Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

Anyone predicting that gold would outperform housing in 2001 would likely have been viewed as being seriously deranged. After all, housing prices had increased for decades and by the peak of the housing market in 2007, real estate was believed to be a “can’t lose investment.” The mantra that housing values only go up proved to be disastrous for many Americans as the over-leveraged real estate market imploded, shattering the wealth dreams of both naive homeowners and investors.

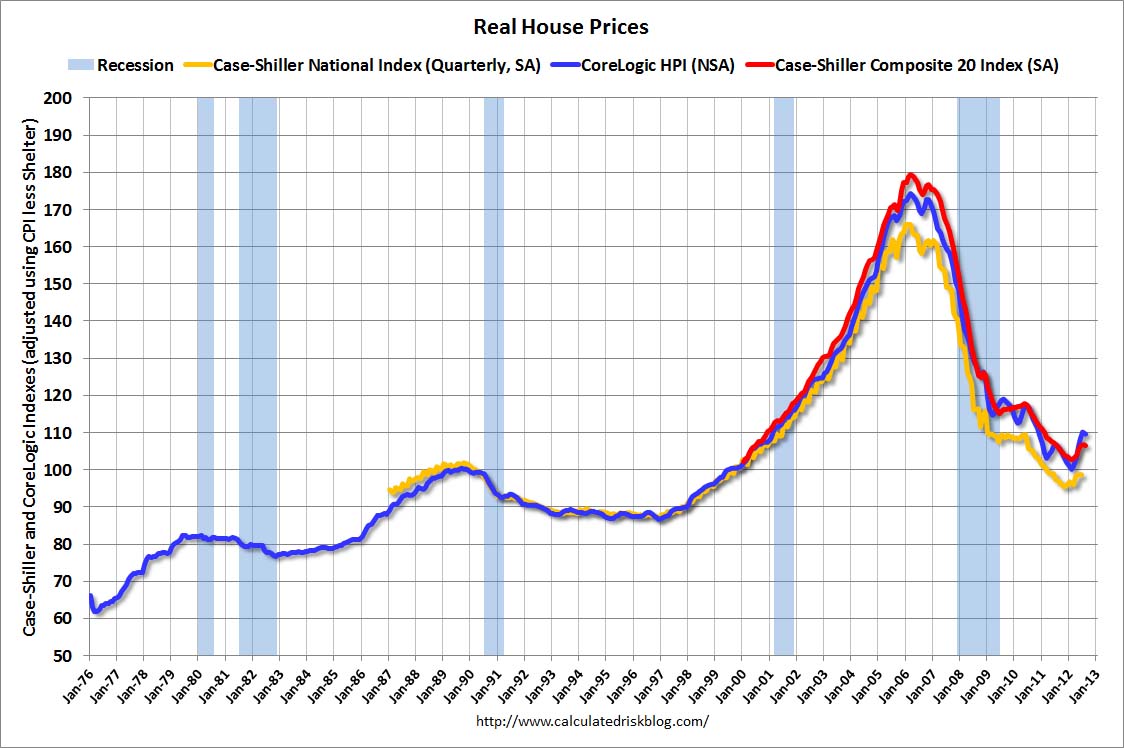

Despite the trillions of dollars of direct support from both the Federal Reserve and Congress, real housing values have yet to recover a fraction of their losses. Mainstream press reports of a solid recovery in housing markets usually neglect to mention, that according to the Case-Shiller National Index, housing prices are still lower than they were at the turn of the century.

Gold, meanwhile, unloved and ignored by most Americans is set to make its 12th straight annual gain. From a yearly low of $255 per ounce during 2001, gold settled in New York trading on Thursday at $1,663.90, up 653% over the past 12 years.

Chart of the Day has some interesting data on the performance of gold versus housing, as represented by the Home Price/Gold Ratio. Based on current prices, 105 ounces of gold will buy you the median priced single family home. In 2001, a home buyer would have needed 601 ounces of gold to buy the same house. Housing, when priced in gold, in down 80% from 2001.

Despite gold’s proven ability to preserve wealth over time, most Americans still seem indifferent to allocating part of their portfolios into gold – something to think about as central banks ramp up the printing presses at an increasingly furious pace.

The article neglects the value of shelter provided by a home. People do not buy houses in order to gain financially. People buy houses in order to live in them. If one does not not have a house to store the gold inside, it does not even make sense to think about buying gold.

The point remains valid that gold outperformed all other asset classes, including especially real estate, over the past decade. An investment in gold contributed greatly to an appreciation in net worth for many people and offset the poor returns in other investments. Renting is always an option and it is not necessary to own a house to store gold due to the invention of safe deposit boxes and secured vaulting services offered by many retailers of precious metals.

The question is how long it will continue to do so. I see a great opportunity to trade my gold for some property in the near future. Not quite yet though 😛