The iShares Silver Trust (SLV) continued to add large amounts of silver to its holdings while the SPDR Gold Shares Trust (GLD) experienced another small decline in holdings.

The iShares Silver Trust (SLV) continued to add large amounts of silver to its holdings while the SPDR Gold Shares Trust (GLD) experienced another small decline in holdings.

Holdings in the GLD declined by 7.28 tonnes compared to a decline of 5.77 tonnes in the previous week. Total holdings have declined by 5.5% or 69.76 tonnes since the start of the year. The GLD currently holds 1,210.96 tonnes or 38.93 million ounces of gold valued at $55.9 billion.

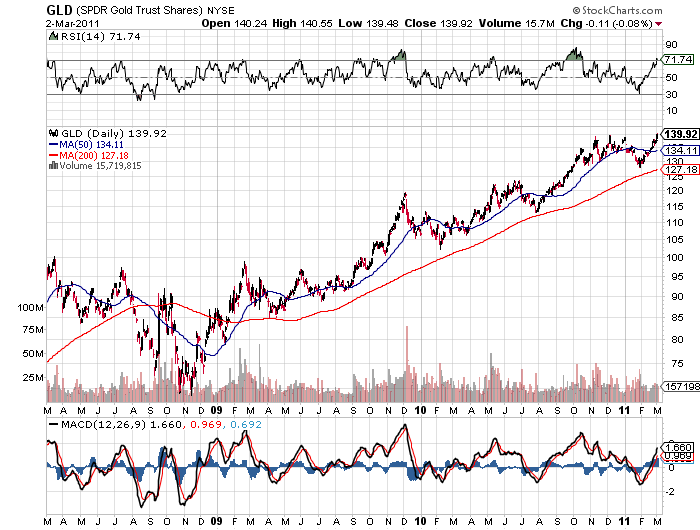

The price of the GLD has traded as low as $128 since last October after running up from approximately $110 from the start of 2010. The GLD hit new highs yesterday at $140.55 before closing at $139.92 reflecting the new all time high in gold prices. Gold settled at $1437.20 for March delivery on the Comex division of the New York Mercantile Exchange.

GLD - COURTESY STOCKCHARTS.COM

The GLD is structured to allow investors a means of investing in gold without taking physical delivery and to buy or sell that interest by trading the GLD shares on a regulated stock exchange. The GLD has been wildly successful since its start by allowing widespread beneficial ownership of gold bullion without the costs involved in physical delivery such as insurance and storage. The GLD has facilitated gold ownership by both large and small investors by supplying liquidity to the market and ease of ownership.

GLD and SLV Holdings (metric tonnes)

| 2-March-11 | Weekly Change | YTD Change | |

| GLD | 1,210.96 | -7.28 | -69.76 |

| SLV | 10,764.52 | +189.29 | -157.05 |

Holdings in the iShares Silver Trust (SLV) increased by 189.29 tonnes over the past week compared to an increase in the previous week of 164.0 tonnes. The year to date decline of 157.05 tonnes represents a 1.4% drop in silver holdings since the beginning of the year. The value of the SLV and GLD are structured to reflect the underlying price of gold and silver but an increase in precious metal prices may not necessarily result in greater gold or silver holdings by the Trusts.

The price of SLV hit an all time high yesterday as March silver prices reached a 31-year high of $34.93 per ounce. As the credit worthiness of many sovereign nations continues to decline, investors continue to see gold and silver as a viable alternative to currencies as a store of value.

The all time high for silver was $48.70 reached in January 1980.

Since last August, silver has dramatically outperformed gold in price appreciation. Silver has soared over 92% since last August while the price of gold has increased by only 22%. This dramatic out performance of silver over gold has resulted in the gold silver ratio declining from a multi decade average of 60 to the current level of 41. Some observers see the decline in the gold silver ratio as an omen for a price pullback in silver while others view it as a fundamental demand shift indicating further sustained price gains for silver.

SLV - COURTESY YAHOO FINANCE

Some “experts” think that Gold leads Silver. I think this last year has taught most investors that Silver no longer is a follower. Because of the price point of Silver, it is far more attractive to more investors like myself. Besides, you need silver to make all those fancy electronic gadgets we love so dearly.