The price of gold has held its own this year despite a long list of reasons from bearish analysts for not owning gold. From a closing price of $1,225 at the start of the year gold has managed to eke out a small gain of 1.8% to a price of $1,247.50 at Friday’s close. In mid March gold had reached a high of $1,385 but quickly surrendered those gains.

The price of gold has held its own this year despite a long list of reasons from bearish analysts for not owning gold. From a closing price of $1,225 at the start of the year gold has managed to eke out a small gain of 1.8% to a price of $1,247.50 at Friday’s close. In mid March gold had reached a high of $1,385 but quickly surrendered those gains.

In a recent interview with Bloomberg several analysts listed various reasons for the unease in the gold market including:

- selling by hedge funds

- a lack of upward price momentum which is discouraging investors from making new purchases

- anxiety over future gold and silver pricing as major banks drop out of the market for establishing the daily gold and silver fix price

- the risk of a large drop in the price of gold if it breaks technical support at $1,230

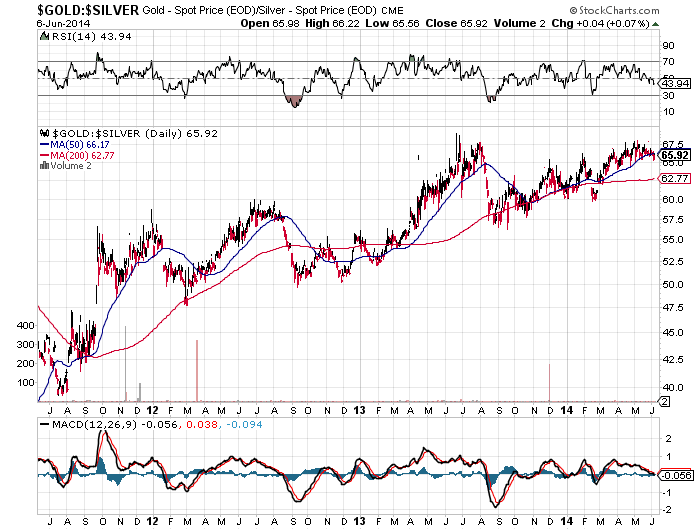

- an increase in the gold silver ratio to almost 70 from the more normal long term average of around 55 to 60.

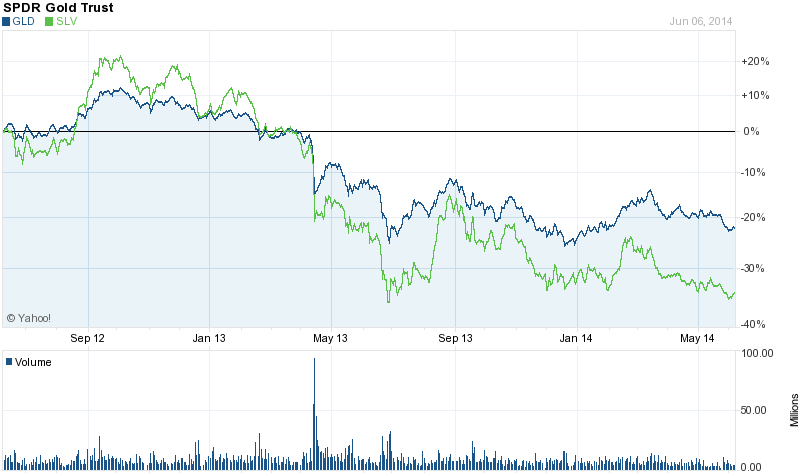

One analyst interviewed by Bloomberg expects the gold silver ratio to converge via a drop in the price of gold, which is one possibility. Another way in which the gold silver ratio could drop, of course, is if silver outperforms gold. Since mid 2012 gold has outperformed silver by a relative percentage of about 17%.

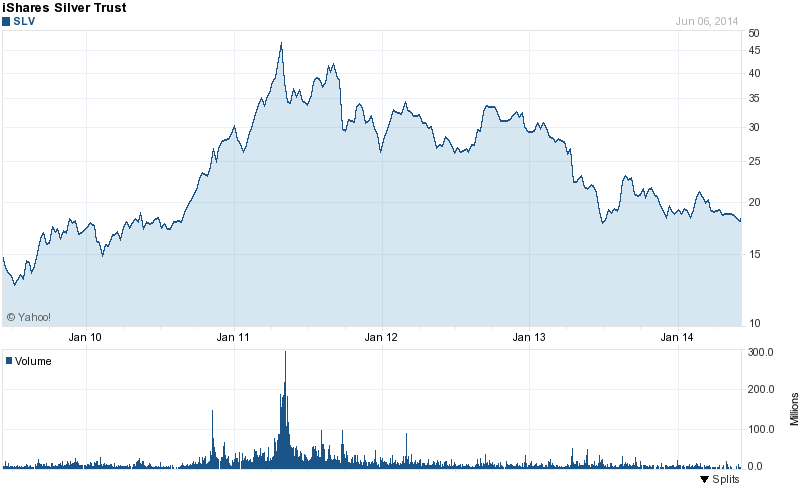

On an absolute basis silver has experienced a major price decline from almost $50 per ounce in March 2011 to $19.94, a price last seen in early September 2010.

Is it time to buy or sell gold and silver? Based on information from precious metal analysts, which is probably already fully discounted by the markets, the risks of buying gold and silver today are very high. Kinda reminds me of what stock analysts were saying about buying stocks in early 2009.

Speak Your Mind