There has been much recent coverage of the rising premiums being paid to purchase physical gold and silver bullion. This has been cited as a consequence of the extreme demand for precious metals and evidence of the growing disconnect between market prices and physical prices.

There has been much recent coverage of the rising premiums being paid to purchase physical gold and silver bullion. This has been cited as a consequence of the extreme demand for precious metals and evidence of the growing disconnect between market prices and physical prices.

I decided to look at some data to calculate exactly what kind of premiums are being paid and see if any trend or patterns in the data could be determined.

Specifically, I looked at selling prices for 100 ounce silver bars on eBay. I decided to use this as a source of data since 100 ounce silver bars have historically been a low premium method to acquire silver. Also, bars of silver are relatively undifferentiated. Bullion coins from different countries or with different dates often carry premiums based on those differences.

I used eBay data because it was accessible. Completed auction records can be obtained for the prior two weeks or more. Also, I believe that eBay represents a real time, liquid market of buyers and sellers who discover prices through a bidding process. Quoted dealer prices may be for delivery at a later date and may not represent actual available supplies.

There are some possible flaws with this method. It does not take into account potential premiums for different manufacturers. I don’t know if people pay more for different makes of bars. Also, shipping costs are not included in the price data used. Some auctions may carry higher shipping charges which would impact the final selling prices. And lastly, some auctions were “true auctions” which start at a minimal opening bid while others were fixed price listings.

Data was available from October 13 to today’s date. I did not include data for today or October 13, since it may represent partial data. I determined the average price for each day’s auctions which closed with a sale. I compared this to the closing market price of silver for each day.

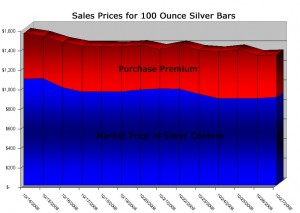

Here is a summary of the data:

Average Price for 100 Ounce Silver Bars on eBay Compared to Market Price of Silver

| Date | Bars Sold | Ave Price | Market Price | Premium | Premium % |

| 14-Oct | 12 | $1,557.17 | $10.89 | $468.17 | 42.99% |

| 15-Oct | 10 | $1,524.70 | $10.92 | $432.70 | 39.62% |

| 16-Oct | 29 | $1,465.07 | $9.99 | $466.07 | 46.65% |

| 17-Oct | 19 | $1,427.68 | $9.56 | $471.68 | 49.34% |

| 18-Oct | 28 | $1,422.00 | $9.56 | $466.00 | 48.74% |

| 19-Oct | 46 | $1,419.04 | $9.56 | $463.04 | 48.44% |

| 20-Oct | 21 | $1,431.76 | $9.79 | $452.76 | 46.25% |

| 21-Oct | 17 | $1,391.94 | $9.86 | $405.94 | 41.17% |

| 22-Oct | 19 | $1,428.11 | $9.84 | $444.11 | 45.13% |

| 23-Oct | 25 | $1,382.84 | $9.34 | $448.84 | 48.06% |

| 24-Oct | 37 | $1,367.78 | $8.88 | $479.78 | 54.03% |

| 25-Oct | 13 | $1,389.31 | $8.88 | $501.31 | 56.45% |

| 26-Oct | 33 | $1,329.91 | $8.88 | $441.91 | 49.76% |

| 27-Oct | 15 | $1,337.33 | $9.01 | $436.33 | 48.43% |

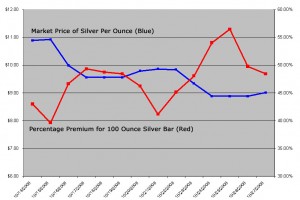

Some charts based on this data appear to the right. (Click for larger versions) The data is only for a limited time frame, but it does spur some interesting observations.

The premium paid for a 100 ounce silver bar has ranged from 39.62% to 56.45%. The premium represents the amount paid in excess of the so-called “market price” of silver. People are clearly paying astounding premiums to acquire physical silver.

On October 15 and 22, the market price of silver dropped. In each instance this caused the percentage premium to rise. This lends some evidence to the anecdotal observation that a decline in market price only spurs greater demand for the physical metal.

Two distinct prices for silver seem to exist. The paper price for the contractual right to acquire future silver, and the physical price to acquire real silver, in hand. How and when will this situation resolve itself?

There have been several recent reports of bullion buyers seeking to take physical delivery of silver and gold from the COMEX. This would allow buyers to purchase real silver at the heretofore “fictional” paper price. If these deliveries take place and become a dependable source of purchasing physical silver, premiums for 100 ounce bars and other physical silver would likely begin to subside.

On the other hand, some are voicing the possibility that since the COMEX only has small coverage of physical metal for outstanding contacts, if enough contact holders demand delivery they will be forced to default and settle in cash. If this occurs, the likely result would be soaring market prices for silver and potentially greater premiums as the argument for physical scarcity gains another leg of support.

[phpbay]100 silver bar, 3, 39489, “”[/phpbay]

Last month (Sept.) I decided to ‘test’ the bullion-sales waters, and began selling silver bullion coins (the Canadian 1-oz. “Maple Leaf”), singly, and in quantity, for about an 80%-to-100% premium over spot.

I first thought of listing them on eBay, where I have been buying & selling since 2000. My “unique” feedback number on eBay is high, and 100% positive.

However, after giving a lot of thought to what I wanted to do, I decided to offer these for a flat price on Amazon –which is known for books, movies, and music– NOT coins.

I am selling only 1995 & 1999 silver Maples (because I have quantities of these two dates), and I plainly state that I am selling them AS BULLION, –NOT as collectible coins.

I sell them at a flat, per coin (per ounce) price, and offer no discounts for quantity.

Sales are brisk.