The latest production figures from the U.S. Mint show a dramatic decline in the sale of both gold and silver bullion coins.

The latest production figures from the U.S. Mint show a dramatic decline in the sale of both gold and silver bullion coins.

According to the U.S. Mint, sales of American Gold Eagle bullion coins in February 2012 totaled 21,000 ounces, a decrease of 83.5% from January sales of 127,000 ounces. Gold bullion coin sales declined by 77.3% from the prior year when a total of 92,500 ounces were sold in February 2011.

Sales of the American Gold Eagle bullion coins during February is the lowest since June 2008 when the Mint sold 15,500 ounces. During 2011, the U.S. Mint sold an average of 83,333 ounces of gold bullion coins each month and rang up annual sales of 1,000,000 ounces. During 2011, sales of the gold bullion coins declined for the third consecutive year.

Sales of the American Silver Eagle bullion coins also declined dramatically during February. The U.S. Mint reports total February sales of 1,490,000 silver bullion coins, down 76.6% compared to 6,107,000 during the previous month. Sales of the silver bullion coins during February declined by 54% from February 2011 sales of 3,240,000 ounces. Sales of the American Silver Eagle bullion coins were the lowest since November 2011 when the U.S. Mint sold 1,384,000 ounces.

Gold and silver sales detailed above do not include U.S. Mint gold and silver numismatic coins which are sold directly to the public.

The American Gold and Silver Eagle bullion coins cannot be directly purchased by the public from the U.S. Mint. The U.S. Mint sells the gold and silver eagle bullion coins only to a network of authorized purchasers (AP’s) who in turn resell them to the public and secondary retailers. The U.S. Mint determined that the AP distribution system was the most efficient means of retailing coins to the public at competitive prices.

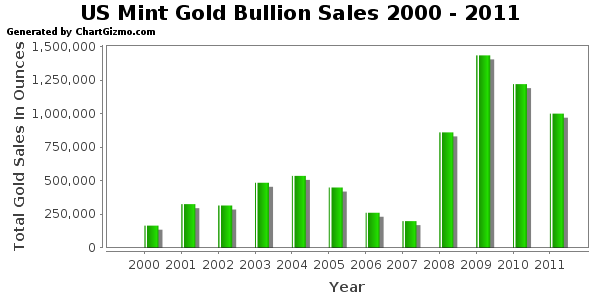

Total yearly U.S. Mint gold bullion coin sales from January 1, 2000 to February 29, 2012 are shown below.

| Gold Bullion U.S. Mint Sales By Year | ||

| Year | Total Ounces Sold | |

| 2000 | 164,500 | |

| 2001 | 325,000 | |

| 2002 | 315,000 | |

| 2003 | 484,500 | |

| 2004 | 536,000 | |

| 2005 | 449,000 | |

| 2006 | 261,000 | |

| 2007 | 198,500 | |

| 2008 | 860,500 | |

| 2009 | 1,435,000 | |

| 2010 | 1,220,500 | |

| 2011 | 1,000,000 | |

| 2012 | 148,000 | |

| 7,397,500 | ||

| Note: 2012 total through February 29, 2012 | ||

Shown below are the yearly U.S. Mint sales figures since 2000 for the American Silver Eagle bullion coins. Sales totals for 2012 are through February.

| American Silver Eagle Bullion Coin Sales |

||

| YEAR | OUNCES SOLD | |

| 2000 | 9,133,000 | |

| 2001 | 8,827,500 | |

| 2002 | 10,475,500 | |

| 2003 | 9,153,500 | |

| 2004 | 9,617,000 | |

| 2005 | 8,405,000 | |

| 2006 | 10,021,000 | |

| 2007 | 9,887,000 | |

| 2008 | 19,583,500 | |

| 2009 | 28,766,500 | |

| 2010 | 34,662,500 | |

| 2011 | 39,868,500 | |

| 2012 | 7,597,000 | |

| TOTAL | 205,997,500 | |

The U.S. public has acquired over 200 million ounces of American Silver Eagle bullion coins since 2000 which are now valued at roughly $7.4 billion. By comparison, the iShares Silver Trust ETF (SLV) currently holds 313 million ounces of silver bullion valued at $11.7 billion.

The most common coin collecting question is, “How much is my coin worth?” or “Is my coin worth anything?” Unfortunately it’s necessary to see the coin to determine its exact value. Gold coins and silver coins have intrinsic value, they have worth at least equal to the weight of gold or silver within them.