Silver and gold mining stocks have been indiscriminately sold off during the correction in precious metal prices. While the sell off has been painful for investors in precious metal mining stocks it also presents profitable opportunities. The price of gold and silver will not remain at bargain levels forever and now is the time to establish positions in selected mining stocks that offer solid long term capital appreciation.

Silver and gold mining stocks have been indiscriminately sold off during the correction in precious metal prices. While the sell off has been painful for investors in precious metal mining stocks it also presents profitable opportunities. The price of gold and silver will not remain at bargain levels forever and now is the time to establish positions in selected mining stocks that offer solid long term capital appreciation.

Investing in precious metal mining stocks has recently been a minefield for investors due to a variety of reasons including poor management decisions, overpriced acquisitions, increased production costs, increased government taxation, and falling gold and silver prices.

One silver mining stock that has rock solid finances, pays a dividend, owns substantial silver reserves, and has excellent price appreciation potential when silver prices go back up is Pan American Silver Corp (PAAS).

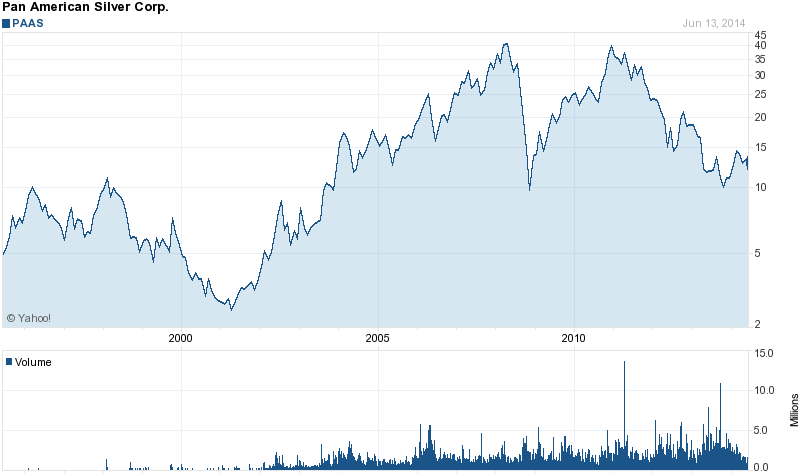

Although no one can predict when silver prices will head back up, both PAAS and silver appear to be forming bottoms. Pan American Silver recently made a multi-year double bottom in the $10 per share range and silver stubbornly refuses to break below the $18 per ounce level despite wide ranging bearish commentary on the metal.

Moving beyond technical analysis there are also many fundamental factors in place that could easily send the price of PAAS to much higher levels. Here’s my list of the top 7 reasons why now is a good time to buy the common stock of Pan American Silver.

- According to the company website, over the past ten years PAAS has added almost 270 million ounces of new silver reserves at a cost of just $0.38 per ounce. The new silver reserves more than replaced the 225 million ounces of silver mined since 2004.

- During the first quarter of 2014 PAAS increased its silver production by 5% to 6.61 million ounces.

- In order to maintain a strong financial position in the face of declining silver prices PAAS implemented cost cutting measures while improving operational efficiency. The all-in sustaining cost per silver ounce sold dropped by 20% in the first quarter of 2014 to $15.54 per ounce while cash costs dropped to $8.25 per ounce from $11.33 in the comparable prior period.

- Pan American Silver was just upgraded by Charles Schwab from “avoid” to “neutral” and added to the firm’s trigger stock list which identifies PAAS as a buy candidate if the price closes above $13.81. The reasons listed by Schwab for upgrading the stock include a rising 50 and 200 day moving average which is bullish, an up/down pattern that indicates the stock is under accumulation, and a bullish trend as indicated by the moving average convergence/divergence (MACD).

- PAAS is in a strong financial position with ample liquidity. As of March 31, 2014, the company held cash and short term investments of $394 million and working capital was over $680 million.

- The Company pays a current quarterly dividend $0.125 per share or $.50 annually which works out to an annual yield of almost 4% which is about 4% higher than what a saver can currently get from a bank due to the Federal Reserve’s zero interest rate policies.

- PAAS sells below its book value of $14.33, has only $40 million in long term debt, and generates operating cash flow of over $123 million. The Company does not engage in price production hedging so any increases in the price of silver flow right to the bottom line.

A strong financial position, long life low cost silver reserves, a 4% annual dividend, and a currently depressed price of silver all form the perfect recipe that should make the purchase of PAAS common stock a rewarding experience.