Every bull market has pullbacks. Sharp sell offs can generate fear and panic, causing investors to sell at the worse possible time.

Every bull market has pullbacks. Sharp sell offs can generate fear and panic, causing investors to sell at the worse possible time.

Steep and sudden price declines are characteristic of any long term bull market. Speculators and investors with short term perspectives wind up selling instead of adding to positions during the buying opportunity that arises from panic selling.

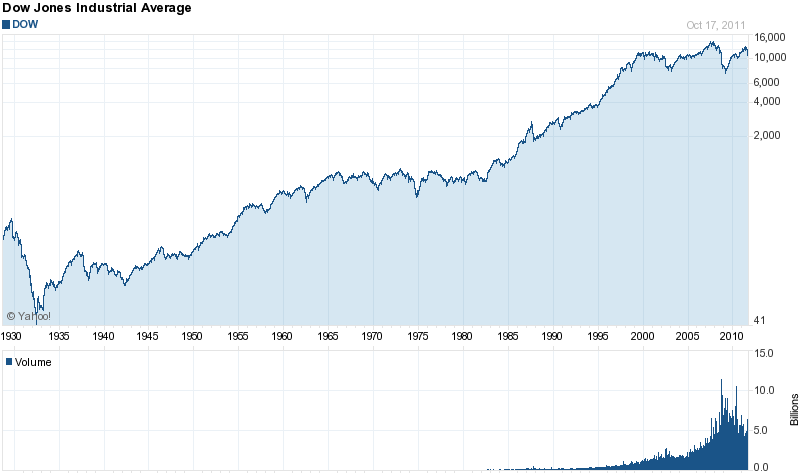

The great bull market in stocks, which lasted from the early 1980’s to 2000, provides a classic case of a sell off that proved to be a great buying opportunity. On October 19, 1987, a day now referred to as Black Monday, the Dow collapsed in a sea of sell orders that left the Dow down by 508 points for a shocking loss of almost 23% in one day.

The loss on the Dow was the largest in history, causing panic among investors. After Black Monday, a group of the world’s foremost economists unanimously predicted an economic downturn similar to the 1930’s.

Although the exact cause of the Crash of 1987 is still being debated, those who stayed in the market and used the sell off to add to positions, went on to enjoy one of the greatest bull markets in history. Anyone gazing at a long term price chart of the Dow has to squint to see the Crash of 1987 that transpired during the super 20 year bull market that finally ended in 2000.

We have recently witnessed what some are referring to as a “crash” in the gold market, with bullion dropping suddenly by $300 per ounce. Although a rapid depreciation in the price of gold by over 15% can be painful, especially if new positions were initiated prior to the sell off, the decline should be of minor concern to long term gold investors. The fundamental reasons for owning gold have not changed. Investors in the gold market today are being given an opportunity similar to that offered to stock investors in late 1987.

Gold is the only defense against fiat currencies which all ultimately fail and the day of reckoning may be sooner than many think. In his new book “Suicide Of A Superpower”, Patrick Buchanan makes a compelling case that America could collapse financially before 2025. In an interview with Sean Hannity on Fox News (see video link below), Buchanan argues that:

- America’s problems are “deep and endemic”.

- Half of the American population are “tax consumers” rather than tax payers and thus have no incentive to support reduced government spending.

- American society has lost its moral foundations and its sense of right and wrong.

- The widely different views of the major political parties cannot be reconciled and America thus faces a “Balkanization” that will further contribute to the breakdown of American society.

- America will soon become California – bankrupted by the demands of “tax consumers” who will always demand more. By virtue of their majority status, the “tax consumers” will elect politicians who promise them the most, thus ensuring the bankruptcy of America.

The decline of America that Buchanan warns about is already well underway. From a long term perspective, that is all gold investors really need to know.

Audio Link to Suicide Of A Superpower narrated by Patrick Buchanan.

http://cashforgoldusa.com/blog/2011/10/your-gold-is-more-precious-than-ever-choosing-the-right-cash-for-gold-company/

now that gold is at a record high, it’s important to find the right gold sellers! check this out, it might help!