In August Ron Paul accused the U.S. Treasury “guilty of counterfeiting dollars” by virtue of its monopoly power on money in America. Paul noted that the expanding role of the Federal Reserve in monetizing government debt has resulted in a massive debasement of the purchasing power of the U.S. dollar.

In August Ron Paul accused the U.S. Treasury “guilty of counterfeiting dollars” by virtue of its monopoly power on money in America. Paul noted that the expanding role of the Federal Reserve in monetizing government debt has resulted in a massive debasement of the purchasing power of the U.S. dollar.

Continued reckless money printing by the Federal Reserve and massive government deficits will ultimately result in the loss of confidence by holders of U.S. dollars. Ron Paul sees the U.S. dollar inexorably losing its status as global reserve currency unless the dollar is backed by precious metals or commodities.

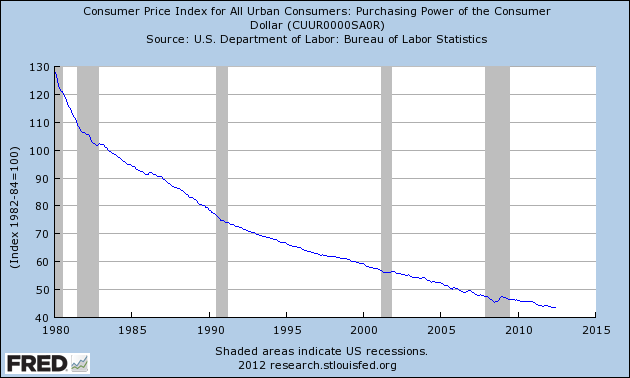

Evidence of the horrendous loss of purchasing power by the U.S. dollar is not hard to understand. The average citizen sees it everyday as higher prices and lower incomes relentlessly lower our standard of living. The systematic destruction of the U.S. dollar’s purchasing power can be seen in a chart published by the Federal Reserve Bank of St. Louis.

How Long Will the Dollar Remain the World’s Reserve Currency?

By: Congressman Ron Paul

We frequently hear the financial press refer to the U.S. dollar as the “world’s reserve currency,” implying that our dollar will always retain its value in an ever shifting world economy. But this is a dangerous and mistaken assumption.

Since August 15, 1971, when President Nixon closed the gold window and refused to pay out any of our remaining 280 million ounces of gold, the U.S. dollar has operated as a pure fiat currency. This means the dollar became an article of faith in the continued stability and might of the U.S. government.

In essence, we declared our insolvency in 1971. Everyone recognized some other monetary system had to be devised in order to bring stability to the markets.

Amazingly, a new system was devised which allowed the U.S. to operate the printing presses for the world reserve currency with no restraints placed on it– not even a pretense of gold convertibility! Realizing the world was embarking on something new and mind-boggling, elite money managers, with especially strong support from U.S. authorities, struck an agreement with OPEC in the 1970s to price oil in U.S. dollars exclusively for all worldwide transactions. This gave the dollar a special place among world currencies and in essence backed the dollar with oil.

In return, the U.S. promised to protect the various oil-rich kingdoms in the Persian Gulf against threat of invasion or domestic coup. This arrangement helped ignite radical Islamic movements among those who resented our influence in the region. The arrangement also gave the dollar artificial strength, with tremendous financial benefits for the United States. It allowed us to export our monetary inflation by buying oil and other goods at a great discount as the dollar flourished.

In 2003, however, Iran began pricing its oil exports in Euro for Asian and European buyers. The Iranian government also opened an oil bourse in 2008 on the island of Kish in the Persian Gulf for the express purpose of trading oil in Euro and other currencies. In 2009 Iran completely ceased any oil transactions in U.S. dollars. These actions by the second largest OPEC oil producer pose a direct threat to the continued status of our dollar as the world’s reserve currency, a threat which partially explains our ongoing hostility toward Tehran.

While the erosion of our petrodollar agreement with OPEC certainly threatens the dollar’s status in the Middle East, an even larger threat resides in the Far East. Our greatest benefactors for the last twenty years– Asian central banks– have lost their appetite for holding U.S. dollars. China, Japan, and Asia in general have been happy to hold U.S. debt instruments in recent decades, but they will not prop up our spending habits forever. Foreign central banks understand that American leaders do not have the discipline to maintain a stable currency.

If we act now to replace the fiat system with a stable dollar backed by precious metals or commodities, the dollar can regain its status as the safest store of value among all government currencies. If not, the rest of the world will abandon the dollar as the global reserve currency.

Both Congress and American consumers will then find borrowing a dramatically more expensive proposition. Remember, our entire consumption economy is based on the willingness of foreigners to hold U.S. debt. We face a reordering of the entire world economy if the federal government cannot print, borrow, and spend money at a rate that satisfies its endless appetite for deficit spending.

Go Ron Paul!With the possible exception of Gary Johnson, Paul is the ONLY national figure to state the truth: the U.S. dollar is in serious decline and has been for a long time. What exactly is the value of “the full faith and credit” of the U.S. dollar?

Yes, the federal government can _tax_ and _inflate_ to cover its enormous debts, but _borrowing_ may cease being part of the government’s trio of tools that allow it to spend in deficit for years on end. This will put huge pressure on the other two, and how much tax will the American people tolerate, particularly when rich people’s money runs low and it begins to hit the middle and lower classes?

We can fret about this or invest wisely, where gold or other metals are an essential component of a careful diversification. I advocate Harry Browne’s Permanent Portfolio as a way ride out the biggest bubble of them all… the one at least 80 years in the making: the GOVERNMENT BUBBLE.

Central Banks , became net buyers of gold in 2009. In 2011 they bought 440 tonnes. Central banks continued to buy gold; net purchases recorded during the first quarter, 2012 amounted to 80.8 tonnes, accounting for around 7% of global gold demand. Central banks from a diverse group of countries added to the overall holdings of the official sector, with a number of banks making sizable purchases.

After having already purchased ten tonnes of gold so far this year, the National Bank of Kazakhstan said it plans to purchase an additional fifteen tonnes this year and as much as seventy tonnes per year in 2013 and beyond.

“Nineteen fifty-eight marked the first year in which foreign central banks exercised their convertibility rights in significant amounts and returned their dollars for gold. US gold reserves fell 10% from 20,312 metric tons to 18,290 that year. The US made it abundantly clear stopping the drain of its gold reserves, and the depreciation of its currency against gold, was a huge priority. Ultimately ir removed the right to exchange dollars for Gold

Since 1913 the US dollar has lost over 95% of its purchasing power while gold has gone from US$20 an ounce to currently over US$1600.00 per ounce in the same time frame When people catch onto the fact that all government statistics are so massaged as to be useless, and actually start to think about how much more they are paying today over yesterday for the necessary everyday items they need to get by, than they will start to understand why gold is so important to a sound monetary system Continuing low interest rates, combined with higher inflation rates will equal low to negative real rates of return causing continued demand for gold which is being bought with dollars. The world’s continues to dispose of dollars and buy gold. China has imported more gold in six months than Portugal’s entire gold reserves

China continues to do one thing. Buy. Because while earlier today we were wondering (rhetorically, of course) what China is doing with all that excess trade surplus if it is not recycling it back into Treasury’s, now we once again find out that instead of purchasing US paper, Beijing continues to buy non-US gold, in the form of 68 tons in imports from Hong Kong in the month of June. The year to date total (6 months)? 383 tons. ( at current prices a ton is about $51.78 milliondollars) In other words, in half a year China, whose official total tally is still a massively underrepresented 1054 tons, has imported more gold than the official gold reserves of Portugal, Venezuela, Saudi Arabia, the UK, and so on, and whose YTD imports alone make it the 14th largest holder of gold in the world. Realistically, by now China, which hasn’t provided an honest gold reserve holdings update to the IMF in years, most certainly has more gold than the IMF, and its 2814 tons, itself. Of course, the moment the PBOC does announce its official updated gold stash, a gold price in the mid-$1000 range will be a long gone memory.

Here is the latest breakdown of gold reserves by Top 20 countries via the WGC:

World Offical Gold Holding

1 United States ( down from 18,290 mtins in 1958) to 8,135.5 tonnes

2 German 3,395.5

4 Italy 2,814.0

5 China 1,054.1

6Switzerland 1,040.1

7 Russia 918.0

9 Japan 765.2

10 Netherlands 612.5

11 India 557.7

12 ECB 502.1

13 Taiwan 422.7

14 Portugal 382.5

15 Venezuela 365.8

16 Saudi Arabia 322.9

17 United Kingdom 310.3

18 Lebanon 286.8

19 Spain 281.6

20 Austria 280.0

The traditional unit of weight for precious metals and gems.

1 troy ounce = 31.1034768 grams.

32.15 troy ounces = 1 kilogramme (Kilo)

32,150 troy ounces = 1 metric ton (1,000 kilos) at $1,600 per troy ounce =

51,780,000

1000 troy ounces = 31.1 kilograms

The world continues to sell Dollars and convert them into gold to escape the inflation caused by QE

Total US debt as of 2010 when all liabilities are included $202 trillion dollars

Existing US Gold about 152 billion dollars

If a new gold backed currency were issued. Each $206 dollars of outstanding FRN’s would buy one new gold backed dollar.

If Congress won’t abolish the Fed. The world might abolish the dollar

The traditional unit of weight for precious metals and gems.

1 troy ounce = 31.1034768 grams.

32.15 troy ounces = 1 kilogramme (Kilo)

32,150 troy ounces = 1 metric ton (1,000 kilos) at $1,600 per troy ounce =

51,780,000

1000 troy ounces = 31.1 kilograms

The world continues to sell Dollars and convert them into gold to escape the inflation caused by QE

Total US debt as of 2010 when all liabilities are included $202 trillion dollars

Existing US Gold about 152 billion dollars

If a new gold baced currency were issued. Each $206 dollars of outstanding FRN’s would buy one new gold backed dollar.

If Congress won’t abolish the Fed. The world might abolish the dollar

Iraq insulted my daddy so I want to bomb them.

or Iran has WMD’ so I want to bomb them.

———————————————–

Iran refuses to take our fiat money…bomb them,

or

Iran might make a bomb someday…bomb them.

=====================

Drug companies are paying me to help them sell drugs.

or

We must protect our citizens from marijuana.

———————————

I think the sooner electronic or paperless currency is introduced, the better.