Hedge fund investor John Paulson, who made billions shorting mortgage securities ahead of the financial crash, lost 13% on his gold holdings in May after taking a blood bath in April.

Hedge fund investor John Paulson, who made billions shorting mortgage securities ahead of the financial crash, lost 13% on his gold holdings in May after taking a blood bath in April.

Billionaire John Paulson, the hedge-fund manager trying to recover from losses related to bullion this year, posted a 13 percent decline in his Gold Fund last month, according to a letter to investors.

The drop brings losses in the strategy to 54 percent since the start of the year, the firm said in the letter, a copy of which was obtained by Bloomberg News. The Gold Fund is the smallest strategy of the $19 billion money manager, with about $360 million, or 2 percent of assets, most of it Paulson’s own money.

Gold fell 5.4 percent and gold equities declined 3 percent in May on speculation the Federal Reserve will scale back its bond purchases, reducing the attractiveness of bullion and related securities as a hedge against inflation.

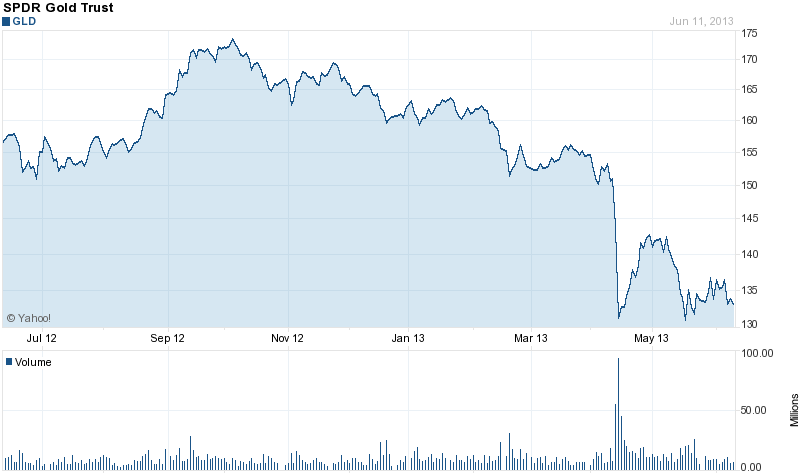

Paulson holds most of his massive gold positions in the SPDR Gold Trust (GLD) and had increased his position in mid 2012, bringing his total holdings to 21.8 million shares. The April 2013 gold crash resulted in losses on Paulson’s gold positions of over $600 million. Even as other large hedge fund traders such as George Soros liquidated large gold positions, Paulson remained committed to his gold positions and has told investors to remain invested in gold since current valuations provide a “significant upside.”

At December 31, 2012, Paulson’s position of 21.8 million shares in the GLD was valued at $3.4 billion. Based on yesterday’s closing price of $133.25, the value of Paulson’s GLD shares would be worth $2.9 billion for a decline of $500 million, a serious loss even for a billionaire.

Seasoned stock traders know that “cutting your losses short” is the most important rule of investing and often the toughest rule to follow. Does Paulson know something about the gold market that no one else knows or will he wind up closing his gold positions to avoid further losses? Since Paulson is the largest investor in the SPDR Gold Trust with an ownership position of 6.5%, liquidation of such a large position is almost certain to put additional downward pressure on the price of gold.

Maybe gold investors should hope that Paulson dumps his entire position in the SPDR Gold Trust. Even brilliant investors like John Paulson can pull the trigger at exactly the wrong time. After holding a massive position in both Bank of America and Citigroup for almost two years, Paulson liquidate his entire position in the stocks at the end of 2011 right before both stocks soared. Since the end of 2011 Bank of America is up almost 300% and Citigroup is up around 100%. Bottoms are made when the last seller capitulates. Since gold is incredibly oversold at this point, a Paulson capitulation could be the trigger for an explosive move up in the SPDR Gold Trust.

Courtesy yahoo finance

Well John has made all the right moves over the years, but like any above average inverter that he is. his track records stands on their own. when he dumped his large holds of shares with Bank of America and Citigroup. Look what happened to them stocks……… a 300 percent increase and a 100 percent increase….

Would be very interesting to see if history repeats it self, if he dumped a large portion of his asset of gold… Not sure he is about to do this, even with a 500 million loss so far….

It would not even surprise me if he bought more gold to add to his impressive portfolio.

He did not make his fortune but making mistakes, but then again he is human…

Cheers,

Joseph Botelho