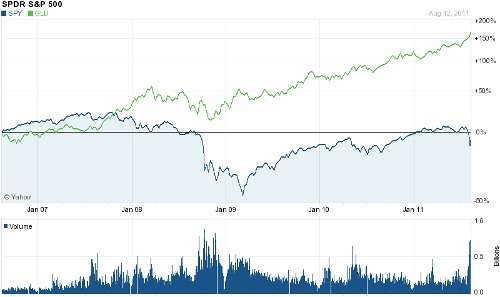

Gold had another stellar week while stock markets gyrated wildly. As measured by the closing London PM Fix Price, gold gained $77.25 on the week, hitting all time highs and closing at $1,736. After the London close, gold recovered from an earlier pullback and closed in New York trading at $1,747.30, up $11.30 from the London close.

Gold had another stellar week while stock markets gyrated wildly. As measured by the closing London PM Fix Price, gold gained $77.25 on the week, hitting all time highs and closing at $1,736. After the London close, gold recovered from an earlier pullback and closed in New York trading at $1,747.30, up $11.30 from the London close.

Silver ending the week down slightly at $38.29 while platinum gained $91 to $1,800 and palladium edged up $5 to $747.

Gold has gained $253 or 17% since July 1st when it closed at $1,483.00. The rapid price gains have pushed gold above its long term trend line. Gold is now trading at $290 (or 20%) above its 200 day moving average. On previous occasions in late 2009 and the fall of 2010 gold also traded more than $200 dollars above the 200 day moving average and the result was a minor pullback or sideways consolidation.

Gold may be overbought on a short term basis but the fundamental reasons for owning gold are expanding exponentially. Public realization that dysfunctional governments are incapable of solving our economic problems is resulting in a loss of confidence. A loss of confidence combined with a debt crisis and out of control spending can have only one result – increasingly worthless paper money and stocks as the world central banks attempt to prevent an economic collapse with zero interest rates and printed money.

Government and central bank policies have been destroying the value of the US currency for decades and have given birth to crashing housing markets, lower incomes, depression level unemployment and numerous stock market crashes. When one considers that the last hope of preventing an all out depression now lies in the hands of the very central banks who have already brought Hell down upon us, we should all be very, very scared.

If the last ditch efforts of the Central Banks fail to contain the financial collapse that is imminent, expect to see governments institute totalitarian measures in order to maintain a semblance of organized society. As bankrupt empires collapse, they also attempt to expropriate every last dollar of wealth from its citizens in order to maintain their grip on power as long as possible.

The most recent large scale example of the implosion of an empire was the USSR, whose sudden collapse surprised CIA analysts who had been studying the Soviet Empire in detail for decades. Ironically, those even more surprised by the collapse of the USSR were the politicians and bureaucrats who ran the country into the ground as they remained oblivious to their economy killing policies. Tragically, misguided and misinformed middle class citizens of the USSR saw the value of their rubles collapse along with pension plans, bank savings and other financial assets. Those who walked away with more than they had, other than corrupt politicians, were those few citizens who converted paper money into gold or silver before the financial system imploded.

A potential short term price correction in gold is a meaningless concern. Developed world economies are in inexorably decline from which there is no escape. The primary concern for most US citizens should be to develop a financial strategy that does not leave them impoverished when the end game arrives.

Unfortunately, most Americans have a religious conviction that “The Government” will save and nourish them as has been promised by every politician of this century. These promises will all be broken but Americans won’t believe it until it happens, at which point there is no financial escape.

As a worldwide systemic financial collapse grows more probable with each passing day, Americans remain in denial and place their life savings in US government debt and bank accounts, secure with the promise that they are “guaranteed by the government”. Sorry folks, bankrupt governments don’t keep promises. The proof of American citizens’ faith in paper assets is their very low commitment to gold and silver. The public will belatedly turn to gold and silver en masse when the system starts crashing down around them. This event will be the real rush to gold and at that point, prices will rise thousands of dollars per week.

When establishment journalists warn of a “bubble” or “top” in gold, don’t get annoyed – simply buy more gold, especially on pullbacks. The ultimate price of gold will wind up shocking even the biggest gold bulls. When gold demand is insatiable and supply very limited, attempting to figure out the ultimate high price for gold is a fruitless exercise. (see Why There Is No Upside Limit For Gold and Silver).

| Precious Metals Prices | 8/12/11 | ||

| PM Fix | Since Last Recap | ||

| Gold | $1,736.00 | +$77.25 | +4.66% |

| Silver | $38.29 | -$0.95 | -2.42% |

| Platinum | $1,800.00 | +$91.00 | +5.32% |

| Palladium | $747.00 | +$5.00 | +0.67% |

Gold is going to shock everyone. The markets look like they are just going to keep see sawing up and down. But silver and gold will keep going up as investors seek a safe haven.

shopforsilver.org