Will gold soar this year as central banks go wild with money printing? Or will gold collapse as debt defaults overwhelm the system and propel the world economy into a deflationary black hole?

Will gold soar this year as central banks go wild with money printing? Or will gold collapse as debt defaults overwhelm the system and propel the world economy into a deflationary black hole?

Members of this week’s Barron’s Roundtable were asked what they thought about gold. Panel members offered their usual variety of informed opinions on what could happen to the price of gold during 2012 – here’s what they had to say.

Marc Faber, editor of the Gloom, Boom & Doom Report, expects massive money printing by central banks during 2012 and a continuing correction in gold prices.

The worse the news gets, the more the U.S. and the European Central Bank and China will print money.

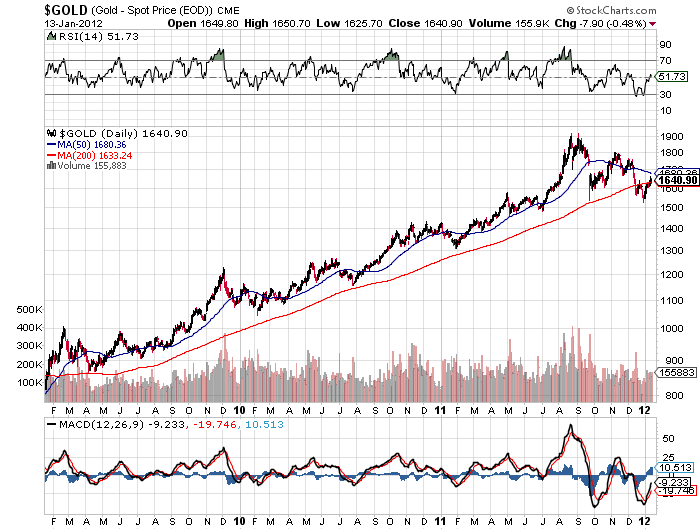

In the past 10 years gold and silver have performed superbly. The gold price overshot on the upside when it reached $1,921 an ounce on Sept. 6. Now it is in a correction phase and could fall another $200.

It is not that the gold price will go up. It is that the value of paper money will go down. Diversification is important, and people should put 15% to 25% of their assets in gold.

Brian Rogers, Chief Investment Officer of T. Rowe Price, sees oil as a good investment but does not foresee a big rally in gold prices.

It is easier to get your arms around oil than gold in terms of the numbers and demand. Oil is a good investment in the next few years, with optionality to the upside if something extreme happens in the Middle East. Gold is a good diversifier, but not a great way to make money.

Fred Hickey, editor of The High-Tech Strategist, predicts higher gold prices this year and views gold stocks as a relative better value than gold bullion.

Gold will rally, then have a seasonal selloff. By the end of the year it could be up 15%, as has been typical in this 11-year secular bull market for gold.

Gold stocks have been terrible. They dropped 20% last year, so that makes them a better buy relative to the price of gold. Last year I owned a lot of gold. Now I have more money in gold stocks than in physical gold or the GLD [ SPDR Gold Trust].

I own a smaller amount of exploration companies through the GDXJ [ Market Vectors Junior Gold Miners exchange-traded fund] and a larger percentage of producers.

Felix Zulauf, President of Zulauf Asset Management, sees gold prices soaring as the world economy approaches depression like conditions, forcing central banks to print money on a vast scale.

The world economy will experience a brutal slowdown. Deflationary forces are going to strengthen and commodities in general will decline. You can buy oil to hedge a decline in base metals. Gold started a cyclical correction within a secular bull market last summer. The first wave of selling is ending now. Gold has to be bought some time this year, probably in the second half, below $1,600. Then the monetary authorities will load their guns again and print more money, which will make investors buy more gold. The gold market is so tiny that when people want to shift just a small piece of their wealth into gold, the price flies to new highs.

Scott Black, President of Delphi Management, favors a modest position in gold stocks but thinks that people holding gold as a hedge against inflation are misguided.

A lot of people own gold as a hedge against inflation. I don’t see inflation in the cards in the U.S. Capacity utilization in the manufacturing sector it is only 77%. We own a couple of gold stocks but buy them as we do other stocks. We look for high returns on equity and low P/Es. We own Barrick Gold [ABX], which trades for 7.8 times this year’s expected earnings. Even absent a big upswing in gold prices, it will do well because production is growing.

Putting things into perspective, the rather lukewarm endorsement for gold by the Barron’s Roundtable should be viewed as a bullish indicator for gold prices. The healthy and normal correction in the price of gold from the high of $1,900 in August has resulted in rampant bearishness and numerous predictions that the bull market in gold is over. Ironically, many of the most bearish gold forecasts are coming from the same “analysts” who were predicting the end of the gold bull market multiple times over the past decade.

Bearish sentiment on gold has reached extreme levels according to the Hulbert Gold Newsletter Sentiment Indicator. The average gold timer has thrown in the towel. Over leveraged speculative investors panicked at the first sign of weakness in gold and sold out. According to Hulbert, “this is building a strong foundation for a fresh assault on gold’s recent all-time high above $1,900 an ounce.”

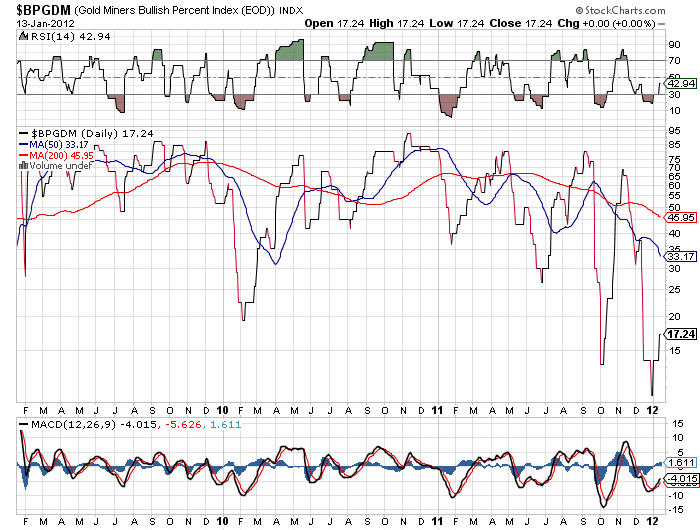

Bearish sentiment on gold stocks has also reached extreme levels as seen by the Gold Miners Bullish Percent Index.

After briefly falling below the 200 day moving average, gold rebounded strongly, rising from $1,598 at the start of the year to a Friday closing price of $1,635.50. Over the past decade, the few times that gold previously fell through the 200 day moving average set the groundwork for a major price advance.

The fundamental and technical indicators for gold remain rock solid. Gold may very well wind up shocking the bears by outperforming every other asset class in 2012.

While it is impossible to predict the price of gold on December 31, 2012 with any degree of certainty, one can predict with a high degree of certainty that gold will not be a worthless asset by this time next year. Considering what can happen quickly to paper assets, such as Corzine’s MF Global, there should be growing recognition and assurance that if you own physical gold bullion there is no need to depend on any person or organization for the gold you own to retain its value. Gold has survived every world calamity for the past 3000 years. The fact that you can purchase such an asset, at any price, is quite a deal.

I certainly don’t see any reason for the price of gold to take a drastic drop. I think we’ve seen the short term correction and gold will continue to rise for the near future. It seems like the populace is slowly waking up to the realities of their fiat currencies and looking for the alternatives that have stood the test of time – gold and silver.