Besides offering an incredible selection of gold and silver precious metal products at fair prices, the Perth Mint excels at educating its customers.

Besides offering an incredible selection of gold and silver precious metal products at fair prices, the Perth Mint excels at educating its customers.

The Perth Mint has specialized in the production of precious metal coins since 1899. The Perth Mint operates and owns the only gold refinery in Australia and is owned by the Gold Corporation which operates under the statutory authority of the Government of Western Australia.

All gold and silver bullion coins and bars produced by the Perth Mint are available in 99.99% pure gold and are issued as legal tender in Australia.

In this week’s Bullion News, the Perth Mint explains to potential buyers the different factors to take into account when deciding whether to buy gold cast bars, gold minted bars, or gold bullion coins.

Gold Cast Bars

Investors seeking to pay the lowest premium over spot gold prices will typically consider purchasing gold cast bars since they have the lowest fabrication cost. The Perth Mint warns buyers that when buying gold cast bars it is essential to make purchases from a totally trustworthy seller to ensure weight, purity and re-saleability.

The Perth Mint sells gold cast bars in 1 ounce, 2 1/2 ounce, 5 ounce, 10 ounce, 20 ounce, and 50 ounce weights. The current markup over spot on a 1 ounce cast bar is only $35. Investors planning to make larger purchases such as a 20 oz cast bar can pick it up for less than $100 over the current spot price of $25,633.

Gold Minted Bars

Gold minted bars are cut from rolled gold, have a better finish and appearance, and are stamped with various designs on a minting press. I have observed while traveling that gold minted bars are extremely popular in gold and jewelry stores in China since they can be purchased in sizes as small as 0.3 grams and often come in a tamper proof security container.

The Perth Mint sells gold minted bars in 5 g, 10 g, 20 g, 1 oz, 50 g, 100 g, and 10 oz. A one ounce gold minted bar currently sells for a premium over spot of around $44.

Gold Bullion Coins

Gold bullion coins are typically favored by many small investors since they are issued and guaranteed by governments, come in numerous sizes, are difficult to counterfeit due to their thin size, and are issued with distinctive and detailed designs which add another dimension to the desirability of owning gold. The minting process to produce a gold bullion coin is far more complex than that for producing bars and therefore the premium over the gold spot price is significantly higher.

The Perth Mint sells gold bullion coins ranging in size from only 1/20 ounce to a massive 1 kilogram. The one kilogram gold bullion coin currently sells for about $42,000.

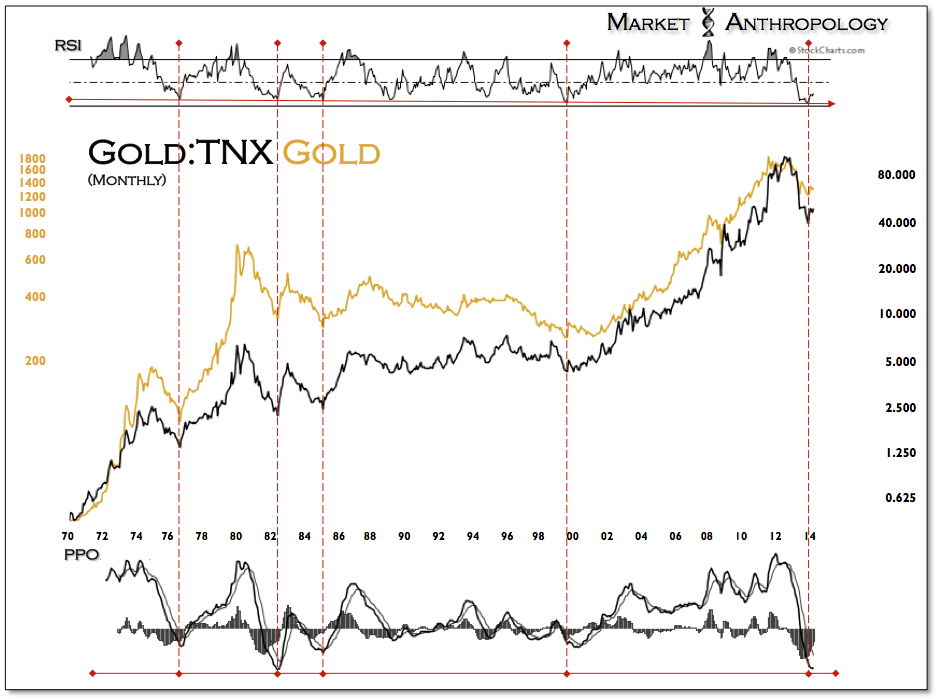

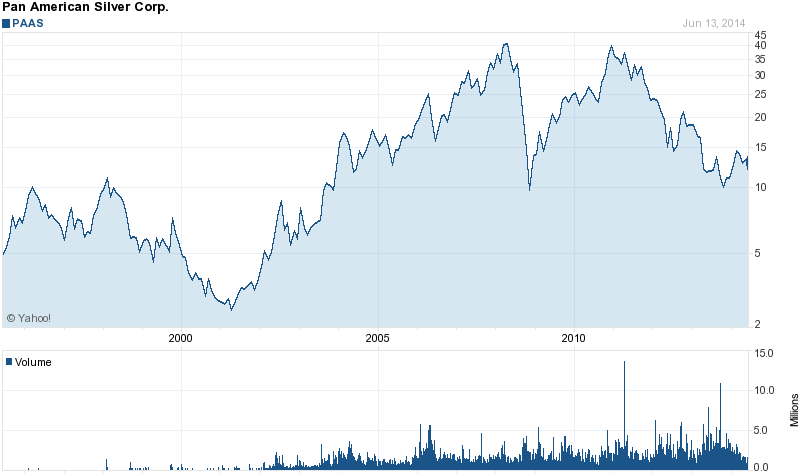

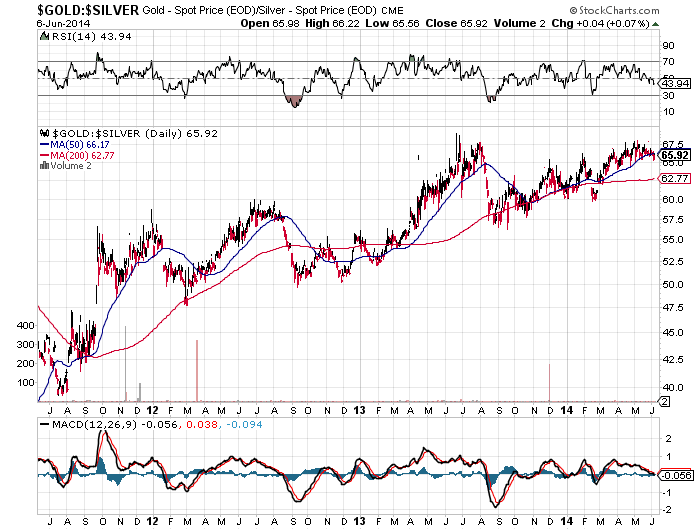

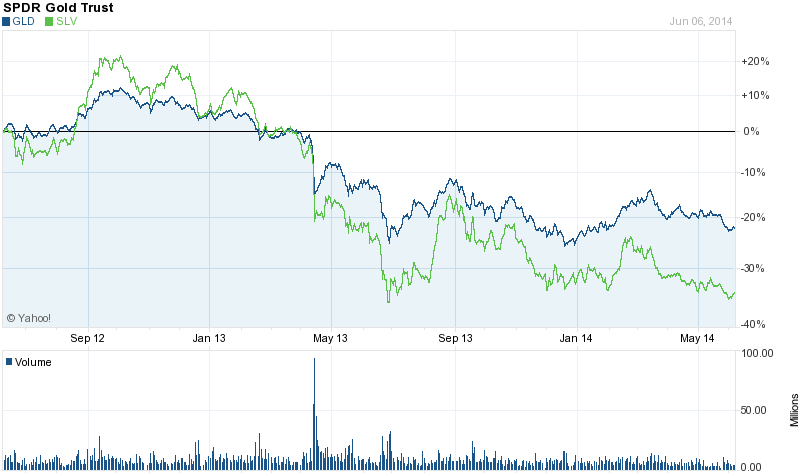

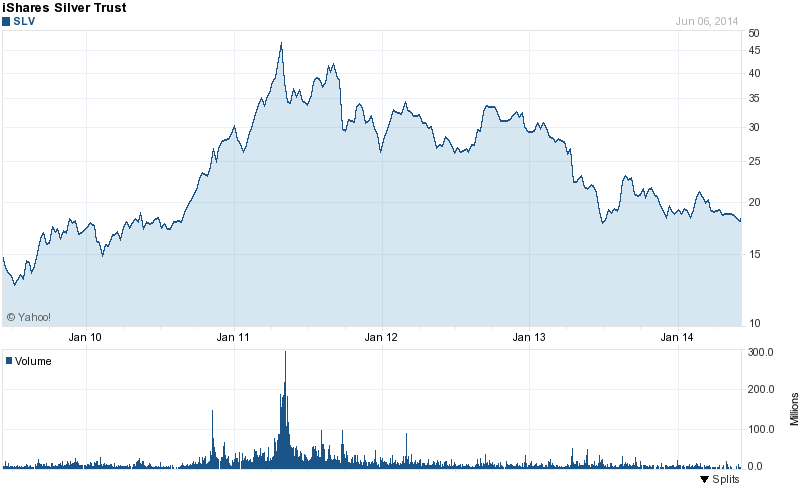

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.

After almost a three year bear market in gold and silver it’s safe to conclude that most of precious metal bears have sold out and moved on. As gold and silver prices corrected sharply over the past three years, the chorus of bearish sentiment in the mainstream press has become endemic, thus setting the stage for a powerful and unexpected contra rally.