According to the World Gold Council, total global demand for gold in the first quarter of 2011 jumped by 11% to 981.3 tonnes. Gold demand was driven by increased investor purchases, especially in China where surging demand for gold reached record highs.

According to the World Gold Council, total global demand for gold in the first quarter of 2011 jumped by 11% to 981.3 tonnes. Gold demand was driven by increased investor purchases, especially in China where surging demand for gold reached record highs.

The World Gold Council foresees increased 2011 gold demand based on fundamental factors that include unrest in the Middle East, the sovereign debt crisis in Europe, global inflationary worries, weakness in the U.S. dollar, concern over a slowing U.S. economy and continued strong physical demand for gold by China and India. Increased purchases of gold by central banks is also likely to increase to protect reserves against paper currencies issued by over indebted sovereign nations.

The World Gold Council noted that gold hit its eight consecutive record high price during the first quarter of 2011 after a brief pullback in prices early in the year. Due to higher prices the value of gold purchased during the first quarter rose by almost 40% from $31.4 billion to $43.7 billion.

Investment demand surged by 26% during the first quarter to 310.5 tonnes and represented 31.6% of total first quarter gold demand. The investment demand category includes physical bars, official coins, medals and ETF products. Investors showed a strong preference for holding physical gold as bar demand increased by 62%, official bullion coins by 39% and medals by 3%. Bullion holdings by ETFs declined by 55.9 tonnes during the quarter as investors decided to hold more physical gold due to worries about counterparty and credit risk. Despite the reduction in first quarter ETF holdings, total global holdings of ETFs amount to 2,100 tonnes valued at approximately $95 billion.

Jewelry demand of 556.9 tonnes accounted for 56.8% of total gold demand during the first quarter. Total jewelry demand grew by 7% during the first quarter with India and China accounting for 63% of total demand. China, which has seen explosive demand for gold over the past decade, registered a 21% increase in jewelry sales to 142.9 tonnes.

Technology demand for gold, which includes electronics, industrial and dental use declined slightly to 113.8 tonnes. Gold demand by the electronics industry remains strong and during 2010, the industry consumed a record 326.8 tonnes.

Despite the surging global demand for gold, supply is not increasing and actually dropped by 39.9 tonnes or 4.4% during the 2011 first quarter compared to last year’s first quarter. The decline was primarily due to large central bank purchases which the World Gold Council deducts from available supplies. Central Banks have been rapidly increasing their purchases of gold reserves and during the 2011 first quarter purchased 129 tonnes of gold which exceeded the total amount purchased during the first nine months of 2010.

Surging gold prices should be a natural incentive for the mining industry to increase production but this has not been the case. Mine production increased by only 7% to 663.9 tonnes during the first quarter, trailing total demand of 981.3 tonnes. During 2010 gold mine production provided 62% of total supply with recycled gold accounting for the bulk of other supply.

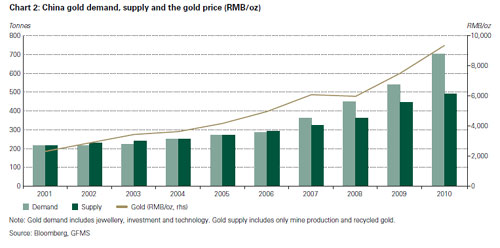

The big picture in the gold market remains focused on China. The World Gold Council report notes that “The past 10 years have witnessed exponential growth in China investment demand for gold, which entered a new era with the opening of the Shanghai Gold Exchange. By the end of 2010, annual gold demand totalled 187.4 tonnes, an increase of 71.1% over the previous year.”

Chinese gold demand has been increasing by 14% per year since 2001 with jewelry accounted for 64% of total demand. During 2010 gold jewelry demand in China was 451.8 tonnes, up 100% since 2004. Chinese gold investors are also huge buyers and in the first quarter of this year were the largest buyers in the world of physical bullion coins and bars.

The World Gold Council expects Chinese gold demand to double within less than ten years due to gold demand based on Chinese culture, inflationary fears, buying by the Chinese Central Bank, a desire to diversify wealth holdings, advise from prominent Chinese economists to increase gold reserves, increased institutional demand and increased demand by a growing middle class.

Speak Your Mind