Sales of the US Mint American Eagle silver bullion coins has been extremely robust ever since the financial system can close to collapse in 2008. Prior to the financial crisis sales of the silver bullion coins averaged about 9 million coins per year.

Sales of the US Mint American Eagle silver bullion coins has been extremely robust ever since the financial system can close to collapse in 2008. Prior to the financial crisis sales of the silver bullion coins averaged about 9 million coins per year.

Over the past five years, despite the large correction in the price of silver, yearly sales of silver bullion coins have run well over 30 million coins per year with sales reaching an all time record high of almost 43 million coins in 2013.

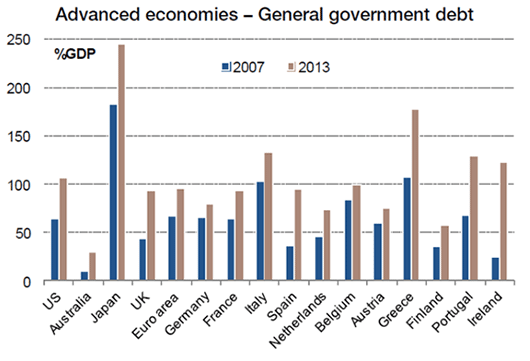

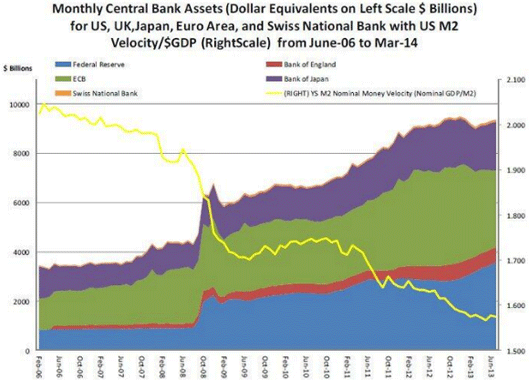

Purchasers of physical silver bullion coins buy for the long term to diversify their wealth and hedge against ruinous monetary and fiscal policies fostered by both the government and the Federal Reserve. While the financial system has been held together over the past five years by the Fed’s zero interest rate policy and money printing, the long term financial health of not only the United States but the world is beginning to look increasingly fragile as debt levels continue to explode world wide resulting in a financial system leveraged beyond comprehension.

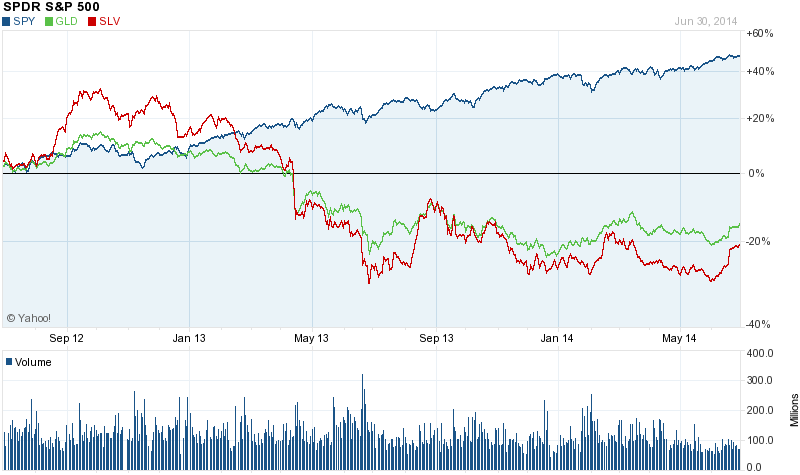

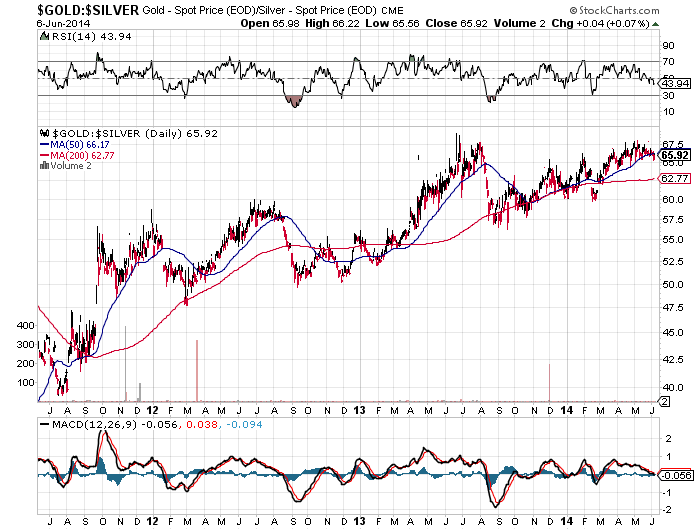

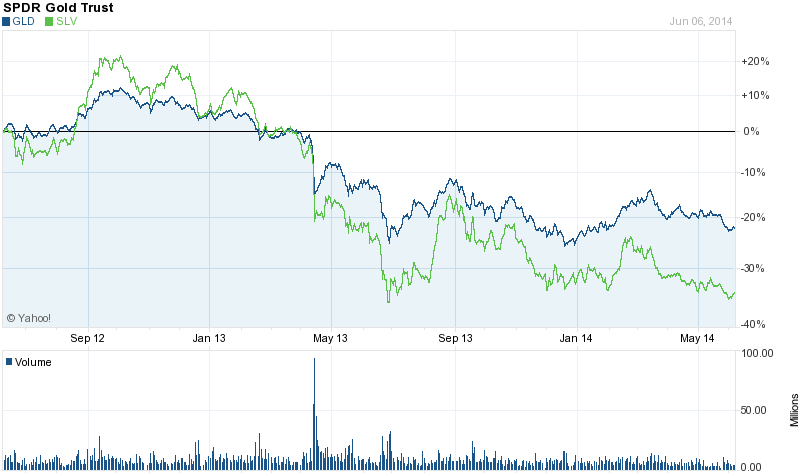

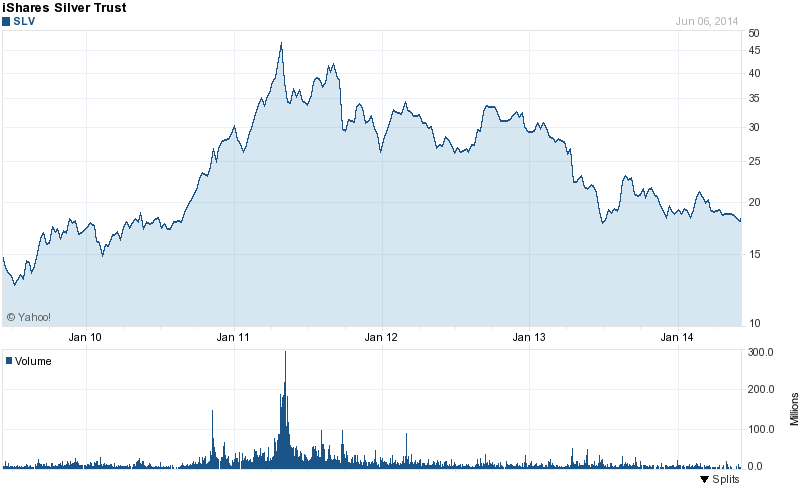

Silver has dipped below $17 per ounce this year, off 13% on the year after plunging by 36% in 2013. While this decline has obviously been painful for silver investors, it has put silver in the bargain bin and silver bullion coin investors are responding accordingly. If silver bullion coin sales continue at the current pace, sales for all of 2014 could hit an all time high.

The US Mint reports that September sales of the silver bullion coins for September 2014 totaled 4,140,000 ounces, double August sales of 2,007,500 and up 37.4% from September sales of the prior year.

Due to a slump in sales during the summer months, year to date sales of silver bullion coins through September are running behind comparable prior year sales. Year to date sales of the American Eagle silver bullion coins through September 30, 2014 totaled 32,251,000 down from 36,088,000 from the prior year.

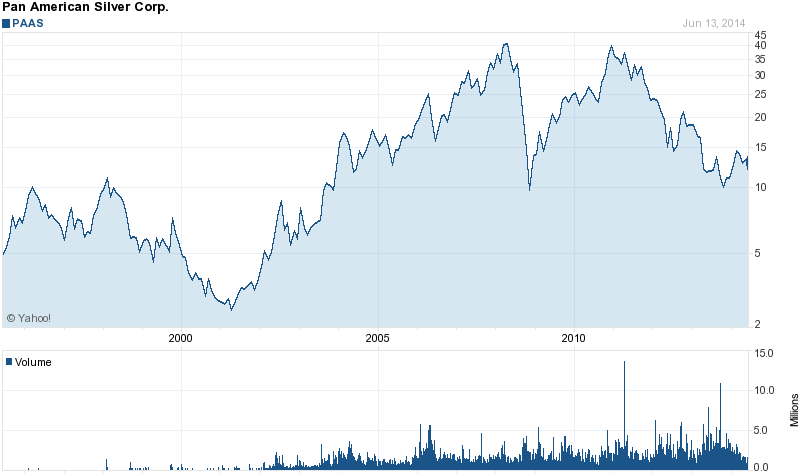

Since 2000 investors have purchased over 300 million of the one ounce US Mint silver bullion coins as shown below.