As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

As government spending spirals out of control and the Federal Reserve perpetuates a deliberate strategy of currency debasement, precious metals prices continued to soar. Gold, as measured by the London PM Fix Price, closed at $1504.00, up $27.25 on a shortened four day trading week .

Gold has gained $86 during April and $185 from its January low of $1,319. The price acceleration in April comes in the aftermath of the government’s dismal failure to reduce deficit spending, even as S&P warned of a credit ratings downgrade for the U.S. The great budget compromise reached by both parties was soon exposed as a shameful hoax by the Congressional Budget Office, which said that government spending would actually be higher after the “budget cuts” due to gimmicks.

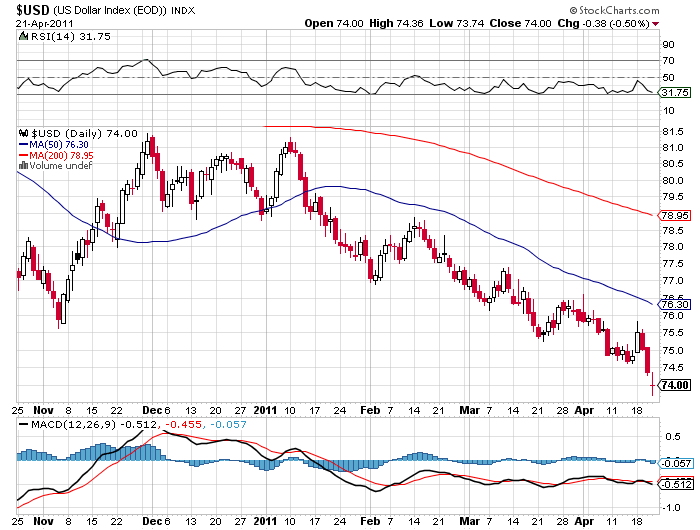

As unsustainable government debt continues to balloon and the Fed continues to print money, the dollar is getting trashed. Governments worldwide are taking steps to protect themselves from the Fed’s explicit policy of dollar debasement and this means selling dollars. The US dollar has fallen almost 10% since the beginning of the year. Gold and silver are becoming the de facto reserve currency, as the flight from dollars intensifies.

US Dollar- COURTESY STOCKCHARTS.COM

Silver has continued to confound the bears with another standout performance, gaining $3.65 or 8.57% on the week, after gaining $2.39 in the previous week. The closing price for silver as measured by the London PM Fix Price was $46.26. Silver is rapidly closing in on its all time closing high of $48.70 hit in January 1980. The current price momentum in silver could easily push silver into new all time highs next week.

The huge rally in silver prices has some wondering if there will be a pullback soon. Silver has gained $8.63 per ounce this month for a 22% gain. Since the January low of $26.68, silver has gained a spectacular $19.58 per ounce for a huge gain of 73%. The question is not one of if, but rather of when there will be a pullback – a routine event in every bull market.

| Precious Metals Prices | ||

| Fri PM Fix | Since Last Recap | |

| Gold | $1,504.00 | +27.25 (+1.84%) |

| Silver | $46.26 | +3.65(+8.57%) |

| Platinum | $1,812.00 | +25.00 (+1.40%) |

| Palladium | $765.00 | -7.00 (-0.91%) |

But perhaps the bears will have to wait a while longer for the much anticipated pullback. The volume in put options on the silver ETFs has seen numerous days of record volume, implying that some big players are betting on a significant decline in silver prices. Does the record put buying on silver reflect speculators betting on a silver plunge or merely long time silver investors hedging long positions? Either way, the implication is that the expectations for a silver pullback seems to be growing, but markets rarely accommodate investors’ perceptions of when a market is truly overbought – expect higher silver prices to shock the put buyers in silver.

Long term, any price pullback in silver should be looked at as a gift. Financial players should never “fight the Fed” and in this case, both Federal Reserve and Government policies guarantee higher precious metals prices (see Why There Is No Upside Limit To Gold and Silver Prices).

I love these articles who all but promise a “dip”, or a “pullback”, or a “correction” in silver prices. These people don’t recognize a different animal when they see it, that being silver as the new unstoppable force in the world. Gold, why its appreciation is only a cough in the silver hurricane. Dips, pullbacks, and corrections should be left to gold. Silver will keep on truck’n. The smart players will keep on stack’n.

mthhawg,

Suggest you do your homework. $4.00+ dip this morning puts silver on sale. Long term silver is headed way up but short term dips and corrections (pretty accurately called by many) should be regarded as buying opportunities. YMMV.

$50.00 in 1980 adjusted for inflation is $136.50. Silver has a long way to go.