It’s only two trading days into November, and gold is already posting a sizable gain for the month. I took a look at some recent historical data to try to see if gold displays any seasonal performance patterns.

It’s only two trading days into November, and gold is already posting a sizable gain for the month. I took a look at some recent historical data to try to see if gold displays any seasonal performance patterns.

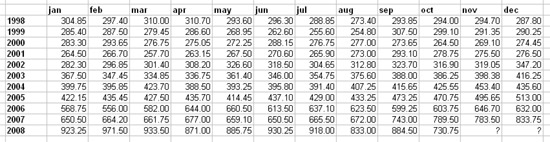

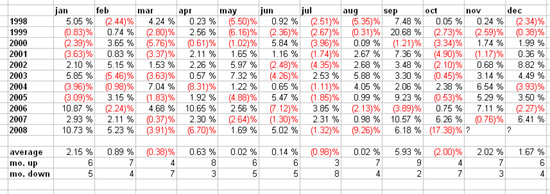

Specifically, I looked at the closing price of gold for each month since 1998. Then I determined the percentage gain or loss for each month based on the difference between the closing price present month and prior month.

With the percentage change for each month, I could take a look at the average gain/loss for each month and the number of times gold was up or down for each month. While this is only a limited set of data, it does suggest some strong seasonal patterns.

Closing Monthly Gold Prices 1998 – Present

(click image for large version)

Monthly Percentage Change Gold Prices 1998 – Present

(click image for large version)

Based on the data examined, gold typically experiences its worst month in October, which certainly held true this year.

Gold experiences its strongest month in September. This year gold posted its second biggest monthly percentage gain in September. Other strong months based on the data include January, November, and December. So far this year, January has held true. Will November and December follow?

I usually don’t put too much faith in seasonal patterns, but I feel that they are useful to be aware of. If nothing else, this is just one more factor contributing to a growing number of catalysts which could propel the price of gold higher into the end of the year.