The latest edition of Barron’s published an extremely negative article on Gold Resource Corp. Barron’s raised questions about the gold miner’s reserves, stock sales by company insiders, mine production delays, gold production below targeted results and the use of stock dividends to “promote” Gold Resource’s stock price.

The latest edition of Barron’s published an extremely negative article on Gold Resource Corp. Barron’s raised questions about the gold miner’s reserves, stock sales by company insiders, mine production delays, gold production below targeted results and the use of stock dividends to “promote” Gold Resource’s stock price.

In response to the Barron’s article, Gold Resource issued a press release disputing all of the Barron’s allegations. In addition, Gold Resource also raised serious questions about the massive increase in short positions prior to the publication of the negative Barron’s article.

By way of background, Mr. Santoli contacted the Company on May 18, 2011 which was just after the short interest in the Company’s common stock jumped by 1,585,906 shares to its largest short position of 2,235,554, an increase of 41%, according to the Amex May 2011 short interest report. As Mr. Santoli pointed out in his article, the short position has continued to increase substantially since that time to approximately 3.4 million shares, according to the latest NYSE report. However, one thing Mr. Santoli failed to mention in his article is that he was in direct contact with investors holding short positions during the time he was preparing his article. While we can only speculate about his motivations while creating this article and the reason why the short position increased significantly during this time period, we are going to focus our energy on correcting a few of Mr. Santoli’s incorrect factual assertions.

As previously discussed, one week prior to the publication of the Barron’s article, the trading volume in Gold Resource exploded to 7.7 times the daily average volume with the stock down about 5%. The massive increase in short positions prior to the publication of Barron’s article appears to be more than a coincidence. Short sellers appeared to know in advance that a negative article on Gold Resource was due to be published and dramatically increased short positions.

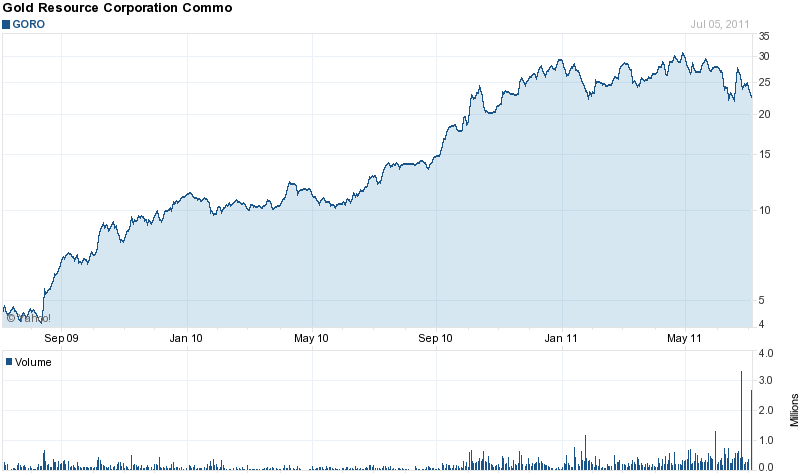

The shorts profited handsomely as the stock plunged in the first day of trading after the Barron’s article was published. After trading as low as $20.55, GORO closed at $22.63, down $1.47. Shareholders of Gold Resource certainly deserve more information on the circumstances relating to the massive short position in Gold Resource stock and hopefully the Company will pursue this matter further.

The Gold Resource press release disagrees with every negative point in the Barron’s article and defends the Company’s approach in not using an SEC compliant reserve report.

Gold Resource effectively reputes the Barron’s charge that management “have been consistent sellers of the stock”. The amount of stock sales by management amounted to only $13.7 million in the past year which is immaterial in relationship to total stock holdings by management, who remain the largest shareholders of Gold Resource.

One issue not resolved by either Barron’s article or the Gold Resources press release is a definitive answer on the amount of gold reserves in the El Aguila mine. Since Gold Resource never conducted a study to assess the “proven and probable reserves” of El Aguila, this question will ultimately be resolved as mine production progresses. Indications that mine production is increasing was provided by another Gold Resource press release on July 5th, in which the Company disclosed record production, revenue and earnings for the second quarter.

If Gold Resource continues to put up records results, the stock price of GORO could soar as nervous short sellers scramble to cover short positions.