There are numerous investment strategies available to capitalize on the gold bull market. Gold investors have the option of investing in gold bullion, gold coins, gold ETFs, gold mutual funds and individual gold mining stocks.

There are numerous investment strategies available to capitalize on the gold bull market. Gold investors have the option of investing in gold bullion, gold coins, gold ETFs, gold mutual funds and individual gold mining stocks.

Although many gold investors prefer to exclusively hold physical gold, diversifying into selected gold stocks can dramatically increase total returns. Although gold stocks as a group have recently underperformed bullion, selected gold stocks have outperformed gold bullion.

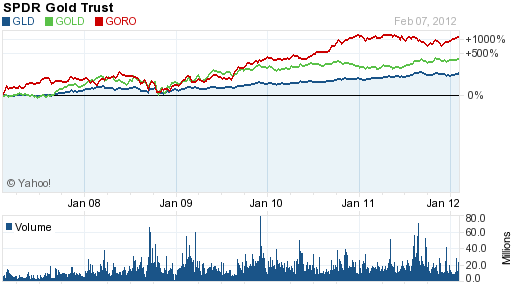

Well managed gold mining companies with large ore reserves and increasing mine production have provided investment returns far in excess of the gain in gold bullion as seen below with the examples of Randgold Resources (GOLD) and Gold Resource Corp (GORO). Both of these gold mining companies have vastly outperformed gold bullion when compared to the SPDR Gold Trust (GLD) which tracks the price of gold bullion.

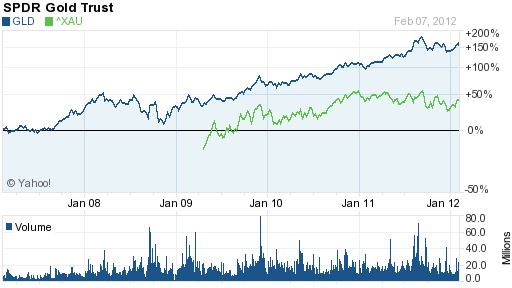

Selecting the gold stock that will outperform bullion is difficult, however, as seen by the lagging performance of the PHLX Gold/Silver Sector (XAU) when compared to the GLD. The XAU Gold/Silver Sector is a broad based index of sixteen large precious metal mining companies. The GLD has outperformed the XAU by three times since 2009.

As with any stock portfolio, diversification is required into order to avoid the risk of under performance. An example of the risk of holding a gold portfolio with only a small number of stocks was seen today when the price of Nevsun Resources (NSU) collapsed by almost 31% after the company unexpectedly announced that gold production will plunge by nearly half in 2012 due to a reduction in estimated gold reserves.

Since selecting individual gold stocks can be a daunting task for investors, a better alternative would be to invest in an actively managed gold stock mutual fund with a proven record of superior investment returns. Past performance has shown that an actively managed gold stock mutual fund has outperformed passively managed gold index funds.

One gold fund that should top the list for investors to consider is the Tocqueville Gold Fund (TGLDX), run by legendary gold investor John Hathaway. The Tocqueville Gold Fund has a remarkable average annual return over the past ten years of 23.3%, almost double the gain in the Philadelphia Gold/Silver Index.

Although gold bullion has outperformed gold stocks since 2008, Mr. Hathaway’s outlook for gold remains extremely bullish and he expects that as gold continues to increase in price, gold stocks should once again outperform the returns of gold bullion. In his latest Investment Update, here is what Mr. Hathaway had to say.

Gold and gold stocks appear to be bottoming in the wake of a four month correction which began in mid -August when the metal peaked at $1900/oz. Bearish sentiment is at extremes not seen in many years. This and a number of other indicators, such as stocks that have been hit by negative sentiment, the downtrend in gold prices since August, and tax loss selling, support our view that a rally lies ahead. This very bullish market set-up, in our opinion, mirrors the extraordinary investment opportunity of the despondent year end in 2007. Even though gold prices have been declining for several months, they finished the year with substantial gains. This suggests that the value represented by gold mining equities held in our portfolio could be extraordinary.

Disarray in Europe is, in our opinion, a slow motion version of the global market meltdown in 2007. It appears to us that the U.S. Fed is once again acting as the lender of last resort to European central banks in their efforts to save the euro. As in 2007, U.S. sovereign credit will be substituted for failing credits, in this case, peripheral European states. The fig leaf to justify such action on the Fed’s part is sado-fiscalism, or extreme austerity packages administered by technocrats. Tough restraints on profligate public spending, which has become a way of life in all Western democracies, will not go down easily. These measures are deflationary and will be ultimately met by howls of protests from mobs demanding renewed money printing and deficit spending. In our opinion, the fundamentals for gold are stronger than ever because the outlook for paper currencies is dire. The difficult correction of the last four months has shaken out all but the strongest holders, a perfect set-up for advances to new all-time highs in 2012.

Even though gold has had an 11-year high, Robert Allan Young-editor for the financial web site Gold Report, doesn’t see it ending anytime soon. Young believes the run is not over. Esposito believes that “Gold prices still have a long way to go,” Young said. “The average person hasn’t even set foot in the market.”

One reason Young is so keen on the precious metal is the ongoing flood of paper currency being printed and pushed into the markets. “Throughout history, when governments printed a lot of money, the average person turned to gold as a safe haven to preserve their wealth. Once the average person gets in, they will own the most important currency in the world; gold.”