Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

Gold investors have two basic choices – buying gold bullion or buying shares in companies that produce or own gold. As we examine the two basic investment vehicles available to gold investors, it becomes apparent that choosing the best investment option can be a complex decision. Some of the questions that a gold investor should consider include the following.

What has produced better investment results – owning gold bullion or a gold mutual fund?

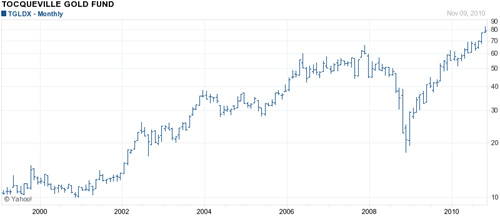

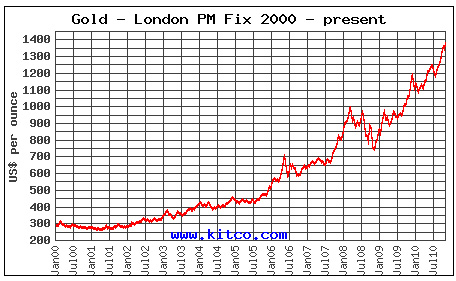

To gain insight into investment returns, let’s compare how an investment in gold bullion compared to investing in the Tocqueville Gold Fund (TGLDX). I selected TGLDX since it is one of the best performing, actively managed gold funds with a long term track record. An investment of $10,000 in the Tocqueville Gold Fund in 2000 would now be worth approximately $86,000 for a stunning return of 860%. A $10,000 investment in gold bullion in 2000 would currently be worth approximately $46,400 or a 467% return.

Since gold mining companies are leveraged to the price movement of gold, it is not entirely surprising that the gold stocks would outperform the metal. Leverage, however, works both ways and in 2008, when gold experienced a price correction, TGLDX dropped from 65 to 19, a horrendous decline of 71%, whereas gold bullion experienced a normal bull market correction of only approximately 25%. For those investors unwilling to tolerate huge price fluctuations, bullion seems a better way to go. When gold is moving up, expect the gold funds to outperform the metal. In 2010, TGLDX has increased 42.7% compared to an increase in gold of 27%.

TGLDX Chart : Yahoo Finance

Gold 2000-Present: Kitco

If I decide to invest in gold stocks instead of the bullion, how many different stocks should I buy?

One of the primary tenets of sound investing is to always diversify. Although selected gold stocks have vastly outperformed the price movement in bullion, many have not and some have dramatically underperformed. Evaluating the prospects of an individual gold mining company is difficult, even for the experts. An investor choosing to allocate a large percent of assets into gold stocks is probably better off (from a risk standpoint) investing in a well managed gold fund with a solid long term track record. For an investor that does not want to hold physical gold nor own individual gold stocks, investment in a gold ETF such as GLD, that tracks the price movement of the bullion, would be an option.

I don’t trust paper assets and want to hold only gold bullion – what are my options?

For a conservative, risk averse investor looking to protect the value of his money, investing only in gold bullion is a sound strategy. Holding actual bullion, however raises security questions on how and where to store the physical gold. Investors who wish to have their gold stored on their behalf can chose from a variety of firms that securely store gold in protected and insured vaults. For an investor storing gold on his own in a safe deposit box, it would perhaps be wise to diversify storage geographically by using more than one bank.

Is the tax treatment different for gold bullion versus gold stocks?

The IRS considers gold to be a collectible. Gains on gold bullion or coins and ETF’s backed by physical gold and held for more than a year have a maximum tax rate of 28%, while positions sold in less than a year are taxed at ordinary income rates. Gold stocks are considered capital assets by the IRS and standard capital gain tax rates apply to profits.

As nations compete with each other to devalue their currencies and the Federal Reserve engages in outright money printing, gold investors should be expecting substantial profits regardless of what investment vehicle is chosen.

There is a third way!!

I just bought some UBS gold call warrants. Strike $1600 on March 17th 2011.

100 warrants = 1 OZ. – So you get some great leverage in there for your money…They are currently $0.24 per warrant. ($240 an oz gold anyone!!)

Price must be above 1600 or all is lost. Break even is at $1614ish at the price I bought them for a month or so ago….

Bring it on!!

Call Warrant on GOLD (XAU/USD)

Linked to GOLD (XAU/USD) Exchange Rate

Issued by UBS AG

Vanilla Warrant (SVSP/EUSIPA Product Type: 2100)

Valor: 11644319 / SIX Symbol: XAUWB