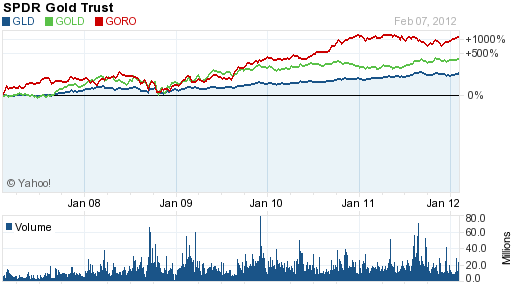

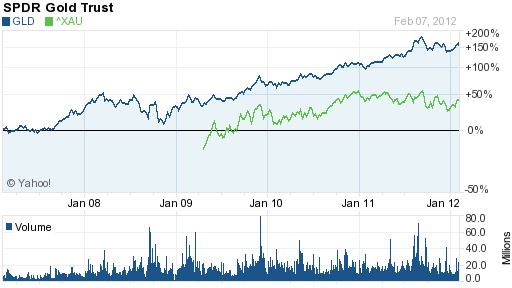

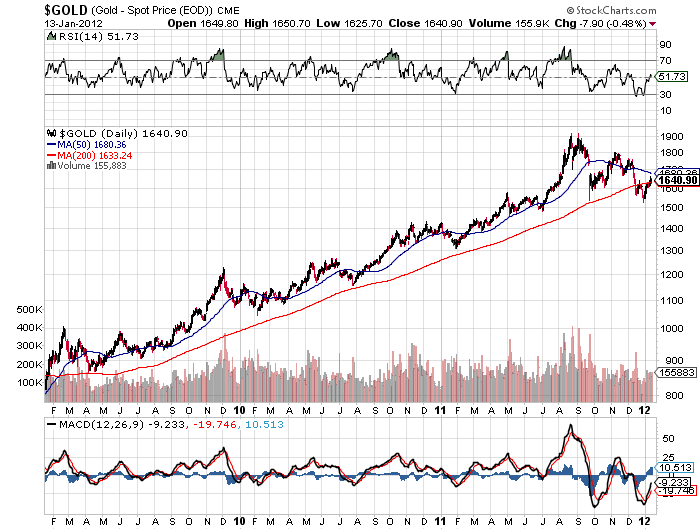

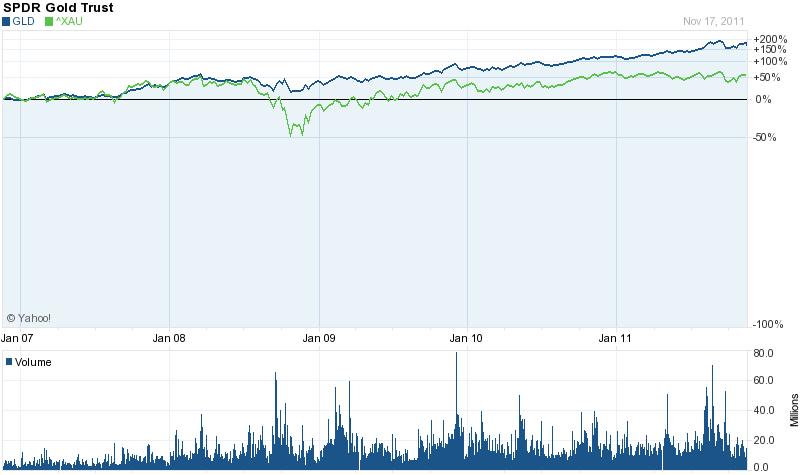

Leveraged earnings gains from rising gold prices have historically resulted in gold stocks outperforming gold bullion. From 2000 to the highs of 2008, the PHLX Gold/Silver Index (XAU) rose by 345% compared to a 252% increase in the price of gold.

Leveraged earnings gains from rising gold prices have historically resulted in gold stocks outperforming gold bullion. From 2000 to the highs of 2008, the PHLX Gold/Silver Index (XAU) rose by 345% compared to a 252% increase in the price of gold.

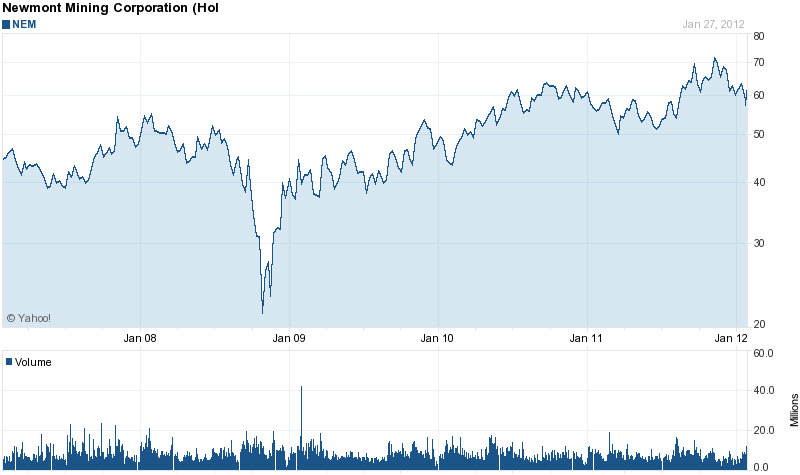

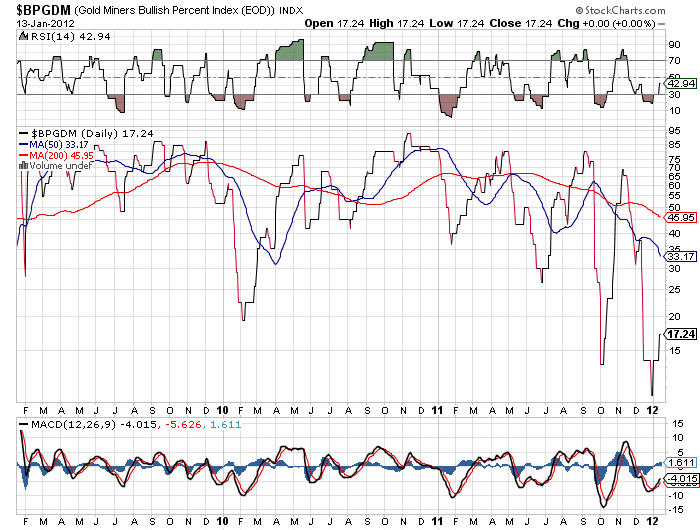

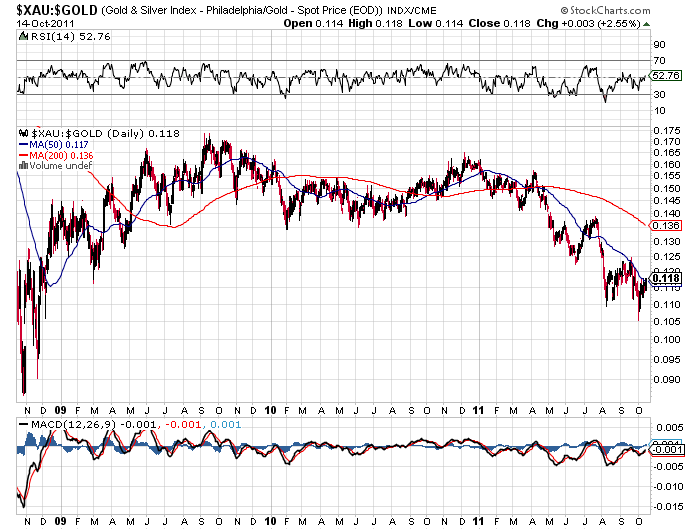

Over the past two years, the out performance of gold stocks has come to a dead halt despite the surge in gold prices. From $1,121.50 in January of 2010, gold has advanced to the current price of $1,781.10 for a gain of $659.60 per ounce or 58.8% while gold stocks have basically flat lined as represented by the Market Vectors Gold Miners ETF (GDX).

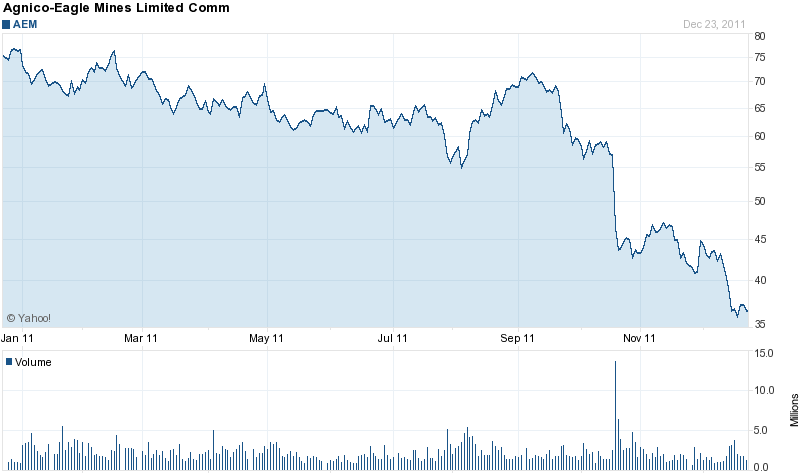

The divergence between gold bullion and gold stocks has resulted in a markdown of world class gold producers, resulting in the best buying opportunity since the 2008 sell off. John Hathaway, who runs the Tocqueville Gold Fund and has the best track record in the industry recently said this in his Investment Update.

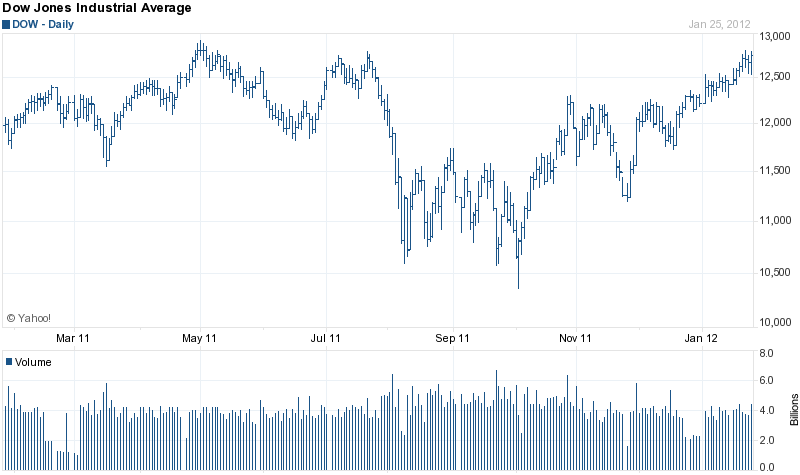

Gold and gold stocks appear to be bottoming in the wake of a four month correction which began in mid -August when the metal peaked at $1900/oz. Bearish sentiment is at extremes not seen in many years. This and a number of other indicators, such as stocks that have been hit by negative sentiment, the downtrend in gold prices since August, and tax loss selling, support our view that a rally lies ahead. This very bullish market set-up, in our opinion, mirrors the extraordinary investment opportunity of the despondent year end in 2007. Even though gold prices have been declining for several months, they finished the year with substantial gains. This suggests that the value represented by gold mining equities held in our portfolio could be extraordinary.

Will the glaring price disparity between gold and gold stocks continue? I have argued in a previous post (see Gold Stocks are Positioned For An Explosive Move Up) that major gold producers with large proven gold reserves are on the bargain table. The steeply discounted value of gold stocks will ultimately result in gold stock prices surging as the fundamentals of gold stocks are recognized by investors.

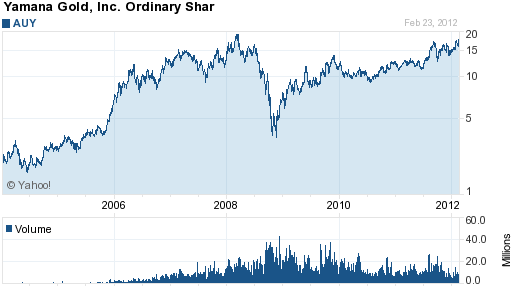

The gold stocks most likely to outperform are the ones with the strongest current relative price strength. One gold stock that fits this criteria and has outperformed the gold stock indexes is Yamana Gold (AUY), a Canadian gold producer.

Yamana has producing, development stage and exploration properties in Chile, Mexico, Colombia and Brazil. The Company recently announced record fourth and year end results for 2011. Highlights of Yamana’s performance for 2011 are shown below.

- Gold production increased by 5% to 916,284 ounces

- Silver production reached 9.3 million ounces

- Revenues increased by 29% to $2.2 billion

- Cash margin increased by 28% to $1,517 per ounce

- Earning increased by 59% to $713 million equivalent to $0.96 per share

- Cash flow increased by 48% to $1.3 billion

- The annual dividend was increased to $0.20 per share

- The Company’s net earnings were equivalent to $497 per ounce with an average realized gold price per ounce of $1,670.

- Yamana has industry low cash costs and operates in stable areas

- Yamana management forecasts that annual sustainable gold production will increase by over 60% to 1.75 million ounces by 2014

Gold prices have surged thus far in 2012 and there is every reason to believe that gold will end the year far higher than its current price (see Fed Lays Groundwork For Price Explosion in Gold and also Why There Is No Upside Limit for Gold and Silver Prices).

The stage is set for an explosive move upwards in Yamana’s stock price based on the confluence of higher gold prices, soaring profits and increased gold production. Based on the fundamentals, Yamana’s stock is dirt cheap. The stock is on the verge of breaking out to a new all time high and could easily double in price during 2012.