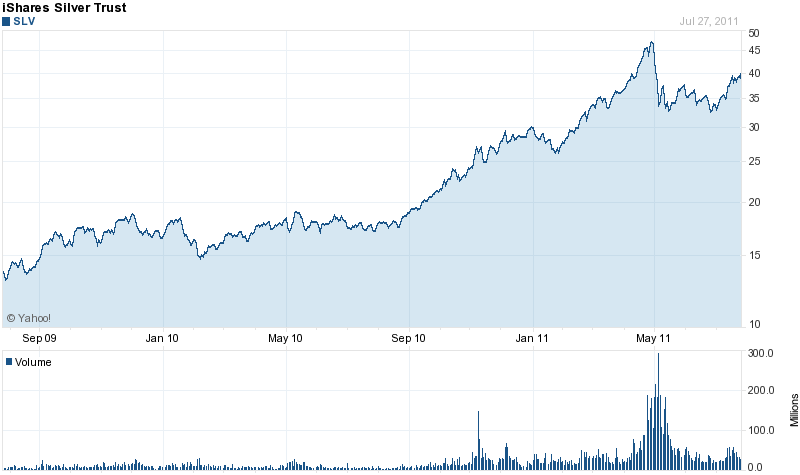

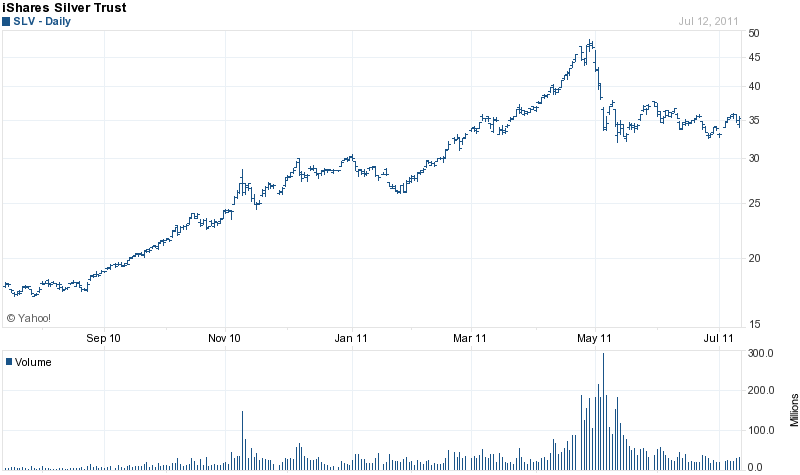

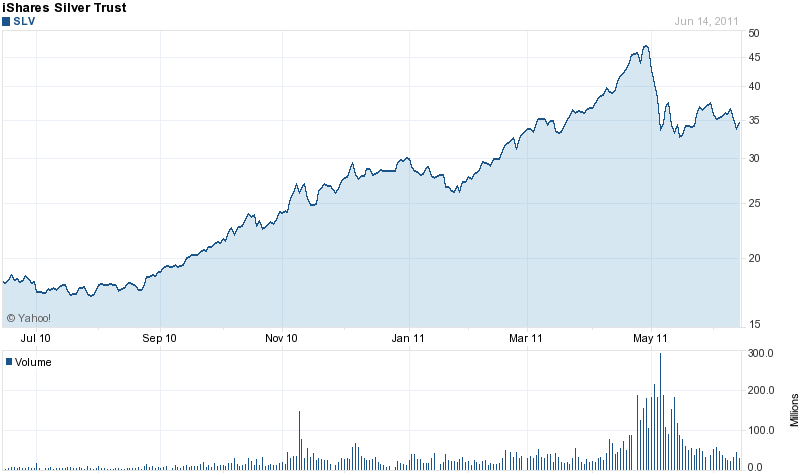

Holdings of the iShares Silver Trust (SLV) gained 112.15 tonnes on the week after increasing by 169.76 tonnes in the previous week. Although SLV holdings have declined by 1,005.71 tonnes since the beginning of the year, holdings of the silver trust have increased markedly in July as silver prices surged.

Holdings of the iShares Silver Trust (SLV) gained 112.15 tonnes on the week after increasing by 169.76 tonnes in the previous week. Although SLV holdings have declined by 1,005.71 tonnes since the beginning of the year, holdings of the silver trust have increased markedly in July as silver prices surged.

Since July 1st, holdings of the iShares Silver Trust have increased by 379.21 tonnes. Holding of the SLV hit an all time high on April 25th when the Trust held 11,390.06 tonnes of silver.

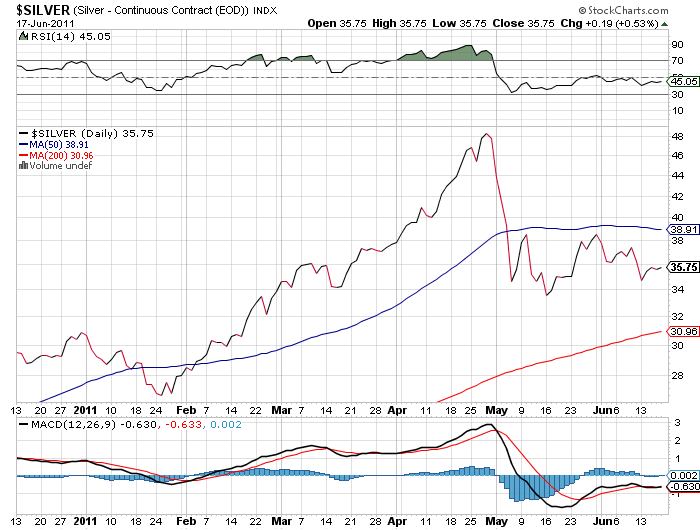

As measured by the London PM Fix Price, silver has gained $6.96 since July 1st, rising from $33.85 to $40.81. Silver is up 33.1% since the beginning of the year when it stood at $30.67. The SLV, after correcting in early May, has broken out of its trading range in the mid 30’s and has been steadily advancing.

Investors looking to past history for clues on the future price move in silver are looking at two entirely different worlds. The parabolic move and subsequent collapse of silver prices in the 1980’s was driven by specific events which quickly reversed. After breaking out of a decades long base, silver will not be a replay of the 1980’s but instead is in a long term super cycle which will ultimately result in much higher prices (see For Silver, This Time Is Different).

The SLV currently holds 318.8 million ounces of silver valued at $13.0 billion. Over the past year the SLV has increased by 86%. Over the past three years the SLV has had an annual rate of return of 25.1%.

GLD and SLV Holdings (metric tonnes)

| July 27-2011 | Weekly Change | YTD Change | |

| GLD | 1,244.80 | -1.21 | -35.91 |

| SLV | 9,915.86 | +112.15 | -1,005.71 |

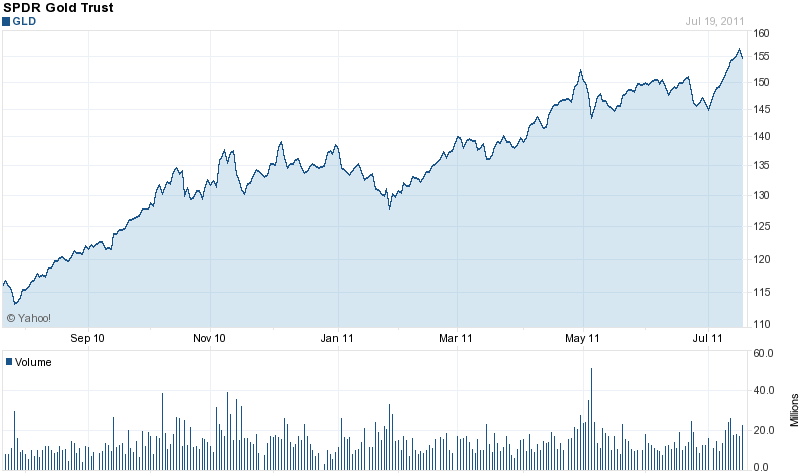

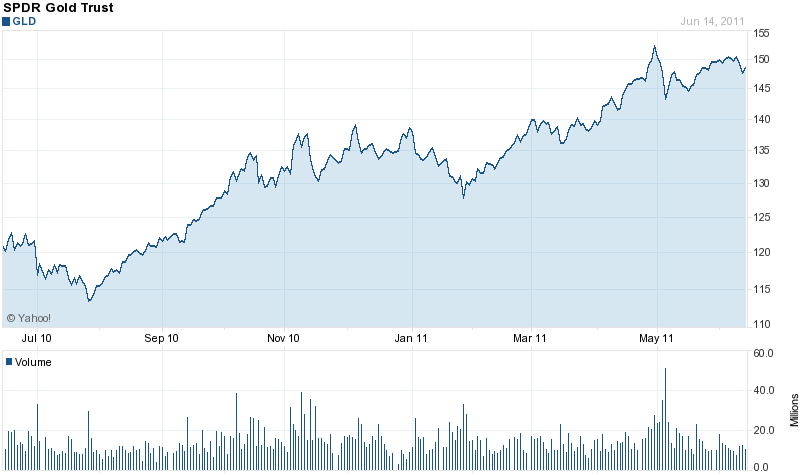

Holdings of the SPDR Gold Shares Trust (GLD) dipped slightly on the week by 1.21 tonnes after increasing by 20.60 tonnes in the previous week.

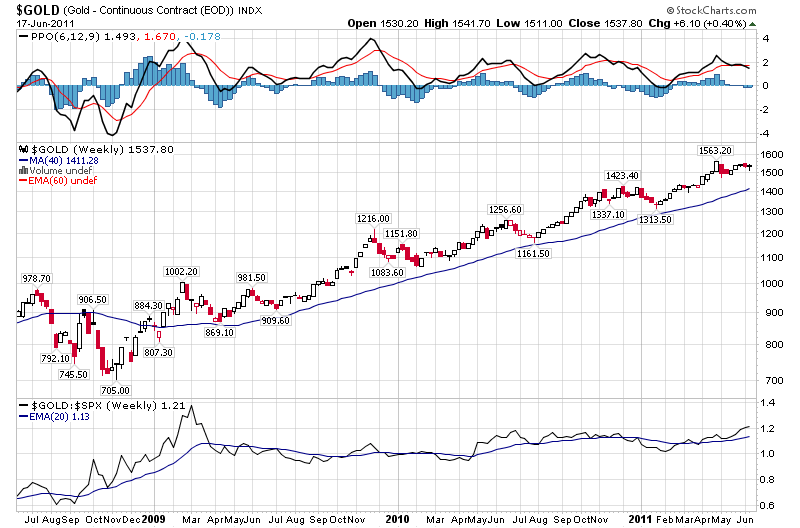

Gold has been in a steady uptrend during July. As measured by the closing London PM Fix Price, gold has gained 9.6% or $142 since July lst. Gold started the year at $1388.50.

Since the beginning of the month, the GLD has gained 39.0 tonnes. The GLD currently holds 1,244.80 tonnes of gold valued at $65.0 billion.

The GLD hit new all time highs this week as the advance in gold prices continued.