market price. Yet that’s exactly the situation when it comes to buying certain gold stocks that are now selling at huge discounts to their intrinsic gold reserves value.

In an interview with Barron’s, value investor David Steinberg of DLS Capital Management explains how his contrarian investment strategy has lead to superior investment results. Since the inception of DLS in 2003, Steinberg has racked up returns of 18%, far outpacing the S&P which returned 8.4%.

Steinberg told Barron’s that his investment strategy is based on valuation and he is currently invested entirely in commodity ETFs and equities. Investing in securities that are currently out of favor but with strong valuation metrics generates superior returns over time. Steinberg believes that gold stocks are undervalued and that “gold mining companies give an investor the opportunity to buy gold in the ground at a significant discount to market prices.”

According to Steinberg, the value of gold reserves held by mining companies is at historical disparities to the price of gold. One gold mining company owned by Steinberg is Kinross Gold (KGC). Kinross recently sold off as investors took a dim view of the merger of Red Back Mining with Kinross. Investors expected that the costs of the merger would adversely impact earnings per share but this has not been the case.

Steinberg told Barron’s that “by owning shares of Kinross, we are buying gold probably at$250 to $275 per ounce, versus the current spot price of about $1,500. Our price target is 27 and the stock is around 15.”

Kinross recently released its first quarter results which showed revenue up by 42%, an adjusted net earnings increase of 81%, margins up 29% and adjusted operating cash flow up 67%. The company’s gold production in the first quarter was 642,857 ounces, up 18% over last year. Kinross is forecasting full year production of about 2.6 million ounces. The company’s production cost per ounce was $543 in the first quarter and production costs are forecast to remain within previous guidance despite industry wide cost pressures.

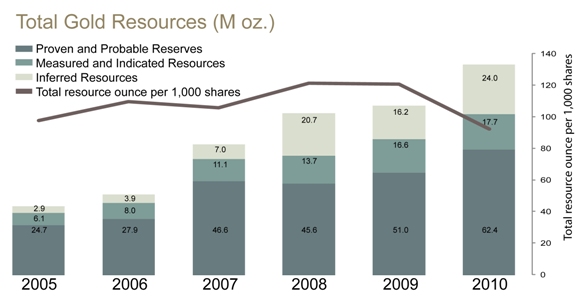

Kinross is based in Canada and has mines and projects in Brazil, Canada, Chile, Ecuador, Ghana, Mauritania, Russia and the United States. Kinross has grown its reserve base by 25% per year over the past 5 years and currently has 92 ounces of gold resources per 1,000 shares.

Kinross Gold expects its equivalent gold production to increase by 77%, growing to 4.5 – 4.9 million ounces in 2015 from 2.6 million in 2011. Of all the senior gold producers, Kinross says it has the best growth profile.

Based on the company’s operating results and forecasts, Kinross Gold stock could wind up being the big winner this year among the senior gold stocks.

Speak Your Mind