Gold, platinum and palladium all advanced on the week while silver gave up most of the previous week’s gains.

Gold, platinum and palladium all advanced on the week while silver gave up most of the previous week’s gains.

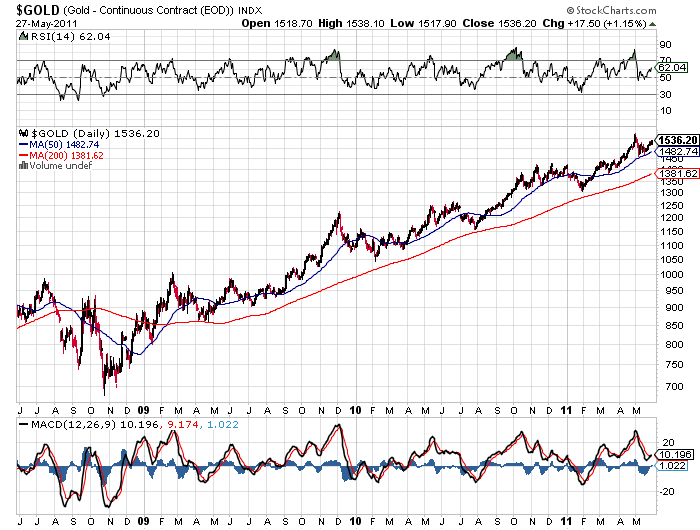

As measured by the London PM Fix Price, gold gained $7 on the week to $1,540.00 while silver pulled back by $2.50 to $35.19. Platinum moved up by $21 to $1,807.00 and palladium gained $13 to $770.00. After the London close, prices of precious metals moved up strongly in New York trading, especially silver, which last traded at $36.39, up $1.20 from the earlier London closing price.

Financial markets worldwide pulled back sharply as the stock traders finally began to acknowledge the fragility of the world’s paper back financial system. Governments that have borrowed and spent trillions of dollars to stimulate economic growth and support a fragile banking system now find themselves reaching the limits of their borrowing capacity.

It is becoming obvious that the financial crisis of 2008 was just a warm up act to the real financial nightmare that is looming ahead. Despite trillions of dollars in stimulus spending, coordinated with a money printing campaign by world central banks, the economies of the U.S. and Europe have not recovered. Unemployment continues to grow, real estate values continue to plunge, debt levels have reached unsustainable levels and real incomes for the majority of workers continue to decline.

There are numerous events that could trigger the second financial crisis There is no way of knowing which specific event will trigger the next crisis, nor does it matter. What does matter is the manner in which Financial Crisis II will be dealt with by world governments and central banks. Unable to raise taxes or take on trillions more in borrowing, monetary authorities will exercise the last resort option of money printing on a massive scale to avoid a total collapse of the world monetary system. The gold market is already reflecting this scenario as one of the few safe havens against paper currencies that have little intrinsic value. When Financial Crisis II gets under way, uninformed talk of a “gold bubble” will quickly disappear as investors will buy gold at any price to preserve their wealth.

| Precious Metals Prices | ||

| PM Fix | Since Last Recap | |

| Gold | $1,540.00 | +7.00 (+0.46%) |

| Silver | $35.19 | -2.50(-6.63%) |

| Platinum | $1,807.00 | +21.00 (+1.18%) |

| Palladium | $770.00 | +13.00 (+1.72%) |

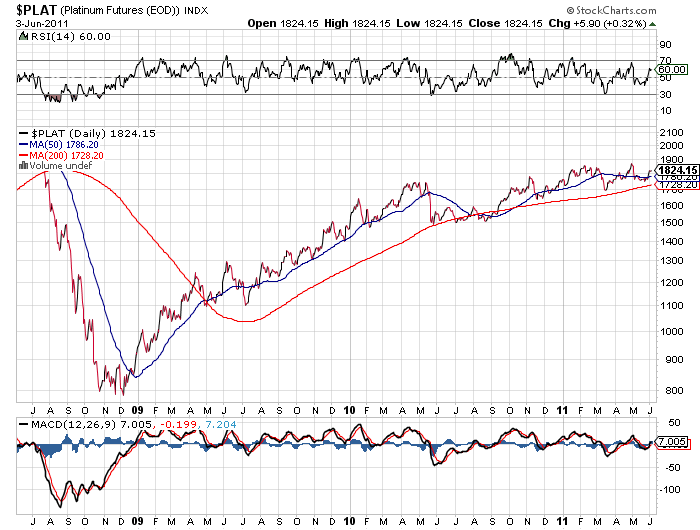

Will platinum, which has lagged the price rallies in other precious metals, start to play catch up? According to the Wall Street Journal, due to rising production costs for platinum, a price of $2,100 per ounce is necessary to encourage increased mine production.

The historical price ratio of platinum to palladium also suggests that platinum prices could rally significantly. The Wall Street Journal notes that when palladium reached $860 per ounce in February, the ratio was 2.15 compared to 2.12 today. The historical average of the platinum/palladium ratio is 3.0 to 4.0, suggesting that platinum is undervalued.

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May.

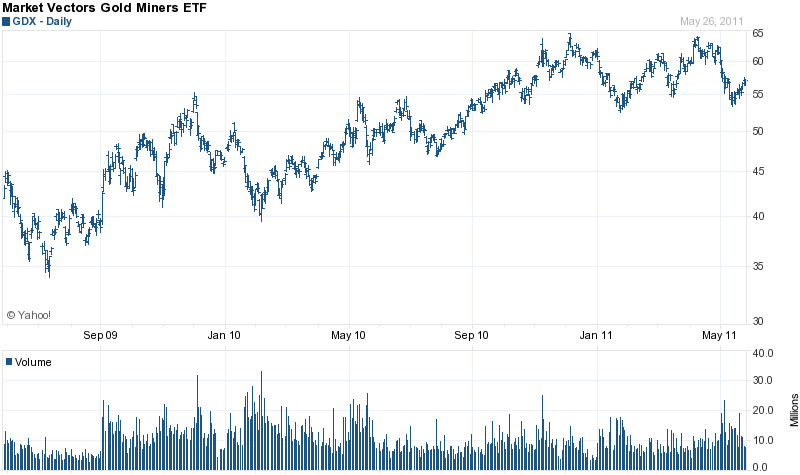

The holdings of the iShares Silver Trust (SLV) declined slightly on the week by 53.10 tonnes as silver prices continued to consolidate after the sharp sell off of early May. The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels.

The recent declines in precious metals seem to have shifted some investors preferences. For the current month to date, US Mint sales of gold bullion sales are on pace for the highest levels of the year, while silver bullion sales remain at typical levels.

Through the end of April, the United States Mint has now sold 466,000 ounces of gold and 16,375,000 ounces of silver through its bullion coin programs. In both cases the figures are far ahead of the numbers from the comparable year ago period, despite the higher market price per ounce for the bullion.

Through the end of April, the United States Mint has now sold 466,000 ounces of gold and 16,375,000 ounces of silver through its bullion coin programs. In both cases the figures are far ahead of the numbers from the comparable year ago period, despite the higher market price per ounce for the bullion. In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.

In a week of volatile precious metals trading, holdings of both the iShares Silver Trust (SLV) and the SPDR Gold Shares Trust (GLD) saw modest declines.