The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

The months long guessing game on whether or not the Fed would start tapering its $85 billion per month of treasuries and mortgage securities came to a conclusion today as the Fed promised to keep the printing presses going full blast.

Many analysts had come to the conclusion that the economy had strengthened enough for the Fed to begin reducing monetary stimulus but they were wrong as Fed, in Surprise Move, Leaves Bond-Buying Intact.

The Federal Reserve postponed any retreat from its long-running stimulus campaign Wednesday, saying that it would continue to buy $85 billion a month in bonds to encourage job creation and economic growth.

As Congressional Republicans and the White House hurtle toward another showdown over federal spending, the Fed said it was concerned that fiscal policy once again “is restraining economic growth,” threatening to undermine what the Fed had described just months ago as a recovery gaining strength.

Proponents of aggressive asset purchases, including Mr. Bernanke, also face mounting pressure from internal critics who argue that the modest benefits of bond-buying are increasingly outweighed by the risk that the Fed is encouraging excessive speculation or interfering with normal market function.

Some critics inside and outside the Fed have even begun to argue that the central bank’s bond-buying is preventing a return to normalcy.

“The economy is positioned to benefit from modestly higher longer-term interest rates,” Ms. George said earlier this month. She noted that higher rates could increase the income of retirees and bolster bank profits without a commensurate increase in risk-taking.

Despite the growing criticism of his securities purchase program the Fed decided that the time was not yet right for reducing the one trillion dollar securities purchase program which is financed by the Fed’s money presses. According to the FRB press release:

Taking into account the extent of federal fiscal retrenchment, the Committee sees the improvement in economic activity and labor market conditions since it began its asset purchase program a year ago as consistent with growing underlying strength in the broader economy. However, the Committee decided to await more evidence that progress will be sustained before adjusting the pace of its purchases. Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month.

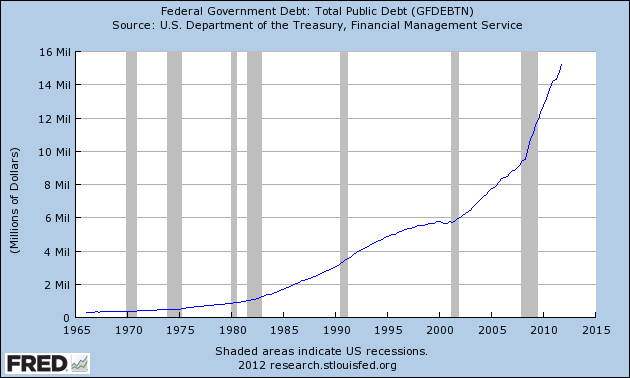

The Fed has already blown up its balance sheet to $4 trillion and the federal government has almost tripled its debt load to $17 trillion from $6 trillion in 2002. After this massive stimulus of $15 trillion into the economy, the Fed now tells us that more is needed.

Today’s actions tell us that the Fed will never find an opportune time to reduce its money creation and the gold and silver markets reacted accordingly. After the Fed’s announcement gold skyrocketed by over $50 per ounce and silver shot up by almost $1.50 per ounce.

The reasons for holding gold and silver have never been stronger despite the recent pullback in prices and today’s announcement by the Fed serves to further prove this assertion.

Some interesting price spikes on those Kitco charts, I wonder where the price of silver and gold will be after October 17th…..