Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.

Both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw holdings jump on the week as precious metal prices continued to climb.

The holding of the SLV increased by a substantial 213.98 tonnes over the past week after posting a decline of 192.74 tonnes in the previous week. The all time record holdings of the SLV was reached on April 11, 2011, at 11,242.89 tonnes.

Strong investment and fundamental demand for silver continued to push silver prices higher with the London PM Fix Price for silver closing yesterday at $44.79, up from $40.22 a week ago.

While some analysts worry about the “inflation” in silver prices, the world’s most successful investor is worried about dollar inflation. Warren Buffet – “We’re following policies that will lead to a lot of inflation down the road unless changes are made”. The U.S. can’t “run the kind of deficits we’re running and other policies…without it being enormously inflationary”.

The SLV currently holds 359.6 million ounces of silver bullion valued at $16.1 billion. The SLV has seen seen an astonishing increase in the value of its holdings. At the Trust’s inception in April 2006, silver holdings of 653.17 tonnes were valued at $263.5 million.

GLD and SLV Holdings (metric tonnes)

| 20-April-2011 | Weekly Change | YTD Change | |

| GLD | 1,230.25 | +17.29 | -50.47 |

| SLV | 11,183.69 | +213.98 | +262.12 |

Gold holdings of the SPDR Gold Shares Trust increased on the week by 17.29 tonnes to a total of 1,230.25 tonnes, after an increase of 7.49 tonnes in the previous week. The GLD now holds a total of 39.6 million ounces of gold valued at $59.4 billion.

Gold continued to gain this past week and, as measured by the London PM Fix Price, closed yesterday at an all time high of $1,501.00. Gold has gained $43.50 over the past week and since the beginning of the month is up $83 per ounce or 5.8%.

The price gains in gold continue to confound the numerous skeptics of the golden metal who can’t understand why gold is going up in the absence of high rates of inflation. Perhaps the skeptics should pay attention to the increasingly vocal concerns by governments holding large reserves of U.S. dollars and whose economies are being harmed by the flood of rapidly depreciating U.S. dollars.

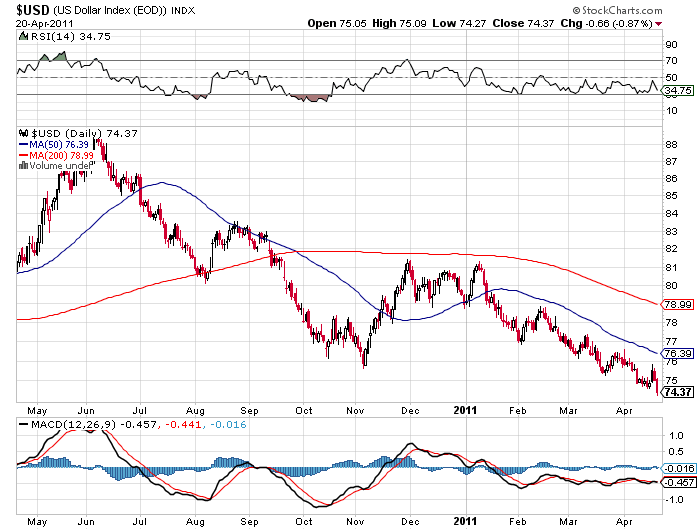

COLLAPSING US DOLLAR - COURTESY STOCKCHARTS.COM

Nyet to diplomacy. In extremely blunt remarks, Russian Prime Minister Vladimir Putin, commenting after the S&P downgrade on the U.S. debt outlook, said: “Look at their (the U.S.) trade balance, their debt and budget. They turn on the printing presses and flood the entire dollar zone – in other words, the whole world, with government bonds. There is no way we will act this way anytime soon. We don’t have the luxury of such hooliganism”. Nor is Mr. Putin simply talking tough – the Russian government is also acting to protect its financial interests by reducing their holdings of U.S. treasury debt. Russia, the world’s third largest holder of U.S. debt has been greatly reducing its dollar holdings this year.

China, the world’s largest holder of U.S. dollars totaling a massive $3 trillion, has been expressing its frustrations and concerns with U.S. monetary policy for years. A plunging US dollar reduces the value of US debt held by China. To offset the losses from holdings US paper assets, China has been reducing its holdings of U.S. dollars and buying physical assets worldwide. China also took major steps this week to gradually implement full convertibility of the yuan in world markets which would allow it to hold fewer US dollars.

Governments worldwide are taking major steps to reduce loss exposure from holding US dollars that can be printed in the trillions by the U.S. Federal Reserve. In another sign of disgust towards U.S. fiscal and monetary policies, Brazil, Russia, India, China, and South Africa recently agreed to use their own currencies among themselves instead of the U.S. dollar.

The result of ultra loose U.S. monetary policies, huge budget deficits and money printing by the Federal Reserve have all contributed to the flight to wealth preservation as reflected by a collapsing US dollar and skyrocketing precious metals prices.

Speak Your Mind