Premium for silver coins soars

Premiums are climbing for silver in any form. Even dealer buy prices for junk silver coins are a few dollars above spot.

Has your barber recommended investing in gold and silver yet?

Zimbabwe gold mines face collapse

Zimbabwe’s gold mining industry was Africa’s third largest nine years ago.

Is the silver futures market about to crack wide open?

“COMEX traders are trading contracts either side, long and short, of 479.4 million ounces of silver but only have 131.5 million ounces behind it.”

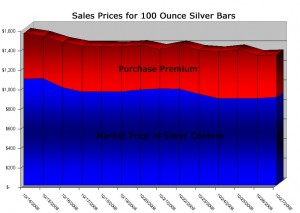

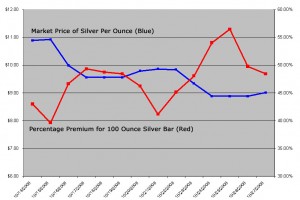

There has been much recent coverage of the rising premiums being paid to purchase physical gold and silver bullion. This has been cited as a consequence of the extreme demand for precious metals and evidence of the growing disconnect between market prices and physical prices.

There has been much recent coverage of the rising premiums being paid to purchase physical gold and silver bullion. This has been cited as a consequence of the extreme demand for precious metals and evidence of the growing disconnect between market prices and physical prices.