In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

In an effort to expand credit and spur job creation, the Federal Reserve has massively expanded its balance sheet with the most aggressive monetary policies in the history of the Federal Reserve. Since the start of the financial crisis, the Fed instituted two rounds of quantitative easing under which over $2.75 trillion of debt securities were purchased by, in effect, printing money.

The first two phases of quantitative easing resulting in soaring stock and gold prices but did little to reduce the unemployment rate which has remained stubbornly high. In early September, Fed Chairman Bernanke went all in on his aggressive monetary policies with the announcement of QE3 under which the Fed will conduct open-ended asset purchases.

The Federal Reserve said it will expand its holdings of long-term securities with open-ended purchases of $40 billion of mortgage debt a month in a third round of quantitative easing as it seeks to boost growth and reduce unemployment.

“We’re looking for ongoing, sustained improvement in the labor market,” Chairman Ben S. Bernanke said in his press conference today in Washington following the conclusion of a two-day meeting of the Federal Open Market Committee. “There’s not a specific number we have in mind. What we’ve seen in the last six months isn’t it.”

Stocks jumped, sending benchmark indexes to the highest levels since 2007, and gold climbed as the Fed said it will continue buying assets, undertake additional purchases and employ other policy tools as appropriate “if the outlook for the labor market does not improve substantially.”

Bernanke is enlarging his supply of unconventional tools to attack unemployment stuck above 8 percent since February 2009, a situation he called a “grave concern.”

Bernanke said the open-ended purchases would continue until the labor market improved significantly. “We’re not going to rush to begin to tighten policy,” he said. “We’re going to give it some time to make sure that the economy is well established.”

While the U.S. has “enjoyed broad price stability” since the mid-1990s, Bernanke said, “the weak job market should concern every American.”

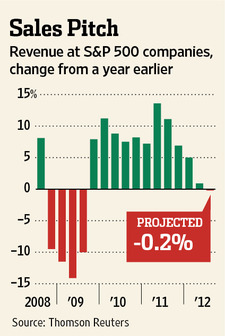

Although Bernanke’s goal is laudable, many consider his extreme monetary policies ineffective while massively debasing the value of the U.S. currency. Printing money is not the primary precursor for job creation or increased national wealth, and the latest economic results prove this assertion. Sales revenues of America’s largest corporations have declined for six consecutive quarters and companies have fired the largest number of employees since 2010.

If economic conditions continue to deteriorate, expect Bernanke to implement even more extreme unconventional monetary policies, all of which would involve money printing on an unimaginable scale.

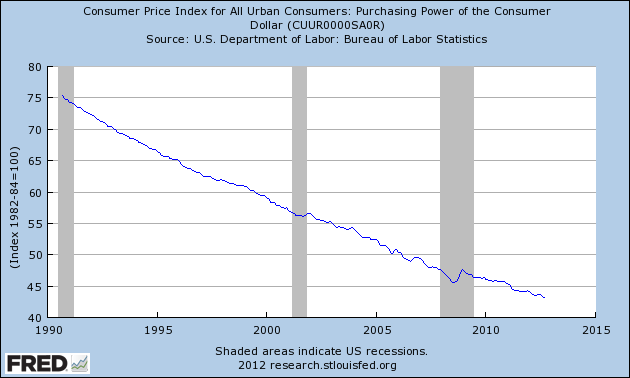

The ludicrous assertion by Fed Chairman Bernanke that the U.S. has “enjoyed broad price stability” since the 1990’s is revealed as an outright falsehood by the Fed’s own statistics on the loss of purchasing power of the U.S. dollar. Meanwhile, gold, the only currency with any intrinsic value is reflecting the true extent to which the U.S. dollar has been debased by Fed policies. As the economy weakens and the Fed expands its monetary madness, the price of gold will continue to soar.

Speak Your Mind